Region:Asia

Author(s):Shubham

Product Code:KRAD5361

Pages:93

Published On:December 2025

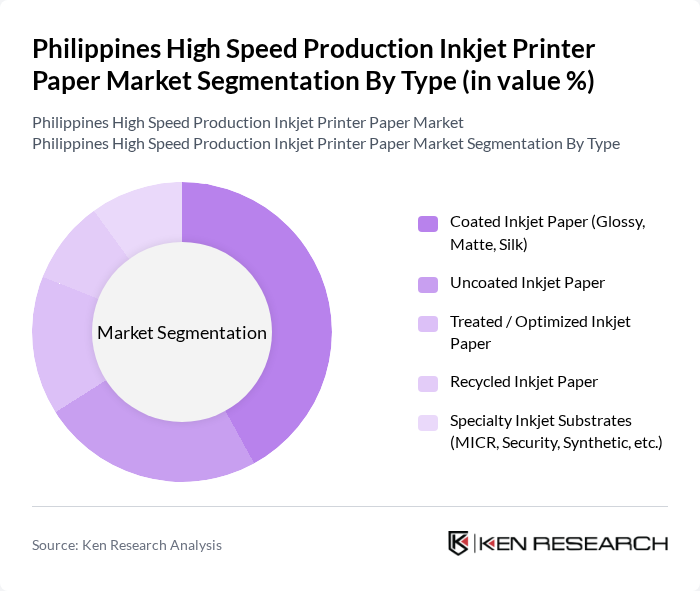

By Type:The market is segmented into various types of inkjet printer paper, including coated, uncoated, treated, recycled, and specialty substrates. Coated inkjet paper, which includes glossy, matte, and silk finishes, is particularly popular for its superior print quality, high optical density, and vibrant color reproduction demanded in direct mail, marketing collateral, and photo-rich applications. Uncoated inkjet paper is favored for everyday transactional and book printing where run-lengths are high and cost-efficiency is critical, while treated or optimized paper is specifically engineered for high-speed production inkjet presses, balancing ink absorption, drying time, and printhead compatibility. Recycled inkjet paper is gaining traction due to increasing environmental awareness and the integration of green public procurement requirements in the Philippines, and specialty substrates cater to niche applications such as MICR cheque printing, security printing, synthetic and durable materials for ID cards, tags, and labels.

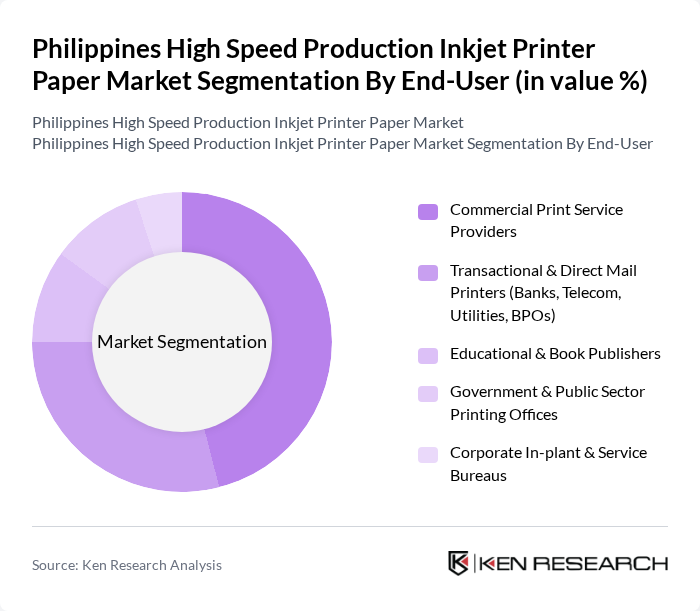

By End-User:The end-user segmentation includes commercial print service providers, transactional and direct mail printers, educational and book publishers, government and public sector printing offices, and corporate in-plant service bureaus. Commercial print service providers dominate the market, reflecting the strong base of commercial printing in the Philippines and their extensive use of high-speed inkjet presses for marketing collateral, catalogs, retail advertising, and packaging-related print components. Transactional printers, particularly in banking, utilities, and telecommunications, also represent a significant segment, driven by high volumes of statements, invoices, and direct mail that benefit from fast, variable-data inkjet production, while publishers and educational institutions are increasingly adopting inkjet for short-run and on-demand book and educational material printing.

The Philippines High Speed Production Inkjet Printer Paper Market is characterized by a dynamic mix of regional and international players. Leading participants such as International Paper Company, UPM?Kymmene Corporation, Stora Enso Oyj, Nippon Paper Industries Co., Ltd., Oji Holdings Corporation, Mitsubishi Paper Mills Limited, APP (Asia Pulp & Paper) Sinar Mas, Mondi Group, Sappi Limited, PaperOne (APRIL Group), HP Inc. (High?Speed Inkjet Media Solutions), Canon Inc. (Inkjet Paper & Media), FUJIFILM Business Innovation Corp., Hansol Paper Co., Ltd., Lecta Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Philippines high-speed production inkjet printer paper market appears promising, driven by technological advancements and a growing emphasis on sustainability. As businesses increasingly adopt eco-friendly practices, the demand for recyclable and sustainable paper products is expected to rise. Additionally, the integration of digital technologies in printing processes will enhance efficiency and reduce costs, positioning the market for robust growth. Companies that innovate and adapt to these trends will likely capture significant market share in future.

| Segment | Sub-Segments |

|---|---|

| By Type | Coated Inkjet Paper (Glossy, Matte, Silk) Uncoated Inkjet Paper Treated / Optimized Inkjet Paper Recycled Inkjet Paper Specialty Inkjet Substrates (MICR, Security, Synthetic, etc.) |

| By End-User | Commercial Print Service Providers Transactional & Direct Mail Printers (Banks, Telecom, Utilities, BPOs) Educational & Book Publishers Government & Public Sector Printing Offices Corporate In?plant & Service Bureaus |

| By Application | Books, Manuals & Educational Materials Transactional Documents & Direct Mail Marketing Collaterals (Brochures, Flyers, Catalogs) Labels, Tags & Light Packaging Variable Data & On?Demand Printing |

| By Distribution Channel | Direct Sales to Large Print Service Providers National Paper Distributors & Importers Office Supply & IT Retail Chains OEM Printer Channels (Vendor?bundled Media) Online B2B / B2C Platforms |

| By Region | Metro Manila / NCR Luzon (excluding NCR) Visayas Mindanao |

| By Quality | Premium High?Speed Inkjet Grade Standard Office & Commercial Grade Economy Grade Archival / Special Performance Grade |

| By Brand | Global OEM & Mill Brands (HP, Canon, Xerox, etc.) Regional Asian Brands Local / Private Label Brands House Brands of Major Distributors |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Printing Firms | 120 | Production Managers, Business Owners |

| Advertising Agencies | 90 | Creative Directors, Account Managers |

| Educational Institutions | 80 | Administrative Heads, Procurement Officers |

| Packaging Industry | 70 | Operations Managers, Product Development Specialists |

| Government Printing Services | 60 | Procurement Managers, Policy Makers |

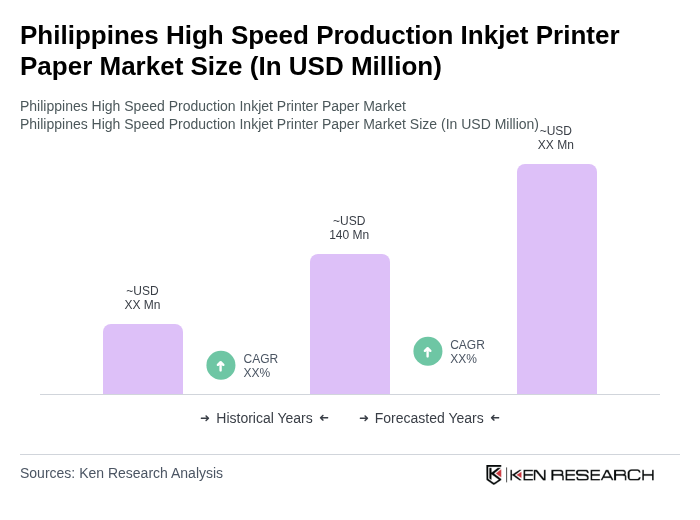

The Philippines High Speed Production Inkjet Printer Paper Market is valued at approximately USD 140 million, reflecting a robust demand for high-quality printing solutions across various sectors, including commercial printing, advertising, and education.