Region:Middle East

Author(s):Dev

Product Code:KRAA8238

Pages:85

Published On:November 2025

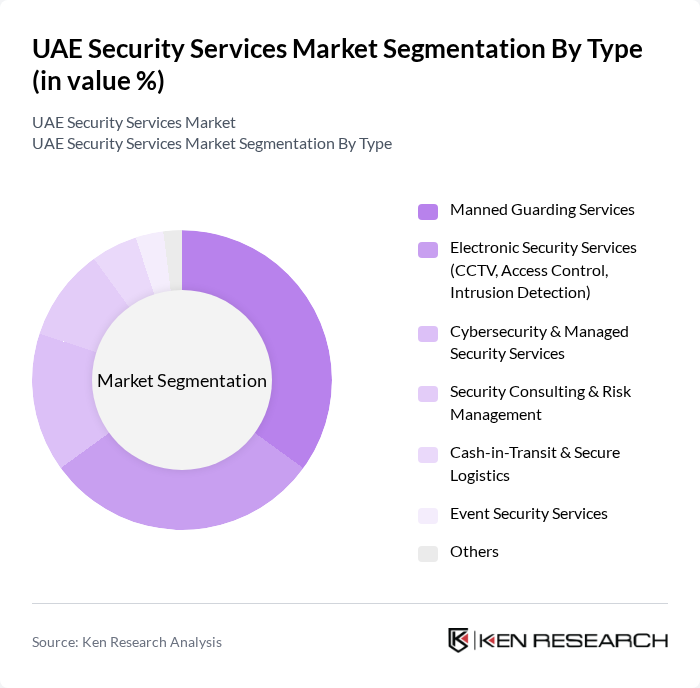

By Type:The segmentation by type includes various services such as Manned Guarding Services, Electronic Security Services (CCTV, Access Control, Intrusion Detection), Cybersecurity & Managed Security Services, Security Consulting & Risk Management, Cash-in-Transit & Secure Logistics, Event Security Services, and Others. Among these, Manned Guarding Services continue to dominate the market due to the increasing need for physical security in commercial and residential sectors. The demand for trained personnel to ensure safety and security in high-risk areas is a significant driver. Electronic Security Services are also gaining traction as businesses invest in advanced surveillance and access control technologies. The integration of artificial intelligence and automation in surveillance systems is a notable trend, enhancing real-time threat detection and response capabilities.

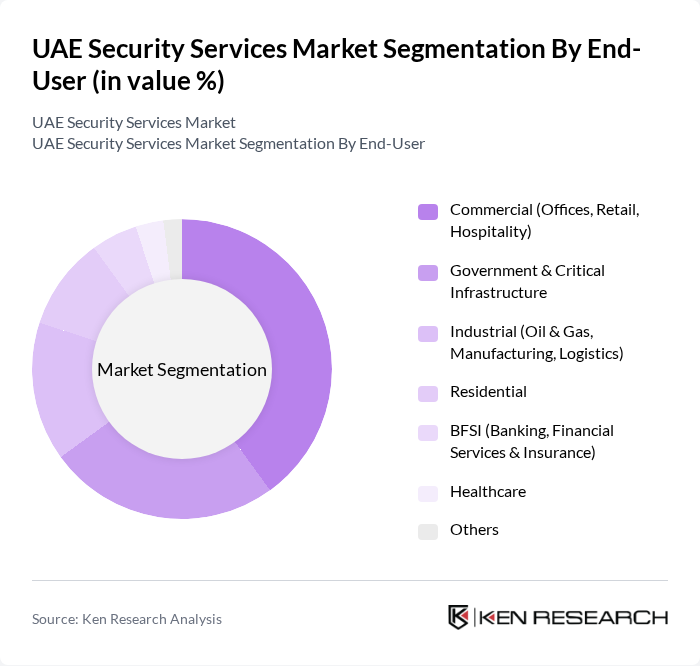

By End-User:The end-user segmentation includes Commercial (Offices, Retail, Hospitality), Government & Critical Infrastructure, Industrial (Oil & Gas, Manufacturing, Logistics), Residential, BFSI (Banking, Financial Services & Insurance), Healthcare, and Others. The Commercial sector leads the market, driven by the need for enhanced security in retail and hospitality environments. Government and critical infrastructure also represent a significant portion of the market due to ongoing investments in public safety and national security initiatives. The increasing focus on cybersecurity in the BFSI sector further contributes to the growth of security services tailored for financial institutions.

The UAE Security Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as G4S Secure Solutions, Securitas AB, Transguard Group, Emirates Security Services, World Security, SecureTech, First Security Group, Falcon Eye Technology (FET), Al-Futtaim Willis Security Services, Magnum Security, Al-Hamra Security, Al-Salam Security, Al-Mansoori Specialized Engineering (Security Division), Al-Farooq Security Services, and Al-Majd Security contribute to innovation, geographic expansion, and service delivery in this space.

The UAE security services market is poised for continued growth, driven by increasing urbanization and a focus on public safety. As the government invests in smart city initiatives, the integration of advanced technologies will enhance security measures. Additionally, the rising threat of cybercrime will propel demand for cybersecurity services. Companies that adapt to these trends and invest in innovative solutions will likely capture significant market share, ensuring a robust competitive landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Manned Guarding Services Electronic Security Services (CCTV, Access Control, Intrusion Detection) Cybersecurity & Managed Security Services Security Consulting & Risk Management Cash-in-Transit & Secure Logistics Event Security Services Others |

| By End-User | Commercial (Offices, Retail, Hospitality) Government & Critical Infrastructure Industrial (Oil & Gas, Manufacturing, Logistics) Residential BFSI (Banking, Financial Services & Insurance) Healthcare Others |

| By Service Model | On-Site Security Services Remote Monitoring & Command Center Services Mobile Patrol Services Event-Based Security Services Integrated Security Solutions Others |

| By Technology | Surveillance Systems (CCTV, Video Analytics) Access Control Systems (Biometric, Card-based) Alarm & Intrusion Detection Systems Integrated Security Management Platforms Cybersecurity Platforms Others |

| By Region | Abu Dhabi Dubai Sharjah & Northern Emirates Ajman Others |

| By Customer Segment | Large Enterprises SMEs Individual Consumers Government Agencies Others |

| By Service Duration | Short-Term Contracts Long-Term Contracts Project-Based Services Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Physical Security Services | 100 | Security Managers, Facility Directors |

| Cybersecurity Solutions | 60 | IT Security Managers, Compliance Managers |

| Consulting and Risk Assessment | 50 | Risk Managers, Business Continuity Planners |

| Event Security Management | 40 | Event Security Coordinators, Security Supervisors |

| Integrated Security Systems | 70 | Operations Managers, Technology Directors |

The UAE Security Services Market is valued at approximately USD 1.8 billion, driven by increased investments in infrastructure, security concerns, and the adoption of advanced technologies. This growth reflects the rising demand for comprehensive security solutions across various sectors.