Region:Asia

Author(s):Dev

Product Code:KRAB5421

Pages:93

Published On:October 2025

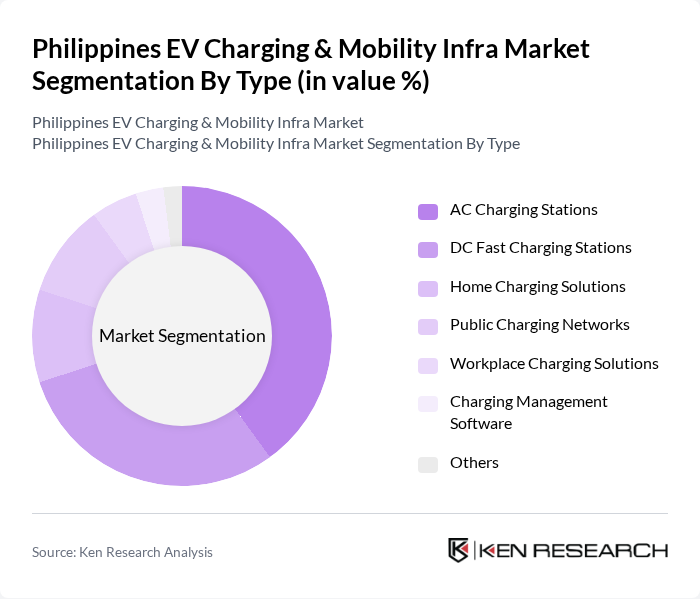

By Type:The market is segmented into various types of charging solutions, including AC Charging Stations, DC Fast Charging Stations, Home Charging Solutions, Public Charging Networks, Workplace Charging Solutions, Charging Management Software, and Others. Among these, AC Charging Stations and DC Fast Charging Stations are the most prominent, driven by the increasing adoption of electric vehicles and the need for efficient charging solutions.

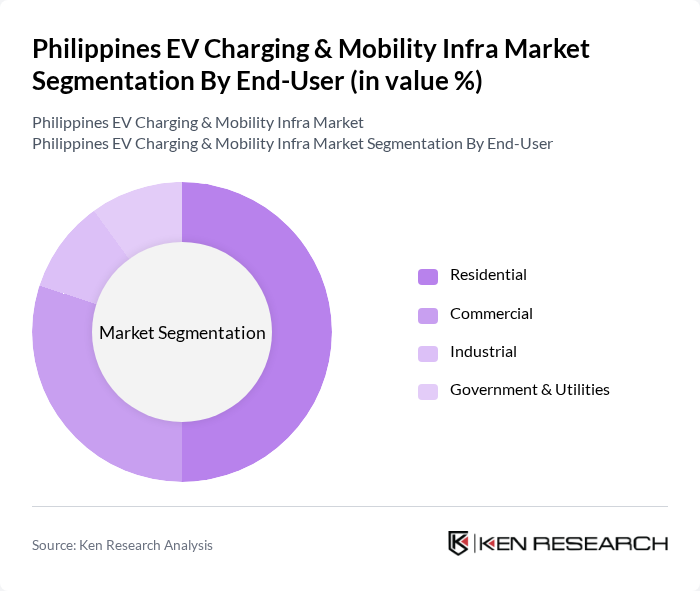

By End-User:The end-user segmentation includes Residential, Commercial, Industrial, and Government & Utilities. The Residential segment is currently leading the market, driven by the increasing number of electric vehicle owners who prefer home charging solutions. The Commercial segment is also growing, as businesses invest in charging infrastructure to support their fleets and attract eco-conscious customers.

The Philippines EV Charging & Mobility Infra Market is characterized by a dynamic mix of regional and international players. Leading participants such as Meralco, Pilipinas Shell Petroleum Corporation, CleanTech Global Renewables, Inc., Electric Vehicle Association of the Philippines (EVAP), Greenstrum, E-vehicle Solutions, Inc., ChargeNet, E-vehicle Philippines, Aboitiz Power Corporation, Envirosafe Solutions, Solar Philippines, Globe Telecom, Inc., Ayala Corporation, SM Investments Corporation, First Gen Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Philippines EV Charging and Mobility Infra market appears promising, driven by increasing government initiatives and consumer demand for sustainable transportation. With the anticipated establishment of more charging stations and the introduction of diverse EV models, the market is set to expand significantly. Additionally, the integration of renewable energy sources into the charging infrastructure will enhance sustainability, making electric vehicles more appealing to environmentally conscious consumers, thereby fostering long-term growth in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | AC Charging Stations DC Fast Charging Stations Home Charging Solutions Public Charging Networks Workplace Charging Solutions Charging Management Software Others |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Application | Passenger Vehicles Commercial Fleets Public Transport Ride-Sharing Services |

| By Investment Source | Domestic Investments Foreign Direct Investments (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Charging Speed | Level 1 Charging Level 2 Charging DC Fast Charging |

| By Distribution Mode | Direct Sales Online Sales Distributors |

| By Policy Support | Subsidies Tax Exemptions Regulatory Support Incentives for Charging Infrastructure |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| EV Charging Station Operators | 100 | Business Owners, Operations Managers |

| Local Government Units | 75 | City Planners, Transportation Officials |

| EV Manufacturers | 50 | Product Managers, Sales Directors |

| EV Users | 120 | Individual Consumers, Fleet Managers |

| Energy Providers | 60 | Energy Analysts, Business Development Managers |

The Philippines EV Charging & Mobility Infra Market is valued at approximately USD 1.2 billion, driven by government initiatives, consumer awareness of sustainability, and the expansion of charging infrastructure in urban areas.