Region:Asia

Author(s):Shubham

Product Code:KRAB3283

Pages:100

Published On:October 2025

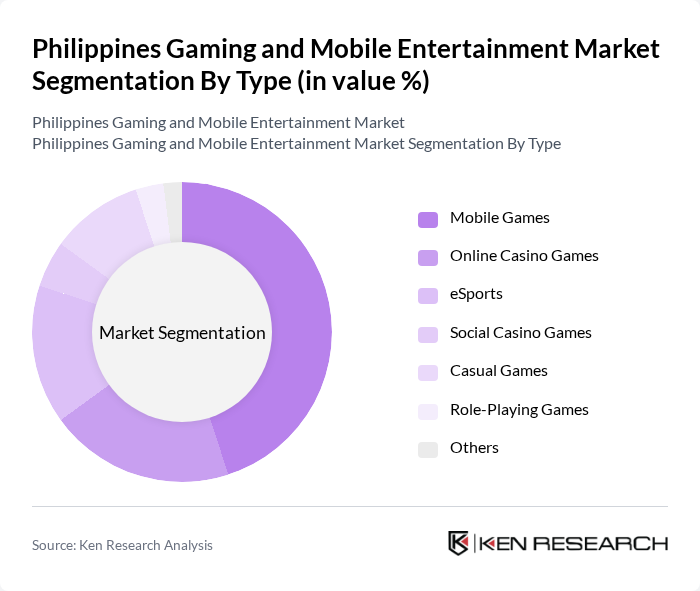

By Type:The market is segmented into various types, including Mobile Games, Online Casino Games, eSports, Social Casino Games, Casual Games, Role-Playing Games, and Others. Among these, Mobile Games have emerged as the leading segment due to the widespread adoption of smartphones and the increasing availability of affordable data plans. The convenience of mobile gaming allows users to engage in gaming activities anytime and anywhere, driving its popularity.

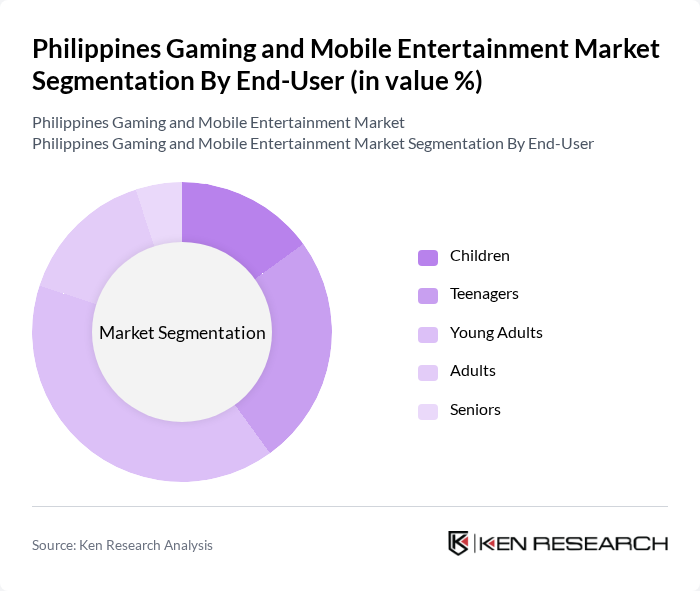

By End-User:The end-user segmentation includes Children, Teenagers, Young Adults, Adults, and Seniors. The Young Adults segment is currently dominating the market, driven by their high engagement levels with mobile devices and gaming platforms. This demographic is particularly attracted to competitive gaming and social interactions within games, leading to increased spending on in-game purchases and subscriptions.

The Philippines Gaming and Mobile Entertainment Market is characterized by a dynamic mix of regional and international players. Leading participants such as GMA Network Inc., Globe Telecom Inc., PLDT Inc., ABS-CBN Corporation, Zynga Inc., Garena, Ubisoft Entertainment S.A., Electronic Arts Inc., Activision Blizzard Inc., Riot Games Inc., Bandai Namco Entertainment Inc., Tencent Holdings Limited, NetEase Inc., PlayPark Inc., Xsolla Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The Philippines gaming and mobile entertainment market is poised for significant evolution, driven by technological advancements and changing consumer preferences. The integration of augmented reality (AR) and virtual reality (VR) technologies is expected to enhance user experiences, while the rise of cloud gaming services will provide gamers with more accessible options. Additionally, the increasing focus on mobile-first gaming will cater to the growing smartphone user base, ensuring sustained engagement and revenue growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Mobile Games Online Casino Games eSports Social Casino Games Casual Games Role-Playing Games Others |

| By End-User | Children Teenagers Young Adults Adults Seniors |

| By Distribution Channel | App Stores Online Platforms Retail Outlets Direct Downloads |

| By Game Genre | Action Adventure Strategy Simulation Sports |

| By Payment Model | Free-to-Play Pay-to-Play Subscription-Based In-App Purchases |

| By User Engagement | Casual Gamers Hardcore Gamers Social Gamers |

| By Device Type | Smartphones Tablets PCs Consoles |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Mobile Game Developers | 100 | Founders, Product Managers |

| Mobile Gamers | 150 | Casual Gamers, Hardcore Gamers |

| Gaming Industry Analysts | 50 | Market Researchers, Industry Experts |

| Mobile App Publishers | 80 | Marketing Directors, Business Development Managers |

| Regulatory Bodies | 30 | Policy Makers, Compliance Officers |

The Philippines Gaming and Mobile Entertainment Market is valued at approximately USD 1.5 billion, driven by smartphone penetration, internet connectivity, and a young, engaged population favoring mobile gaming and entertainment options.