Region:Middle East

Author(s):Dev

Product Code:KRAC3439

Pages:94

Published On:October 2025

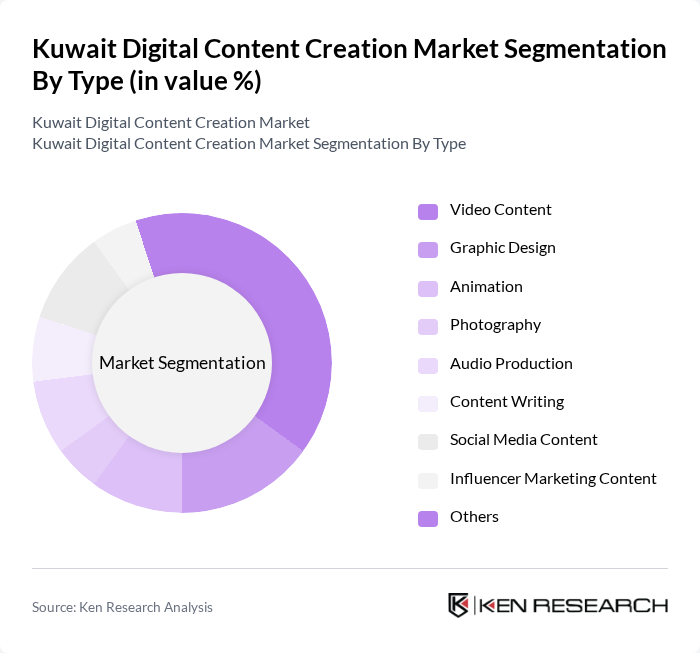

By Type:The digital content creation market is segmented into video content, graphic design, animation, photography, audio production, content writing, social media content, influencer marketing content, and others. Video content remains the leading segment, driven by high engagement rates, the proliferation of short-form videos, and increased consumption across platforms such as Instagram, TikTok, and YouTube . Graphic design and animation are also experiencing growth due to demand for visually compelling branding and advertising materials. Audio production, including podcasts and music, is gaining traction among younger audiences.

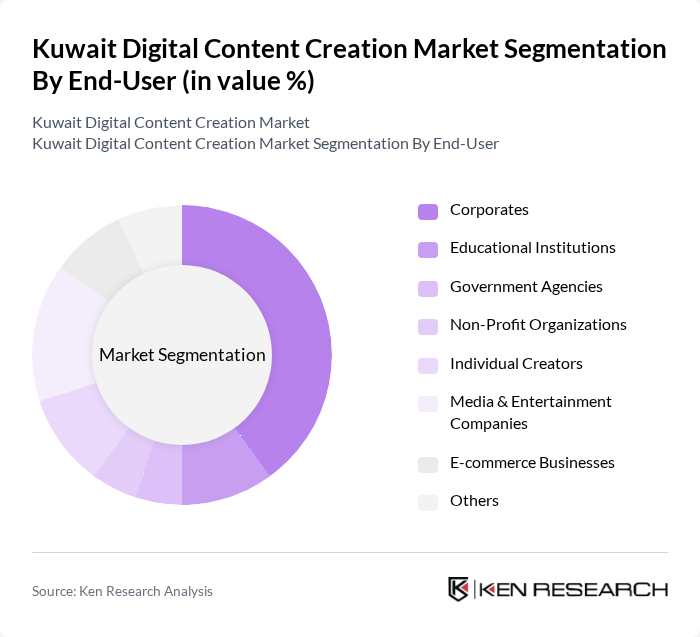

By End-User:The end-user segmentation of the digital content creation market includes corporates, educational institutions, government agencies, non-profit organizations, individual creators, media & entertainment companies, e-commerce businesses, and others. Corporates are the leading end-users, leveraging digital content for marketing, branding, and internal communications. Media & entertainment companies and individual creators are also significant contributors, reflecting the rise of influencer marketing and independent content production . E-commerce businesses increasingly use digital content to enhance customer engagement and drive sales.

The Kuwait Digital Content Creation Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Watania Media, Al-Qabas Media, Kuwait Times, KTV (Kuwait Television), Al Rai Media Group, Zain Group, Ooredoo Kuwait, Gulf Bank, Boubyan Bank, KIPCO (Kuwait Projects Company), MBC Group, OSN (Orbit Showtime Network), StarzPlay Arabia, Tellyo, Creative Media Solutions, Baims, Diwan Media, DotSpace, Think Media Labs, Sarmad Media Network contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait digital content creation market appears promising, driven by technological advancements and evolving consumer preferences. As mobile content consumption continues to rise, creators will need to adapt their strategies to engage audiences effectively. Additionally, the integration of artificial intelligence in content production is expected to streamline processes and enhance creativity. With a focus on sustainability and ethical content practices, the industry is poised for growth, fostering innovation and collaboration among local and international players.

| Segment | Sub-Segments |

|---|---|

| By Type | Video Content Graphic Design Animation Photography Audio Production Content Writing Social Media Content Influencer Marketing Content Others |

| By End-User | Corporates Educational Institutions Government Agencies Non-Profit Organizations Individual Creators Media & Entertainment Companies E-commerce Businesses Others |

| By Distribution Channel | Direct Sales Online Platforms Social Media Partnerships with Agencies Influencer Networks Others |

| By Content Format | Short-Form Content Long-Form Content Interactive Content Live Streaming Podcasts Others |

| By Industry | Entertainment Education Retail Healthcare Technology Financial Services Others |

| By Engagement Type | Paid Content Free Content Subscription-Based Content Sponsored Content User-Generated Content Others |

| By Geographic Focus | Local Content Regional Content International Content Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Digital Marketing Agencies | 60 | Agency Owners, Creative Directors |

| Freelance Content Creators | 50 | Content Writers, Video Producers |

| Social Media Influencers | 40 | Influencers, Brand Collaborators |

| Corporate Marketing Departments | 55 | Marketing Managers, Brand Strategists |

| Consumers Engaging with Digital Content | 90 | General Public, Target Demographic Segments |

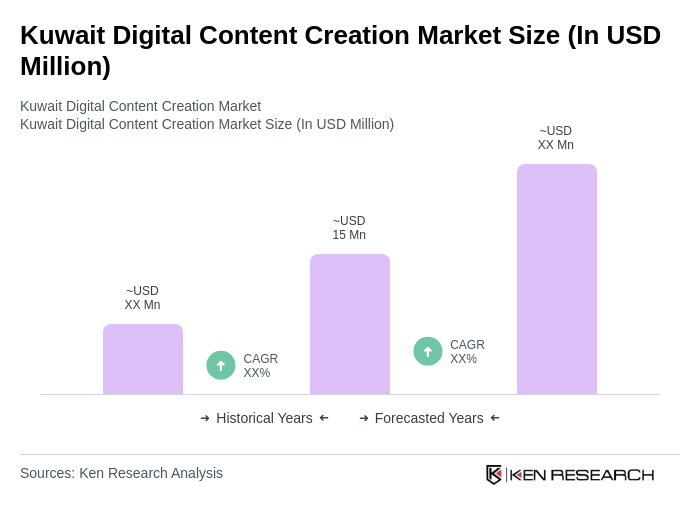

The Kuwait Digital Content Creation Market is valued at approximately USD 15 million, driven by factors such as increasing internet penetration, the rise of social media platforms, and a growing demand for high-quality digital content across various sectors.