Philippines Mattress and Sleep Products Market Overview

- The Philippines Mattress and Sleep Products Market is valued at USD 1.2 billion, based on a five-year historical analysis. This growth is primarily driven by rising consumer awareness of sleep wellness, increasing disposable incomes, and a strong premiumization trend in urban centers. The market is experiencing heightened demand for innovative mattress technologies, such as cooling gel layers, hybrid constructions, and eco-friendly foams, reflecting a shift toward quality sleep solutions and ergonomic bedding preferences .

- Metro Manila, Cebu, and Davao remain the dominant cities in the Philippines Mattress and Sleep Products Market. Metro Manila leads due to its high concentration of affluent consumers and rapid urbanization, while Cebu and Davao continue to see strong economic growth and urban expansion, driving increased demand for premium and specialized sleep products among middle-class and upper-income households .

- In 2023, the Philippines government implemented the "Philippine National Standard (PNS) 2154:2023 – Mattresses," issued by the Bureau of Philippine Standards (BPS), Department of Trade and Industry. This regulation mandates compliance with safety, flammability, and durability standards, requiring manufacturers to undergo product testing and certification to ensure consumer protection and enhance the overall quality of sleep products available in the market .

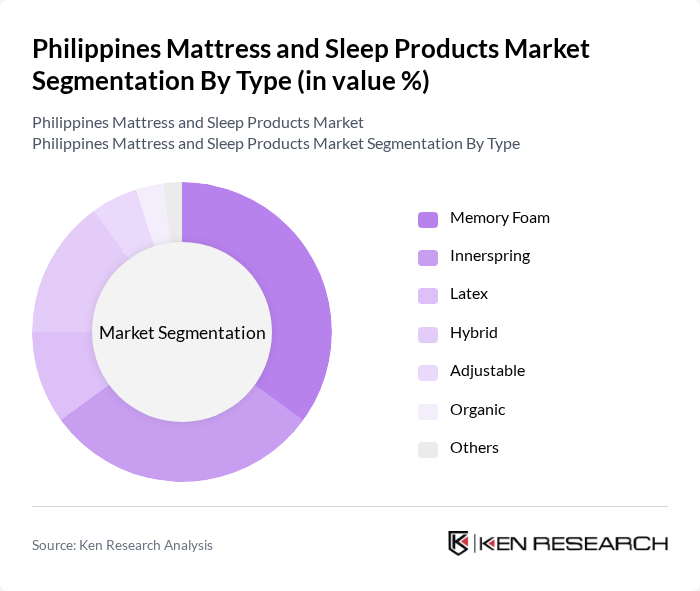

Philippines Mattress and Sleep Products Market Segmentation

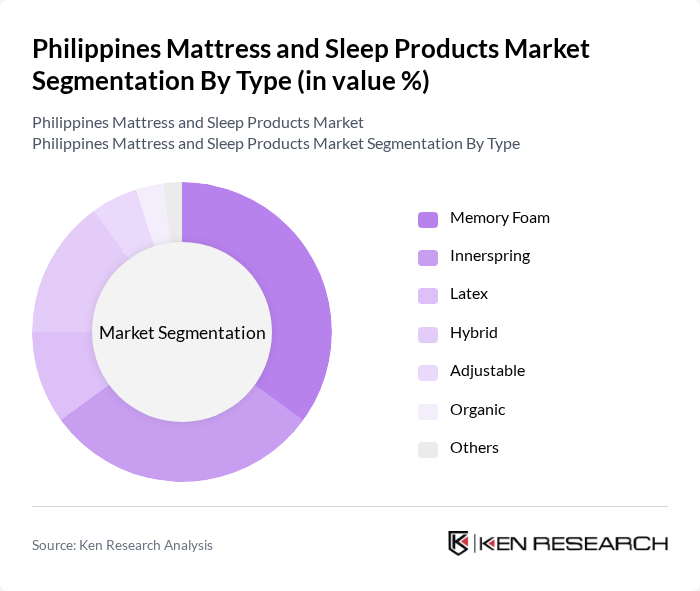

By Type:The mattress and sleep products market is segmented into Memory Foam, Innerspring, Latex, Hybrid, Adjustable, Organic, and Others. Memory Foam mattresses are gaining significant traction due to their ergonomic support, pressure-relieving properties, and suitability for a wide range of consumers, including those with back pain or sleep disorders. Innerspring mattresses remain popular for their traditional feel and affordability, while Hybrid mattresses are increasingly favored for combining foam and innerspring technologies, offering enhanced comfort and support. Latex and Organic mattresses are attracting environmentally conscious buyers, and Adjustable mattresses cater to consumers seeking customizable sleep experiences .

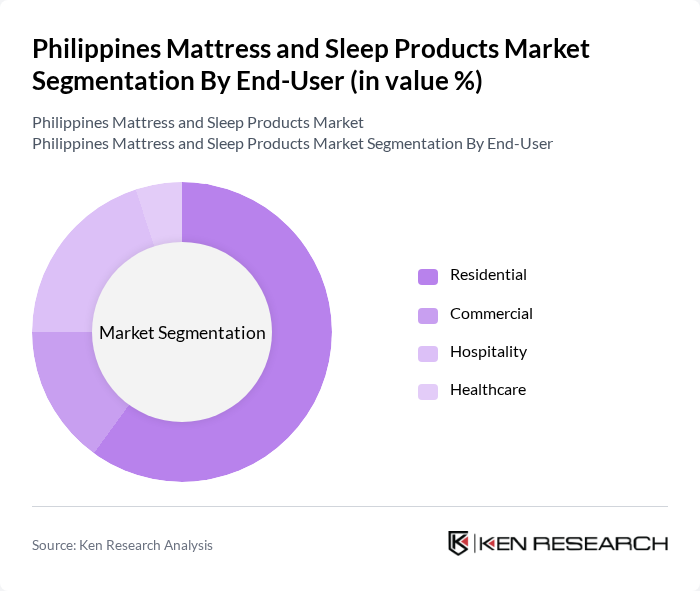

By End-User:The market is segmented by end-user into Residential, Commercial, Hospitality, and Healthcare. The Residential segment dominates, driven by increased consumer spending on home furnishings, urbanization, and a growing focus on sleep health. The Hospitality sector is significant, as hotels and resorts invest in premium mattresses to enhance guest experiences. The Healthcare segment is expanding, with hospitals and clinics adopting specialized sleep products for patient comfort and therapeutic needs. The Commercial segment includes offices and institutional buyers seeking durable sleep solutions for staff accommodations .

Philippines Mattress and Sleep Products Market Competitive Landscape

The Philippines Mattress and Sleep Products Market is characterized by a dynamic mix of regional and international players. Leading participants such as Uratex, Mandaue Foam, Tempur-Pedic, Sealy Philippines, Serta Philippines, Sleep Number, My Mattress, Zinus, King Koil, Dreamland, Comfort Living, Sleep Innovations, IKEA Philippines, Homegrown Mattress Co., The Foam Factory contribute to innovation, geographic expansion, and service delivery in this space.

Philippines Mattress and Sleep Products Market Industry Analysis

Growth Drivers

- Increasing Consumer Awareness about Sleep Health:The Philippines has seen a significant rise in consumer awareness regarding sleep health, with 70% of Filipinos acknowledging the importance of quality sleep for overall well-being. This awareness is driven by health campaigns and social media, leading to increased demand for high-quality mattresses and sleep products. The Philippine Department of Health reported that sleep-related health issues have surged by 15% in recent years, further motivating consumers to invest in better sleep solutions.

- Rising Disposable Incomes:The Philippines' GDP per capita is projected to reach approximately $3,600 in future, reflecting a 6% increase from previous estimates. This rise in disposable income allows consumers to allocate more funds towards premium sleep products. As more households transition to the middle class, spending on non-essential items, including mattresses, is expected to grow, with an estimated increase of 20% in mattress sales anticipated in urban areas, driven by improved living standards.

- Growth in the Real Estate Sector:The real estate sector in the Philippines is projected to grow by 8% in future, with over 200,000 new residential units expected to be completed. This growth is creating a higher demand for mattresses and sleep products as new homeowners seek quality furnishings. Additionally, the Philippine Statistics Authority reported that housing starts have increased by 12% year-on-year, indicating a robust market for sleep products as part of home furnishing.

Market Challenges

- Intense Competition Among Local and International Brands:The mattress market in the Philippines is highly competitive, with over 50 local and international brands vying for market share. This saturation leads to price wars, which can erode profit margins. According to industry reports, the top five brands control only 30% of the market, indicating a fragmented landscape where smaller players can disrupt pricing strategies, making it challenging for established brands to maintain profitability.

- Fluctuating Raw Material Prices:The mattress manufacturing sector faces challenges due to fluctuating prices of raw materials such as foam and fabric, which have seen price increases of up to 25% in the past year. This volatility is largely attributed to global supply chain disruptions and rising transportation costs. Manufacturers are struggling to pass these costs onto consumers, which can impact their bottom line and lead to reduced investment in product innovation.

Philippines Mattress and Sleep Products Market Future Outlook

The Philippines mattress and sleep products market is poised for significant transformation, driven by evolving consumer preferences and technological advancements. As the demand for personalized sleep solutions grows, manufacturers are likely to invest in innovative materials and smart technologies. Additionally, the increasing focus on health and wellness will encourage brands to integrate features that promote better sleep quality. The expansion of e-commerce platforms will further facilitate access to diverse product offerings, enhancing consumer choice and convenience in the coming years.

Market Opportunities

- Growing Demand for Eco-Friendly Products:With environmental concerns on the rise, the demand for eco-friendly mattresses is expected to increase. In future, the market for sustainable sleep products is projected to grow by 30%, driven by consumer preference for organic materials and sustainable manufacturing practices. This trend presents a lucrative opportunity for brands to differentiate themselves and capture a niche market segment focused on sustainability.

- Increasing Popularity of Smart Sleep Products:The integration of technology in sleep products is gaining traction, with smart mattresses and sleep trackers expected to see a 40% increase in sales in future. As consumers become more tech-savvy, the demand for products that monitor sleep patterns and enhance comfort will rise. This trend offers manufacturers a chance to innovate and cater to a growing market segment interested in health and wellness technology.