Philippines Fitness Apps & Digital Wellness Market Overview

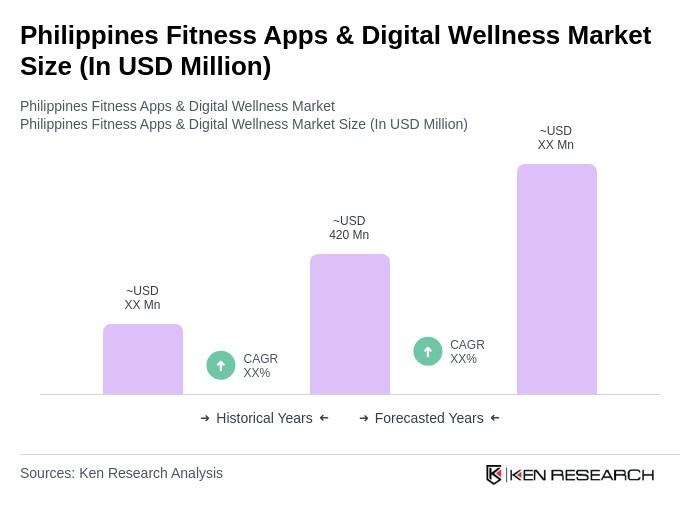

- The Philippines Fitness Apps & Digital Wellness Market is valued at USD 420 million, based on a five-year historical analysis. This growth is primarily driven by the increasing adoption of smartphones, rising health consciousness among the population, and the growing trend of digital fitness solutions. The market has seen a surge in demand for fitness applications that cater to various health and wellness needs, including workout tracking, nutrition, and mental wellness. The integration of AI, wearable device compatibility, and remote coaching are further accelerating user engagement and market expansion, reflecting broader Asia-Pacific trends.

- Metro Manila, Cebu, and Davao are the dominant cities in the Philippines Fitness Apps & Digital Wellness Market. Metro Manila leads due to its high population density, urban lifestyle, and access to technology. Cebu and Davao follow closely, benefiting from a growing middle class and increasing awareness of health and fitness, which drives the demand for digital wellness solutions. Urbanization and higher disposable incomes in these regions are key contributors to market concentration.

- In 2023, the Philippine government implemented the "Healthy Pilipinas" initiative, which aims to promote health and wellness among citizens. This initiative encourages the use of digital health solutions, including fitness apps, by providing incentives for developers and users alike. The government aims to improve public health outcomes and reduce healthcare costs through increased physical activity and healthier lifestyles. The operational framework for digital health solutions is supported by the "Universal Health Care Act (Republic Act No. 11223)" issued by the Department of Health in 2019, which mandates the integration of digital health technologies for preventive care, data management, and public health promotion.

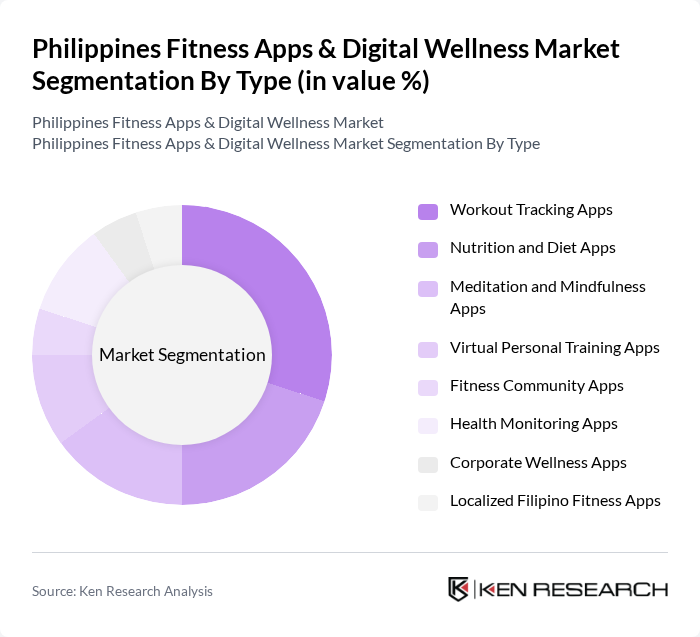

Philippines Fitness Apps & Digital Wellness Market Segmentation

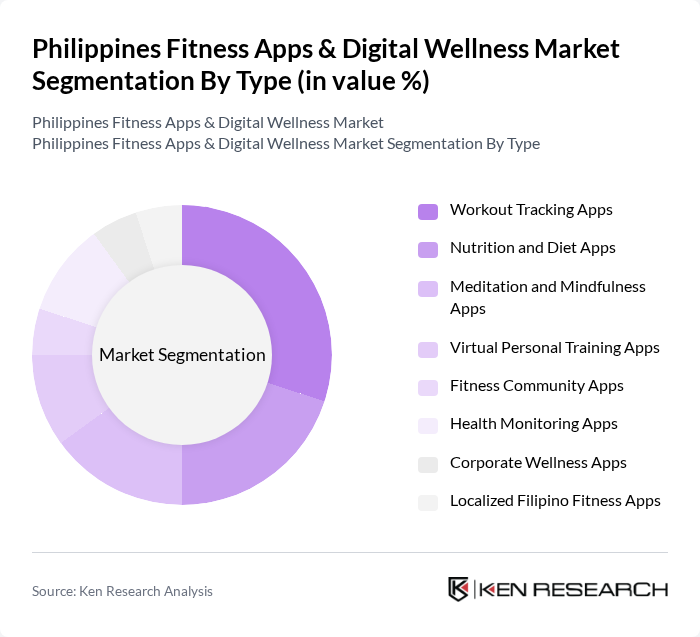

By Type:The market is segmented into various types of fitness applications, each catering to specific user needs. The subsegments include Workout Tracking Apps, Nutrition and Diet Apps, Meditation and Mindfulness Apps, Virtual Personal Training Apps, Fitness Community Apps, Health Monitoring Apps, Corporate Wellness Apps, and Localized Filipino Fitness Apps. Among these, Workout Tracking Apps are particularly popular due to their ability to help users monitor their fitness progress and set personal goals. Nutrition and Diet Apps and Meditation and Mindfulness Apps are also experiencing significant growth, driven by increased interest in holistic wellness and preventive health management.

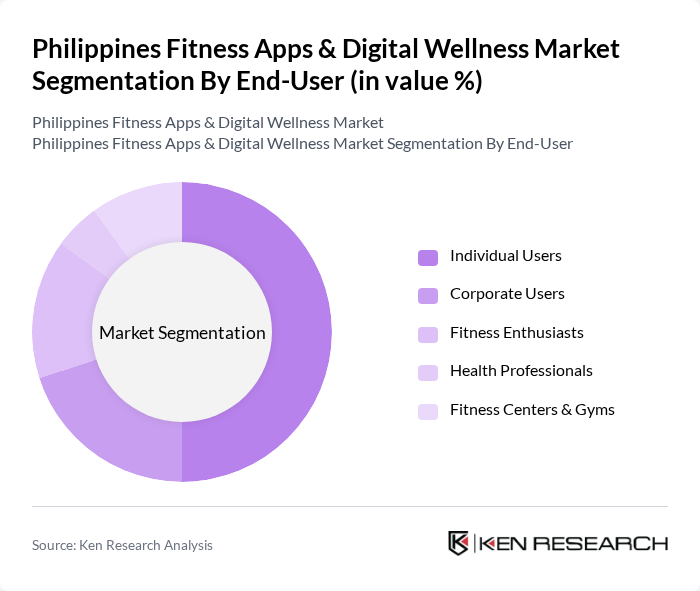

By End-User:The end-user segmentation includes Individual Users, Corporate Users, Fitness Enthusiasts, Health Professionals, and Fitness Centers & Gyms. Individual Users dominate the market as they seek personalized fitness solutions that fit their lifestyles. Corporate Users are also increasingly adopting wellness apps to promote employee health, while Fitness Centers & Gyms leverage these apps to enhance member engagement. The rise in remote work and corporate wellness programs has further boosted adoption among businesses.

Philippines Fitness Apps & Digital Wellness Market Competitive Landscape

The Philippines Fitness Apps & Digital Wellness Market is characterized by a dynamic mix of regional and international players. Leading participants such as MyFitnessPal, Fitbit (now part of Google), Strava, Nike Training Club, Samsung Health, Headspace, Calm, JEFIT, 8fit, Sworkit, Freeletics, Aaptiv, Noom, Lifesum, FitOn, Rebel Fitness (Philippines), Kumu Wellness (Kumu Inc.), Fitness Buddy (Azumio), Anytime Fitness Philippines (digital platform), Gold's Gym Philippines (digital wellness) contribute to innovation, geographic expansion, and service delivery in this space.

Philippines Fitness Apps & Digital Wellness Market Industry Analysis

Growth Drivers

- Increasing Health Awareness:The Philippines has seen a significant rise in health consciousness, with 76% of Filipinos now prioritizing fitness and wellness. This shift is driven by rising obesity rates, which reached 35% in the future, prompting individuals to seek solutions. The government’s initiatives, such as the “Healthy Philippines” program, aim to reduce lifestyle-related diseases, further fueling demand for fitness apps. This growing awareness is expected to enhance user engagement with digital wellness platforms.

- Rise in Smartphone Penetration:As of the future, smartphone penetration in the Philippines is projected to reach 85%, with over 76 million users. This widespread access to mobile technology facilitates the adoption of fitness apps, allowing users to track their health conveniently. The increasing affordability of smartphones, with average prices dropping by 15% in the last two years, has made these devices accessible to a broader demographic, thus expanding the potential user base for fitness applications.

- Growth of Wearable Fitness Technology:The wearable fitness technology market in the Philippines is expected to grow to 5 million units sold in the future, reflecting a 20% increase from the previous year. This surge is driven by the popularity of devices like smartwatches and fitness trackers, which integrate seamlessly with fitness apps. As users increasingly rely on these technologies for health monitoring, the demand for compatible applications that enhance user experience and provide personalized insights is also expected to rise significantly.

Market Challenges

- High Competition Among Apps:The fitness app market in the Philippines is highly saturated, with over 300 apps available in the future. This intense competition makes it challenging for new entrants to gain market share. Established players dominate the market, with the top five apps accounting for 60% of downloads. This competitive landscape necessitates continuous innovation and marketing efforts to attract and retain users, posing a significant challenge for emerging developers.

- Data Privacy Concerns:With the implementation of the Data Privacy Act in the past, concerns regarding user data protection have intensified. In the future, 45% of users expressed apprehension about sharing personal health data with fitness apps. This skepticism can hinder user adoption and retention, as individuals prioritize their privacy. Companies must invest in robust security measures and transparent data policies to build trust and encourage more users to engage with their platforms.

Philippines Fitness Apps & Digital Wellness Market Future Outlook

The Philippines fitness apps and digital wellness market is poised for significant evolution, driven by technological advancements and changing consumer preferences. As health awareness continues to rise, the integration of AI and machine learning into fitness applications will enhance personalization, catering to individual user needs. Additionally, the growing trend of corporate wellness programs will likely create new partnerships, expanding the market reach. These developments will foster a more engaged user base, ultimately driving growth in the sector.

Market Opportunities

- Integration with Health Insurance Programs:Collaborating with health insurance providers presents a lucrative opportunity for fitness apps. By offering incentives for users who engage in regular fitness activities, insurance companies can reduce healthcare costs. This partnership could lead to a 30% increase in app subscriptions, as users seek to benefit from lower premiums while improving their health.

- Partnerships with Fitness Centers:Establishing partnerships with local gyms and fitness centers can enhance user engagement. By offering exclusive content or discounts to gym members, fitness apps can tap into a dedicated audience. This strategy could potentially increase user acquisition by 25%, as fitness enthusiasts seek integrated solutions that complement their gym experience.