Region:Asia

Author(s):Geetanshi

Product Code:KRAD8211

Pages:96

Published On:December 2025

By Type:The market is segmented into Mechanical Heat Meters (Impeller, Turbine, Vane Wheel), Static Heat Meters (Ultrasonic, Electromagnetic, Capacitive), and Smart Heat Meters. Mechanical heat meters are traditionally used for their reliability, while static heat meters are gaining traction due to their accuracy and low maintenance. Smart heat meters are becoming increasingly popular as they offer advanced features such as remote monitoring and data analytics.

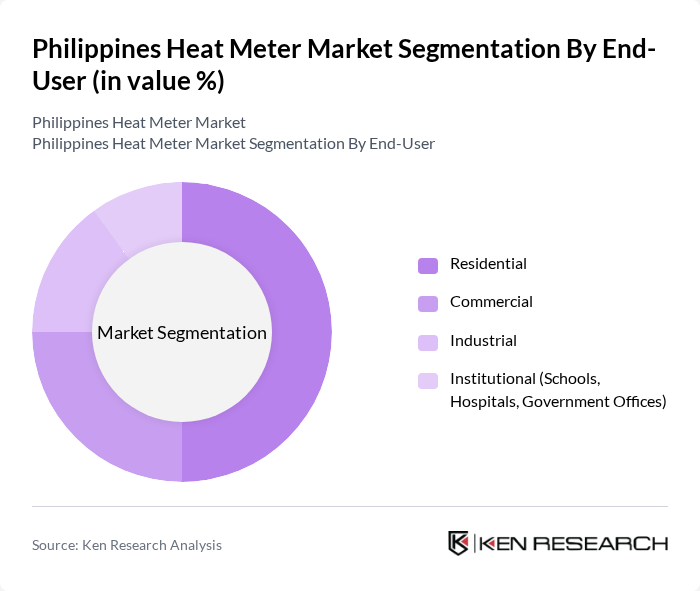

By End-User:The end-user segmentation includes Residential, Commercial, Industrial, and Institutional (Schools, Hospitals, Government Offices). The residential sector is the largest consumer of heat meters, driven by the increasing number of housing developments and the need for efficient energy management. The commercial and industrial sectors are also significant contributors, as businesses seek to optimize energy usage and reduce costs.

The Philippines Heat Meter Market is characterized by a dynamic mix of regional and international players. Leading participants such as Landis+Gyr, Siemens AG, Itron, Inc., Honeywell International Inc., Kamstrup A/S, Diehl Metering, Sensus (Xylem Inc.), Apator SA, Aclara Technologies LLC, Local Philippine Distributors & Installers contribute to innovation, geographic expansion, and service delivery in this space.

The Philippines heat meter market is poised for significant growth, driven by increasing energy efficiency demands and government support for renewable energy initiatives. As smart city projects expand, the integration of IoT technologies in heat metering will enhance operational efficiency and consumer engagement. Additionally, the focus on sustainable practices in energy consumption will further propel the adoption of heat metering solutions, creating a robust market environment that encourages innovation and investment in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Mechanical Heat Meters (Impeller, Turbine, Vane Wheel) Static Heat Meters (Ultrasonic, Electromagnetic, Capacitive) Smart Heat Meters |

| By End-User | Residential Commercial Industrial Institutional (Schools, Hospitals, Government Offices) |

| By Region | Metro Manila Cebu Davao Secondary Cities (Iloilo, Cagayan de Oro) Mountainous Regions (Baguio) |

| By Technology | Wired Communication Technology Wireless Communication Technology Hybrid Systems |

| By Application | Domestic/Sanitary Hot Water Space Heating Space Cooling Process Heating Pool Heating |

| By Installation Type | New Build Retrofit/Replacement |

| By Rated Capacity | Below 10 kW –20 kW Above 20 kW |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Heat Meter Users | 120 | Homeowners, Property Managers |

| Commercial Building Operators | 100 | Facility Managers, Energy Auditors |

| Industrial Heat Meter Installers | 80 | Installation Technicians, Operations Managers |

| Government Energy Policy Makers | 50 | Regulatory Officials, Energy Planners |

| Utility Company Representatives | 70 | Energy Analysts, Metering Supervisors |

The Philippines Heat Meter Market is valued at approximately USD 25 million, driven by increasing energy efficiency demands, government initiatives for sustainable energy, and the growth of smart city projects and HVAC infrastructure development.