Region:Middle East

Author(s):Geetanshi

Product Code:KRAA8970

Pages:88

Published On:November 2025

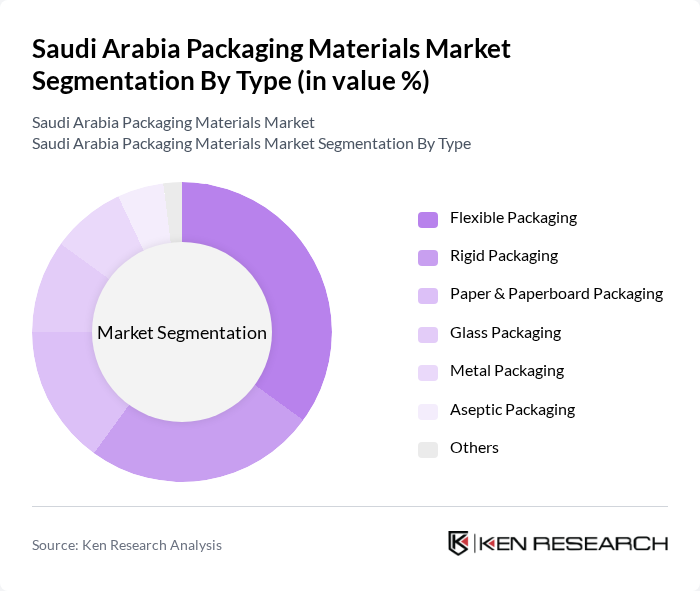

By Type:The segmentation by type includes various forms of packaging materials that cater to different needs and preferences in the market. The subsegments are Flexible Packaging, Rigid Packaging, Paper & Paperboard Packaging, Glass Packaging, Metal Packaging, Aseptic Packaging, and Others. Each of these subsegments plays a crucial role in meeting the diverse requirements of consumers and industries. Flexible packaging and rigid packaging are particularly prominent due to their versatility and protective qualities, while paper & paperboard packaging is gaining traction from e-commerce and sustainability trends.

The Flexible Packaging subsegment is dominating the market due to its versatility, lightweight nature, and cost-effectiveness. It is widely used in food and beverage packaging, where convenience and shelf life are critical. The trend towards on-the-go consumption and the rise of e-commerce have further propelled the demand for flexible packaging solutions. Additionally, advancements in technology have led to innovations in flexible packaging, enhancing its appeal among manufacturers and consumers alike.

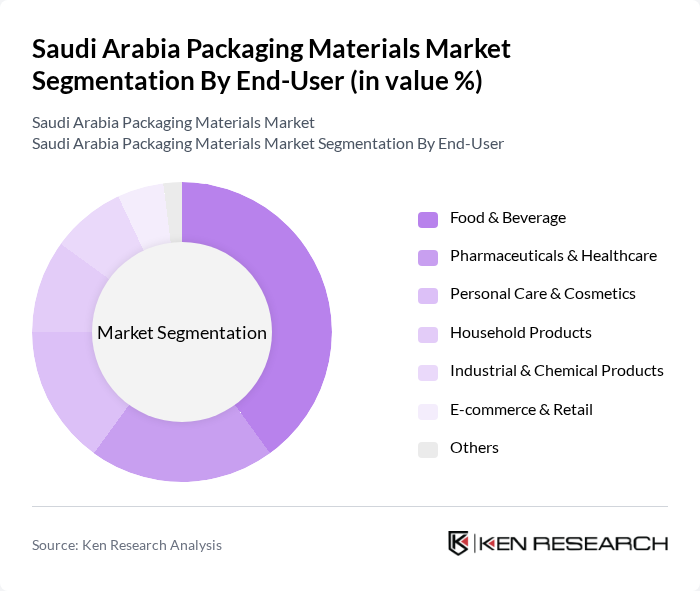

By End-User:The segmentation by end-user includes various industries that utilize packaging materials, such as Food & Beverage, Pharmaceuticals & Healthcare, Personal Care & Cosmetics, Household Products, Industrial & Chemical Products, E-commerce & Retail, and Others. Each end-user segment has unique requirements and preferences that influence the type of packaging materials used. The food & beverage sector is the largest consumer, followed by pharmaceuticals and personal care, reflecting the country's demographic trends and lifestyle shifts.

The Food & Beverage sector is the leading end-user segment, accounting for a significant portion of the market. This dominance is attributed to the increasing consumption of packaged food and beverages, driven by changing lifestyles and the growing trend of convenience. The demand for innovative and sustainable packaging solutions in this sector is also on the rise, as consumers become more health-conscious and environmentally aware.

The Saudi Arabia Packaging Materials Market is characterized by a dynamic mix of regional and international players. Leading participants such as Napco National, Obeikan Investment Group, Takween Advanced Industries Co., National Factory for Plastic Industry, Zamil Plastic Industries, Arabian Plastics Industrial Company Ltd. (APICO), ASPCO (Arabian Shield Plastic Company), Al Bayader International, Al-Jazira Factory for Plastic Products, Al-Watania Plastics, 3P Gulf Group, OCTAL Holding SAOC, Saudi Packaging Industries, Al-Qassim Packaging, Al-Faisal Packaging contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia packaging materials market appears promising, driven by technological advancements and a growing emphasis on sustainability. Innovations in smart packaging and automation are expected to enhance efficiency and reduce waste. Additionally, the increasing focus on personalized packaging experiences will cater to evolving consumer preferences. As companies adapt to these trends, the market is likely to witness robust growth, supported by favorable government policies and rising investments in sustainable practices.

| Segment | Sub-Segments |

|---|---|

| By Type | Flexible Packaging Rigid Packaging Paper & Paperboard Packaging Glass Packaging Metal Packaging Aseptic Packaging Others |

| By End-User | Food & Beverage Pharmaceuticals & Healthcare Personal Care & Cosmetics Household Products Industrial & Chemical Products E-commerce & Retail Others |

| By Material | Plastic (PET, HDPE, LDPE, PP, PVC, Others) Paper & Paperboard Metal (Aluminum, Steel, Others) Glass Others (Biodegradable, Compostable, etc.) |

| By Application | Food Packaging Beverage Packaging Healthcare & Pharmaceutical Packaging Cosmetic & Personal Care Packaging Industrial Packaging E-commerce Packaging Others |

| By Distribution Channel | Online Retail Offline Retail Direct Sales Distributors/Wholesalers Others |

| By Region | Central Region Eastern Region Western Region Southern Region |

| By Sustainability Level | Eco-Friendly Packaging Recyclable Packaging Non-Recyclable Packaging Compostable/Biodegradable Packaging Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food and Beverage Packaging | 120 | Packaging Managers, Quality Assurance Officers |

| Pharmaceutical Packaging Solutions | 80 | Regulatory Affairs Specialists, Production Managers |

| Consumer Goods Packaging Trends | 100 | Brand Managers, Marketing Directors |

| Sustainable Packaging Initiatives | 60 | Sustainability Managers, Product Development Leads |

| Logistics and Distribution Packaging | 50 | Logistics Coordinators, Supply Chain Analysts |

The Saudi Arabia Packaging Materials Market is valued at approximately USD 11.2 billion, driven by increasing demand for packaged goods, particularly in the food and beverage sector, and the rise of e-commerce requiring efficient packaging solutions.