Region:Asia

Author(s):Geetanshi

Product Code:KRAB5842

Pages:84

Published On:October 2025

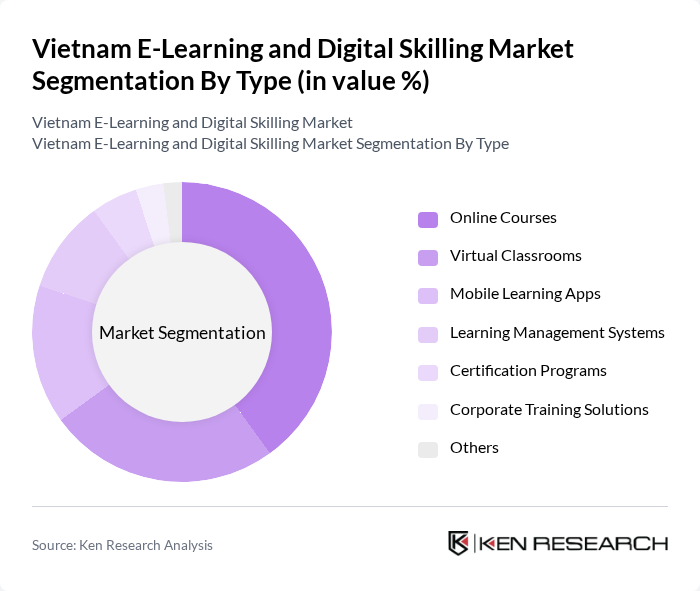

By Type:The market is segmented into various types, including Online Courses, Virtual Classrooms, Mobile Learning Apps, Learning Management Systems, Certification Programs, Corporate Training Solutions, and Others. Among these, Online Courses have emerged as the leading sub-segment, driven by the flexibility they offer to learners. The increasing preference for self-paced learning, mobile learning trends, and the availability of diverse course offerings with gamification methods have made online courses highly popular among students and professionals alike.

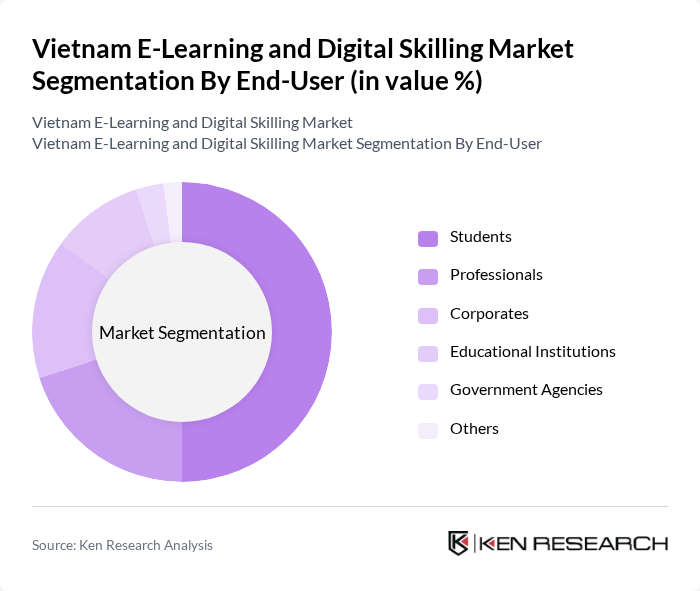

By End-User:The end-user segmentation includes Students, Professionals, Corporates, Educational Institutions, Government Agencies, and Others. The Students segment is the most significant contributor to the market, as the increasing number of learners seeking online education solutions drives demand. The shift towards digital learning environments in schools and universities, enhanced by AI-driven personalized learning experiences and microlearning approaches, has further solidified the position of students as the primary end-users in this market.

The Vietnam E-Learning and Digital Skilling Market is characterized by a dynamic mix of regional and international players. Leading participants such as Topica Edtech Group, Kyna.vn, Edumall, Hocmai.vn, VnEdu, Unica, MindX, Coursera, Udemy, FPT University, Vietnam National University, Viettel Group, TMA Solutions, CMC Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of Vietnam's e-learning and digital skilling market appears promising, driven by technological advancements and increasing acceptance of online education. As the government continues to invest in digital infrastructure, more educational institutions are likely to adopt blended learning models. Additionally, the rise of personalized learning experiences, powered by AI, will enhance engagement and effectiveness. These trends indicate a robust growth trajectory, positioning Vietnam as a key player in the Southeast Asian e-learning landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Online Courses Virtual Classrooms Mobile Learning Apps Learning Management Systems Certification Programs Corporate Training Solutions Others |

| By End-User | Students Professionals Corporates Educational Institutions Government Agencies Others |

| By Content Type | Academic Subjects Professional Skills Language Learning Technical Skills Soft Skills Others |

| By Delivery Mode | Synchronous Learning Asynchronous Learning Blended Learning Self-Paced Learning Others |

| By Pricing Model | Subscription-Based Pay-Per-Course Freemium Corporate Licensing Others |

| By Geographic Reach | National Regional International Others |

| By User Demographics | Age Group Educational Background Professional Experience Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate E-Learning Programs | 120 | HR Managers, Training Coordinators |

| Higher Education Institutions | 90 | University Administrators, Faculty Members |

| Vocational Training Centers | 60 | Program Directors, Instructors |

| Government Digital Literacy Initiatives | 50 | Policy Makers, Educational Planners |

| Freelance and Online Course Providers | 70 | Course Creators, Marketing Managers |

The Vietnam E-Learning and Digital Skilling Market is valued at approximately USD 1.1 billion, reflecting significant growth driven by the increasing demand for online education solutions, particularly accelerated by the COVID-19 pandemic.