Region:Asia

Author(s):Dev

Product Code:KRAD7746

Pages:83

Published On:December 2025

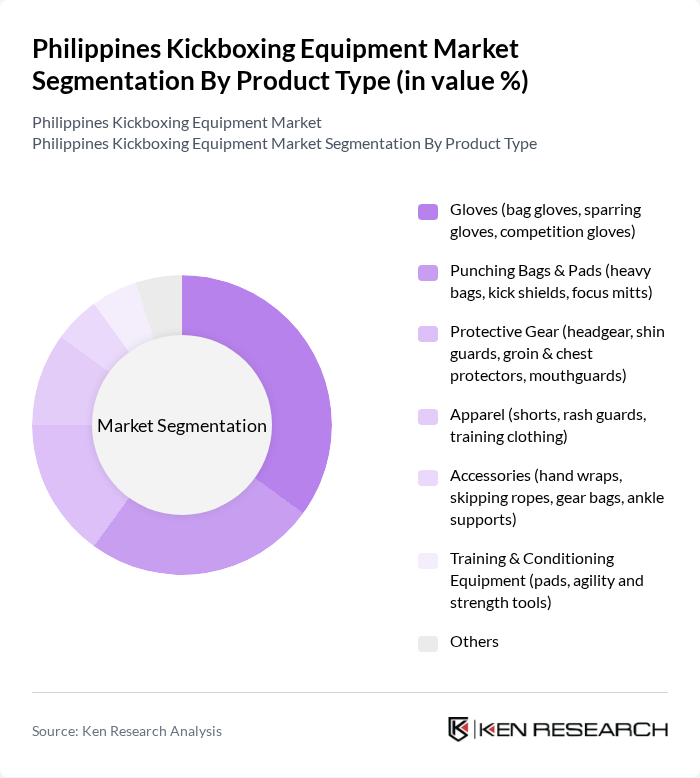

By Product Type:The product type segmentation includes various categories such as gloves, punching bags and pads, protective gear, apparel, accessories, training and conditioning equipment, and others. Among these, gloves are the most popular due to their essential role in kickboxing training and competition. The demand for specialized gloves, including bag gloves, sparring gloves, and competition gloves, has surged as more individuals engage in kickboxing for fitness and sport. Punching bags and pads also hold significant market share, driven by their necessity in training regimens.

By End-User/Application:The end-user segmentation encompasses home users, kickboxing and MMA gyms, fitness clubs, schools, universities, and professional fighters. The segment of kickboxing and MMA gyms is the most significant, as these facilities require a wide range of equipment to cater to their members. The increasing number of fitness enthusiasts opting for kickboxing as a form of exercise has also led to a rise in demand from home users, who seek quality equipment for personal training.

The Philippines Kickboxing Equipment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Everlast Worldwide, Inc., Venum, Fairtex, Hayabusa Fightwear Inc., RDX Sports, TITLE Boxing, LLC, Revgear Sports Co., Twins Special Co., Ltd., Top King Boxing Co., Ltd., Winning (FITEC Co., Ltd.), Ringside, Inc., Cleto Reyes (Industria Reyes, S.A. de C.V.), Sanabul LLC, local Philippine distributors and brands (Olympic Village / Olympic World, Chris Sports, Toby’s Sports private labels), Decathlon S.A. (Outshock brand) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the kickboxing equipment market in the Philippines appears promising, driven by increasing consumer interest in fitness and combat sports. As more individuals seek engaging workout options, the demand for high-quality kickboxing gear is expected to rise. Additionally, the integration of technology in training equipment, such as smart gloves and fitness apps, will likely enhance training experiences. The market is poised for growth as local manufacturers and e-commerce platforms expand their offerings to meet evolving consumer preferences.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Gloves (bag gloves, sparring gloves, competition gloves) Punching Bags & Pads (heavy bags, kick shields, focus mitts) Protective Gear (headgear, shin guards, groin & chest protectors, mouthguards) Apparel (shorts, rash guards, training clothing) Accessories (hand wraps, skipping ropes, gear bags, ankle supports) Training & Conditioning Equipment (pads, agility and strength tools) Others |

| By End-User/Application | Home Users & Individual Fitness Enthusiasts Kickboxing & MMA Gyms / Training Centers Fitness Clubs & Boutique Studios Schools, Universities & Sports Academies Professional & Amateur Fighters Others |

| By Distribution Channel | Online Marketplaces (Lazada, Shopee, brand webstores) Specialty Sports & Martial Arts Stores General Sporting Goods Retailers Gym / Studio Direct Sales & Bulk Procurement Supermarkets and Hypermarkets Others |

| By Price Range | Budget / Entry-Level Mid-Range Premium & Professional Others |

| By Brand Origin | Local & Regional Brands Global Combat Sports Brands Private Label & Gym-Branded Products Others |

| By Material | Synthetic Leather (PU, PVC) Genuine Leather Foam & Padding Compounds Eco-friendly & Recycled Materials Others |

| By User Demographics | Age Group (Youth, Adult, Senior) Gender (Male, Female, Unisex) Skill Level (Beginner, Intermediate, Advanced/Professional) Urban vs. Rural Users |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sales of Kickboxing Equipment | 120 | Store Managers, Sales Representatives |

| Fitness Centers Offering Kickboxing Classes | 100 | Gym Owners, Fitness Instructors |

| Manufacturers of Kickboxing Gear | 80 | Product Managers, Supply Chain Directors |

| Kickboxing Enthusiasts and Athletes | 120 | Amateur and Professional Kickboxers, Trainers |

| Online Retailers of Sports Equipment | 90 | E-commerce Managers, Marketing Directors |

The Philippines Kickboxing Equipment Market is valued at approximately USD 12 million, reflecting a growing interest in kickboxing as a fitness trend and the increasing number of gyms and training centers offering kickboxing classes.