Region:Asia

Author(s):Rebecca

Product Code:KRAD0276

Pages:96

Published On:August 2025

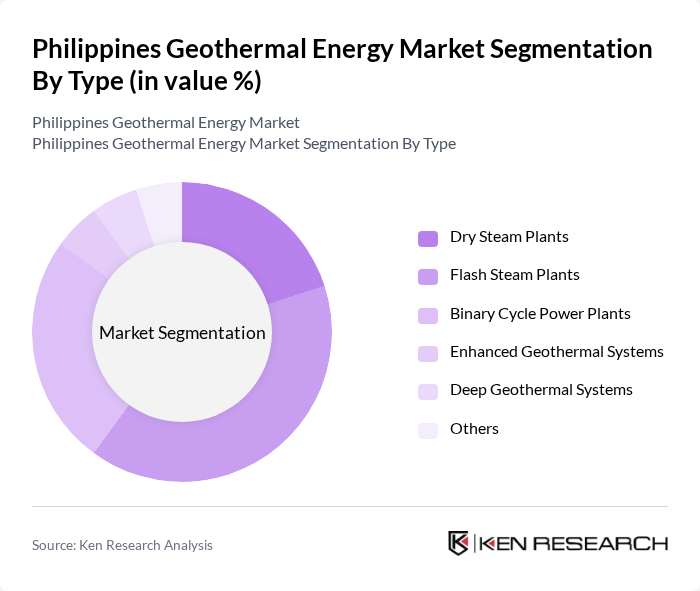

By Type:The market is segmented into various types of geothermal energy plants, including Dry Steam Plants, Flash Steam Plants, Binary Cycle Power Plants, Enhanced Geothermal Systems, Deep Geothermal Systems, and Others. Each type serves different operational needs and efficiency levels, with specific applications in energy generation and direct use .

The Flash Steam Plants segment is currently dominating the market due to their efficiency in converting geothermal steam directly into electricity. This technology is widely adopted in the Philippines, where high-temperature geothermal resources are available. The increasing demand for reliable and sustainable energy sources has led to significant investment in this type of plant, making it a preferred choice among utilities and power generation companies .

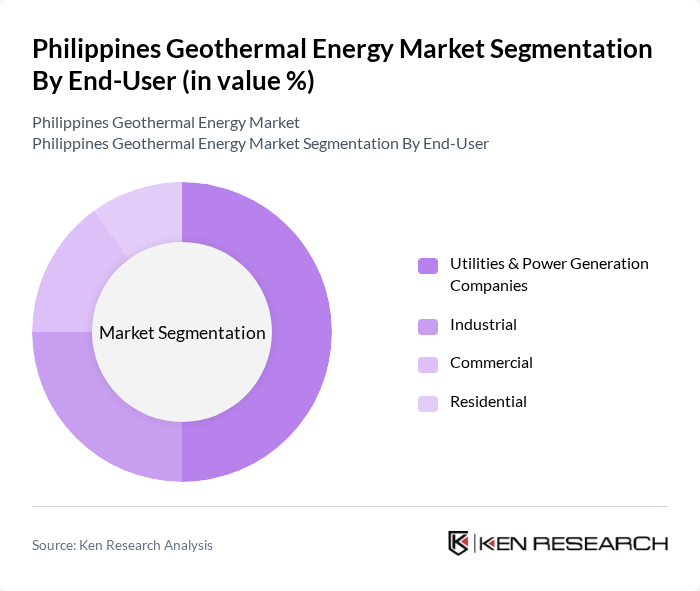

By End-User:The market is segmented by end-users, including Utilities & Power Generation Companies, Industrial, Commercial, and Residential sectors. Each segment has unique energy needs and consumption patterns, influencing the overall demand for geothermal energy .

The Utilities & Power Generation Companies segment leads the market, accounting for half of the total demand. This dominance is driven by the need for stable and renewable energy sources to meet the growing electricity consumption in the Philippines. The increasing focus on sustainability and energy security has prompted these companies to invest heavily in geothermal energy projects .

The Philippines Geothermal Energy Market is characterized by a dynamic mix of regional and international players. Leading participants such as Energy Development Corporation, Philippine Geothermal Production Company, Inc., Chevron Geothermal Philippines Holdings, Inc., Ormat Technologies, Inc., Aboitiz Power Corporation, First Gen Corporation, Philippine National Oil Company – Renewable Energy Corporation (PNOC-REC), Aragorn Power and Energy Corporation (APC Group, Inc.), Enel Green Power Philippines, Inc., Mitsubishi Power (Mitsubishi Heavy Industries Group), EDC Geothermal, Inc., Star Energy Group Holdings Pte. Ltd., Green Core Geothermal, Inc., Philippine Renewable Energy Holdings Corporation, Geothermal Resources International, Inc. contribute to innovation, geographic expansion, and service delivery in this space .

The Philippines geothermal energy market is poised for significant growth, driven by increasing energy demands and supportive government policies. As the country aims for a 35% renewable energy share in future, investments in geothermal technology and infrastructure are expected to rise. Additionally, public awareness of climate change and the need for sustainable energy solutions will further propel the market. Collaborative efforts with international partners will enhance resource exploration and development, ensuring a robust geothermal energy landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Dry Steam Plants Flash Steam Plants Binary Cycle Power Plants Enhanced Geothermal Systems Deep Geothermal Systems Others |

| By End-User | Utilities & Power Generation Companies Industrial Commercial Residential |

| By Application | Electricity Generation Direct Use Applications (e.g., district heating, agriculture, aquaculture) Geothermal Heat Pumps Others |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Policy Support | Subsidies Tax Exemptions Renewable Energy Certificates (RECs) Feed-in Tariff (FiT) Others |

| By Distribution Mode | Direct Sales Power Purchase Agreements (PPAs) Distributors Others |

| By Pricing Strategy | Cost-Plus Pricing Competitive Pricing Value-Based Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Geothermal Power Generation | 100 | Plant Managers, Energy Analysts |

| Geothermal Exploration and Development | 75 | Geologists, Project Developers |

| Government Policy and Regulation | 60 | Energy Policy Makers, Regulatory Officials |

| Environmental Impact Assessments | 45 | Environmental Consultants, Sustainability Experts |

| Investment and Financing in Geothermal Projects | 55 | Investment Analysts, Financial Advisors |

The Philippines Geothermal Energy Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the country's abundant geothermal resources and the rising demand for renewable energy to meet climate commitments.