Region:Asia

Author(s):Rebecca

Product Code:KRAB5904

Pages:83

Published On:October 2025

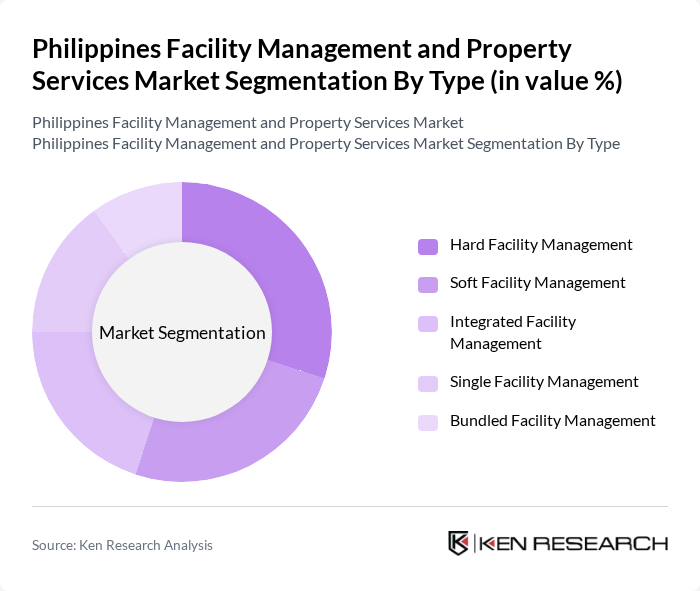

By Type:The market is segmented into Hard Facility Management, Soft Facility Management, Integrated Facility Management, Single Facility Management, and Bundled Facility Management. Hard Facility Management encompasses the physical infrastructure and technical maintenance of buildings, such as HVAC, electrical, and plumbing systems. Soft Facility Management involves non-technical services including cleaning, security, landscaping, and waste management. Integrated Facility Management delivers both hard and soft services through a unified management approach, optimizing operational efficiency and cost-effectiveness. Single Facility Management refers to the administration of individual properties, while Bundled Facility Management offers a package of services across multiple sites, catering to clients seeking comprehensive solutions .

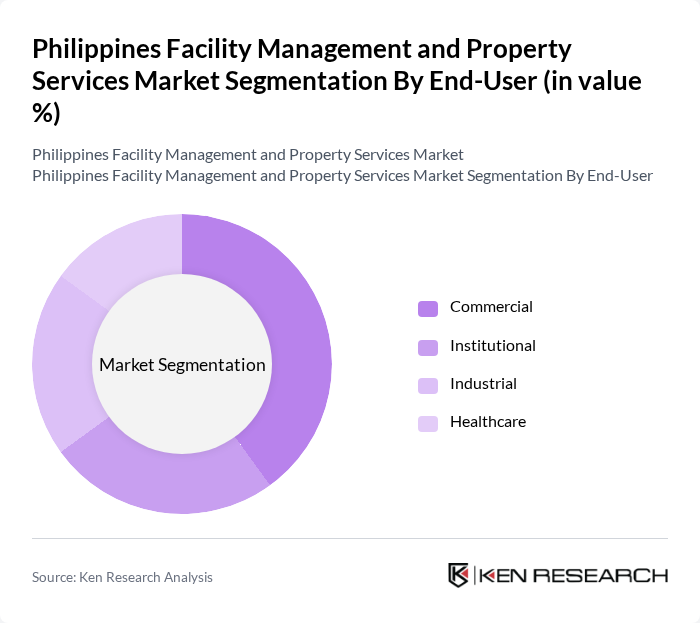

By End-User:The end-user segmentation includes Commercial, Institutional, Industrial, and Healthcare sectors. The Commercial sector is the largest consumer, driven by the need for efficient operations in office buildings, retail spaces, and mixed-use developments. Institutional users—such as educational institutions and government facilities—require specialized services to maintain compliance and operational standards. The Industrial sector is expanding due to increased manufacturing activity and the adoption of smart facility solutions. Healthcare facilities are experiencing growth in demand for facility management services, with a focus on hygiene, safety, and regulatory compliance .

The Philippines Facility Management and Property Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as CBRE, Inc., Jones Lang LaSalle IP, Inc., Cushman & Wakefield LLC, Sodexo Group, OCS Group Holdings Ltd., Century Properties Management, Inc., WeCare Facility Management Services Inc., Santos Knight Frank, SGS S.A., Knight Frank Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Philippines facility management and property services market appears promising, driven by urbanization and technological advancements. As cities expand, the demand for integrated facility services will likely increase, with a focus on sustainability and energy efficiency. Additionally, the adoption of smart building technologies is expected to enhance operational efficiency. Companies that embrace innovation and adapt to regulatory changes will be well-positioned to capitalize on emerging opportunities in this dynamic market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Hard Facility Management Soft Facility Management Integrated Facility Management Single Facility Management Bundled Facility Management |

| By End-User | Commercial Institutional Industrial Healthcare |

| By Service Model | Outsourced In-House Hybrid |

| By Sector | Education Retail Hospitality Government & Utilities |

| By Geographic Coverage | Metro Manila Luzon Visayas Mindanao |

| By Contract Type | Fixed-Price Contracts Time and Materials Contracts Performance-Based Contracts |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Property Management | 120 | Property Managers, Facility Directors |

| Residential Facility Services | 90 | Homeowners Association Leaders, Property Owners |

| Corporate Facility Management | 60 | Corporate Real Estate Managers, Operations Heads |

| Maintenance and Repair Services | 50 | Maintenance Supervisors, Service Providers |

| Security Services in Facilities | 40 | Security Managers, Risk Management Officers |

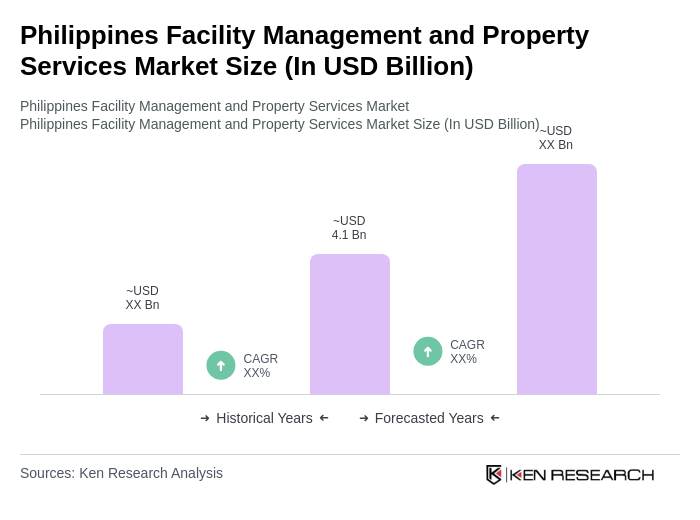

The Philippines Facility Management and Property Services Market is valued at approximately USD 4.1 billion, driven by urbanization, demand for efficient property management, and commercial real estate expansion.