Region:Asia

Author(s):Rebecca

Product Code:KRAD2855

Pages:89

Published On:November 2025

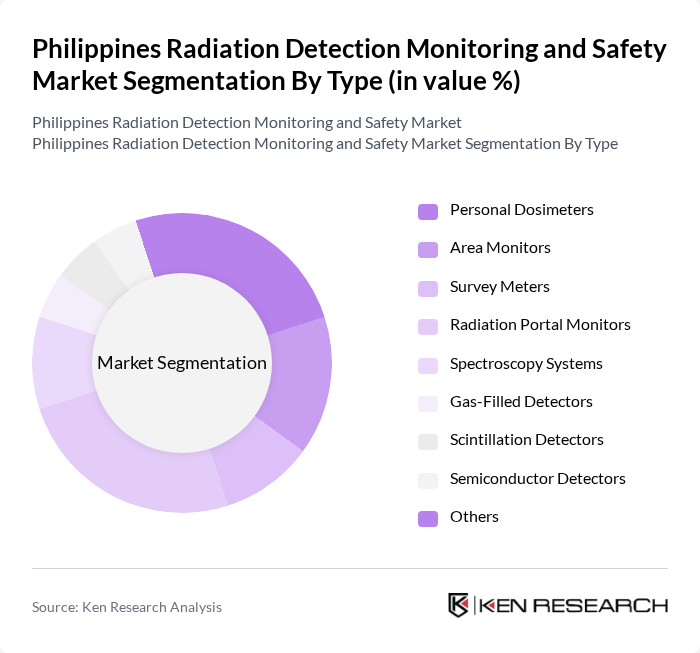

By Type:The market is segmented into various types of radiation detection and monitoring equipment, including Personal Dosimeters, Area Monitors, Survey Meters, Radiation Portal Monitors, Spectroscopy Systems, Gas-Filled Detectors, Scintillation Detectors, Semiconductor Detectors, and Others. Each of these sub-segments plays a crucial role in ensuring safety and compliance across different sectors.

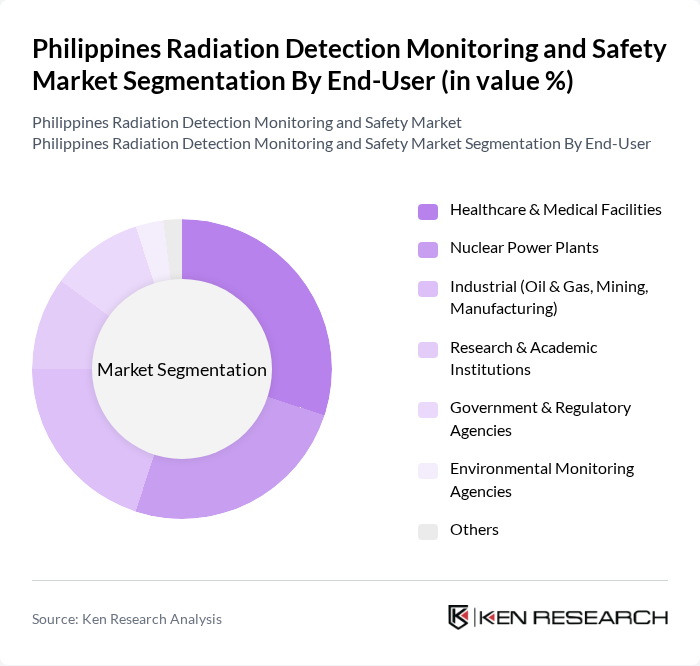

By End-User:The end-user segmentation includes Healthcare & Medical Facilities, Nuclear Power Plants, Industrial (Oil & Gas, Mining, Manufacturing), Research & Academic Institutions, Government & Regulatory Agencies, Environmental Monitoring Agencies, and Others. Each segment has unique requirements for radiation detection and monitoring solutions.

The Philippines Radiation Detection Monitoring and Safety Market is characterized by a dynamic mix of regional and international players. Leading participants such as Mirion Technologies, Thermo Fisher Scientific, Canberra Industries (now part of Mirion Technologies), Ludlum Measurements, Inc., Fluke Biomedical, Landauer, Inc., Radiation Detection Company, ORTEC (Ametek, Inc.), AMETEK, Inc., GE HealthCare, Kromek Group plc, Bertin Instruments (Saphymo), RADOS Technology (Mirion Technologies), Alpha Spectra, Inc., Nuvia Dynamics, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Philippines radiation detection monitoring and safety market appears promising, driven by ongoing technological advancements and increasing regulatory pressures. As the government continues to enforce stricter safety standards, the demand for innovative detection solutions is expected to rise. Additionally, the integration of IoT technologies will likely enhance monitoring capabilities, providing real-time data and improving safety protocols across various sectors, including healthcare and nuclear energy.

| Segment | Sub-Segments |

|---|---|

| By Type | Personal Dosimeters Area Monitors Survey Meters Radiation Portal Monitors Spectroscopy Systems Gas-Filled Detectors Scintillation Detectors Semiconductor Detectors Others |

| By End-User | Healthcare & Medical Facilities Nuclear Power Plants Industrial (Oil & Gas, Mining, Manufacturing) Research & Academic Institutions Government & Regulatory Agencies Environmental Monitoring Agencies Others |

| By Application | Environmental Monitoring Occupational Safety Emergency Response Waste Management Diagnostics & Therapy Security & Border Protection Others |

| By Distribution Channel | Direct Sales Online Sales Distributors Retail Outlets Others |

| By Region | Luzon Visayas Mindanao |

| By Technology | Analog Detection Systems Digital Detection Systems Hybrid Systems Others |

| By Policy Support | Government Grants Tax Incentives Research Funding Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Radiation Safety | 100 | Radiation Safety Officers, Hospital Administrators |

| Nuclear Energy Sector | 80 | Nuclear Engineers, Compliance Managers |

| Industrial Applications | 60 | Quality Control Managers, Safety Inspectors |

| Environmental Monitoring | 50 | Environmental Scientists, Regulatory Affairs Specialists |

| Research Institutions | 40 | Lab Managers, Research Scientists |

The Philippines Radiation Detection Monitoring and Safety Market is valued at approximately USD 20 million, reflecting a five-year historical analysis. This growth is attributed to increased awareness of radiation safety and advancements in detection technologies across various sectors.