Region:Asia

Author(s):Geetanshi

Product Code:KRAC2338

Pages:89

Published On:October 2025

By Type:The IPTV software market can be segmented into various types, including Live Streaming Software, Video on Demand (VOD) Software, Middleware Solutions, Content Delivery Network (CDN) Solutions, Analytics and Reporting Tools, Security Solutions, Content Management System (CMS), Streaming & Encoding Software, and Others. Each of these sub-segments plays a vital role in delivering diverse content and enhancing user experience. Live Streaming and VOD Software are the largest segments, reflecting the growing consumer preference for real-time and on-demand content. Middleware and CDN solutions are increasingly adopted to ensure seamless content delivery and scalability, while analytics and security tools are gaining traction for optimizing user engagement and safeguarding content .

By End-User:The end-user segmentation includes Residential, Commercial, Educational Institutions, Government & Utilities, and Healthcare Providers. Each segment has unique requirements and preferences, influencing the type of IPTV solutions adopted. The residential segment dominates due to the rising demand for on-demand entertainment and multi-device streaming. Commercial and educational sectors are increasingly utilizing IPTV for training, communication, and information dissemination, while government and healthcare segments are leveraging IPTV for public service broadcasting and telemedicine applications .

The Philippines IPTV Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as ABS-CBN Corporation, GMA Network Inc., PLDT Inc., Globe Telecom Inc., Cignal TV, Sky Cable Corporation, Converge ICT Solutions Inc., Mynt (GCash), iWantTFC, HOOQ (ceased operations, but historically relevant), Netflix, Amazon Prime Video, YouTube, Viu, Disney+, HBO GO, Tap Digital Media Ventures Corporation (TapGO), Solar Entertainment Corporation, Smart Communications Inc. contribute to innovation, geographic expansion, and service delivery in this space .

The future of the IPTV market in the Philippines appears promising, driven by technological advancements and evolving consumer preferences. As internet speeds improve with the rollout of 5G networks, IPTV providers will have the opportunity to enhance service quality and expand their content offerings. Additionally, the increasing integration of artificial intelligence in content delivery systems will enable personalized viewing experiences, further attracting subscribers and fostering market growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Live Streaming Software Video on Demand (VOD) Software Middleware Solutions Content Delivery Network (CDN) Solutions Analytics and Reporting Tools Security Solutions Content Management System (CMS) Streaming & Encoding Software Others |

| By End-User | Residential Commercial Educational Institutions Government & Utilities Healthcare Providers |

| By Application | Entertainment Education Corporate Training Advertising Gaming |

| By Distribution Channel | Direct Sales Online Platforms Retail Partnerships Telecom Operator Bundles |

| By Pricing Model | Subscription-Based Pay-Per-View Freemium Ad-Supported |

| By Customer Segment | Individual Consumers Small and Medium Enterprises Large Corporations Public Sector |

| By Content Type | Movies TV Shows Sports News E-Sports Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential IPTV Subscribers | 100 | Household Decision Makers, Media Consumers |

| Commercial IPTV Users | 60 | Business Owners, IT Managers |

| Content Providers | 40 | Content Acquisition Managers, Licensing Executives |

| Telecom Service Providers | 40 | Product Development Managers, Marketing Directors |

| Industry Analysts and Experts | 40 | Market Researchers, Telecom Consultants |

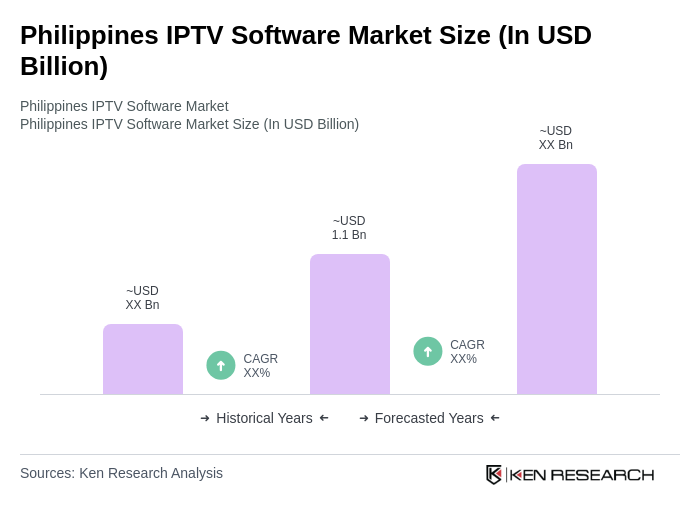

The Philippines IPTV Software Market is valued at approximately USD 1.1 billion, reflecting significant growth driven by increasing demand for high-quality streaming services and the rise of internet penetration across the country.