Region:Asia

Author(s):Dev

Product Code:KRAC2780

Pages:95

Published On:October 2025

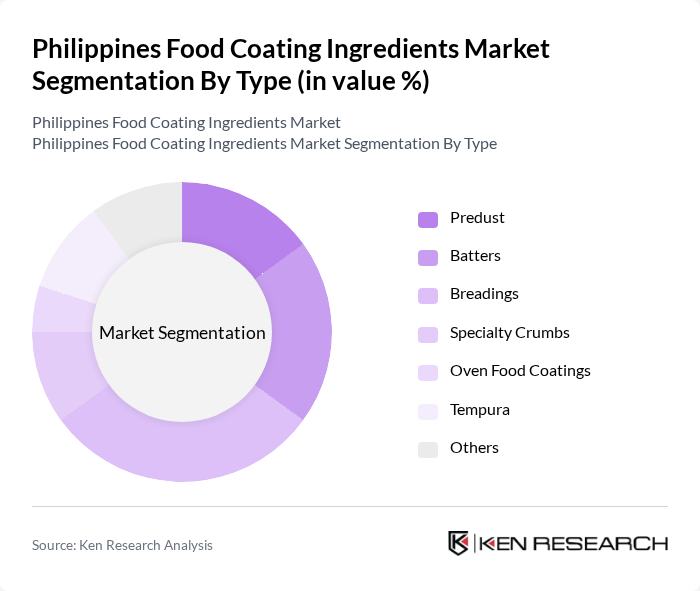

By Type:The market is segmented into Predust, Batters, Breadings, Specialty Crumbs, Oven Food Coatings, Tempura, and Others. Breadings remain the leading sub-segment, primarily due to their extensive use in meat and seafood products and consumer preference for crispy textures and flavors. The popularity of fried foods, combined with the demand for convenient meal preparation, continues to drive growth in this category. Recent trends show increased adoption of gluten-free and plant-based breadings, as well as specialty blends designed for improved adhesion and heat resistance .

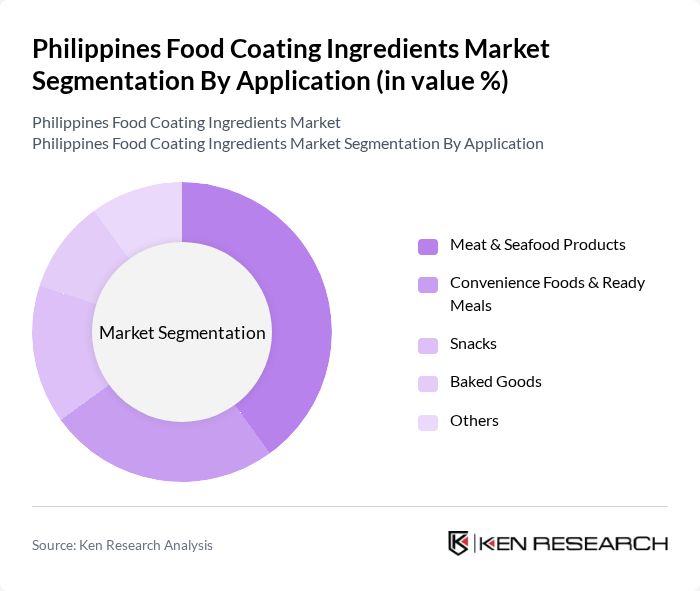

By Application:Food coating ingredients are applied in Meat & Seafood Products, Convenience Foods & Ready Meals, Snacks, Baked Goods, and Others. The Meat & Seafood Products segment is the largest, reflecting high demand for coated meat products in retail and food service. Growth is further supported by the popularity of frozen and ready-to-cook meat products and the shift toward healthier options, including coatings with reduced sodium and allergen-free formulations. Convenience foods and ready meals also show robust growth due to urbanization and changing consumer lifestyles .

The Philippines Food Coating Ingredients Market is characterized by a dynamic mix of regional and international players. Leading participants such as Cargill, Inc., Archer Daniels Midland Company, Ingredion Incorporated, Kerry Group plc, Tate & Lyle PLC, DuPont de Nemours, Inc., BASF SE, Univar Solutions Inc., Emsland Group, Bunge Limited, Sensient Technologies Corporation, DSM Nutritional Products, AAK AB, Olam International Limited, Solvay S.A. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Philippines food coating ingredients market appears promising, driven by evolving consumer preferences and technological advancements. As the demand for healthier and more sustainable food options continues to rise, manufacturers are likely to innovate with natural and organic coatings. Additionally, the growth of e-commerce and online food delivery services will create new distribution channels, allowing companies to reach a broader audience and enhance market penetration in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Predust Batters Breadings Specialty Crumbs Oven Food Coatings Tempura Others |

| By Application | Meat & Seafood Products Convenience Foods & Ready Meals Snacks Baked Goods Others |

| By Form | Liquid Paste Dry |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food Processing Companies | 120 | Production Managers, Quality Assurance Officers |

| Ingredient Suppliers | 80 | Sales Directors, Product Development Managers |

| Food Retailers | 60 | Category Managers, Purchasing Agents |

| Food Service Operators | 50 | Executive Chefs, Operations Managers |

| Regulatory Bodies | 40 | Food Safety Inspectors, Policy Makers |

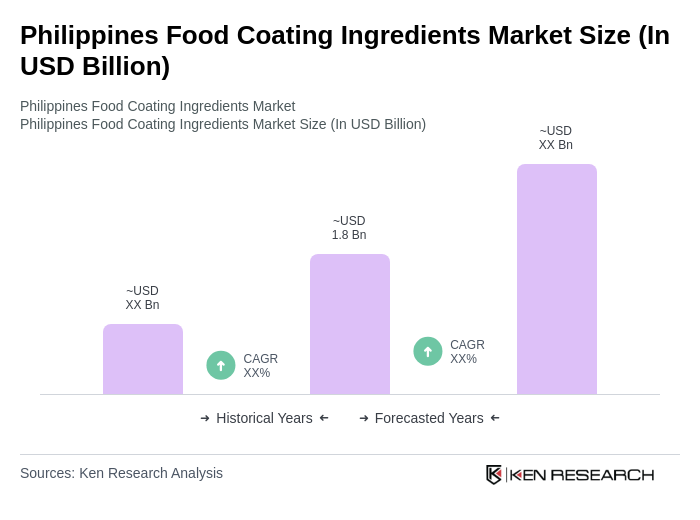

The Philippines Food Coating Ingredients Market is valued at approximately USD 1.8 billion, driven by the increasing demand for processed foods, ready-to-eat meals, and the expansion of the food service industry.