Region:Middle East

Author(s):Rebecca

Product Code:KRAC8449

Pages:86

Published On:November 2025

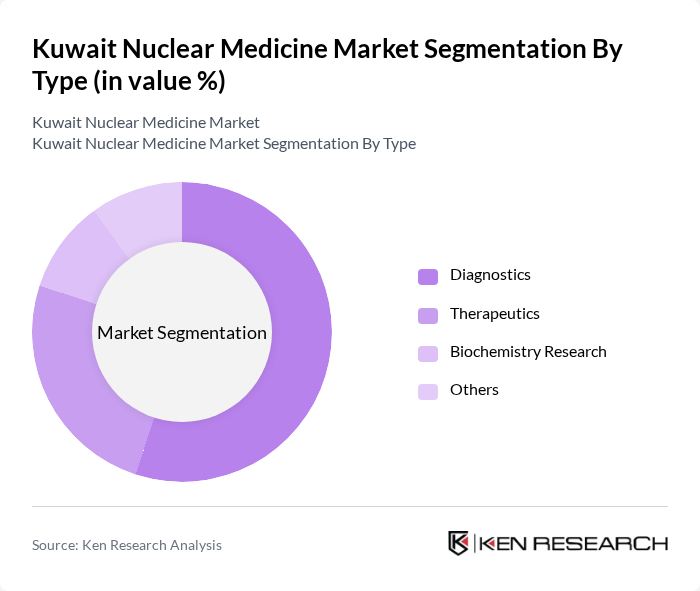

By Type:The market is segmented into Diagnostics, Therapeutics, Biochemistry Research, and Others. Among these, Diagnostics is the leading sub-segment, driven by the increasing demand for early disease detection and the growing adoption of advanced imaging technologies. The rise in chronic diseases such as cancer and cardiovascular conditions has further propelled the need for diagnostic procedures, making it a critical area of focus within the nuclear medicine market. Regionally, the diagnostics segment dominates the nuclear medicine market with a revenue share of 75.90%.

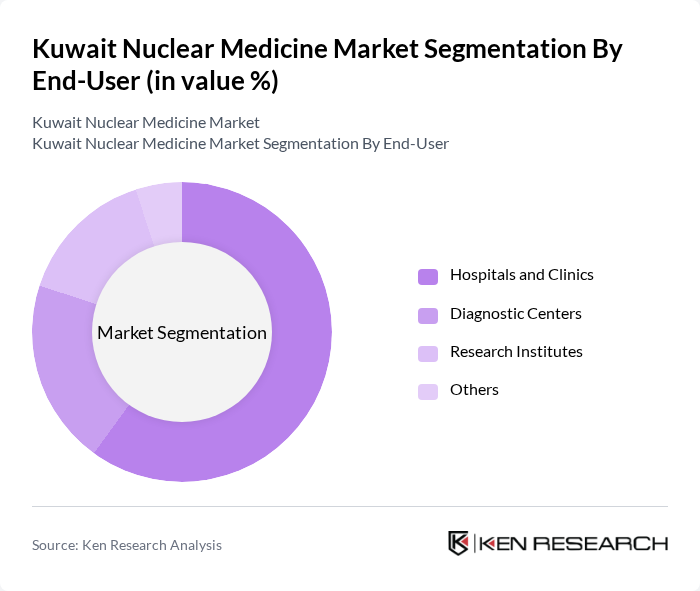

By End-User:The end-user segmentation includes Hospitals and Clinics, Diagnostic Centers, Research Institutes, and Others. Hospitals and Clinics dominate this segment, as they are the primary providers of nuclear medicine services. The increasing number of hospitals equipped with nuclear medicine facilities and the rising patient footfall for diagnostic and therapeutic procedures contribute to the growth of this segment.

The Kuwait Nuclear Medicine Market is characterized by a dynamic mix of regional and international players. Leading participants such as Kuwait Cancer Control Center, Kuwait Nuclear Medicine Center, Al-Sabah Hospital, Mubarak Al-Kabeer Hospital, Jaber Al-Ahmad Hospital, Farwaniya Hospital, Adan Hospital, Al-Amiri Hospital, Al-Razi Hospital, Al-Jahra Hospital, Kuwait University Health Sciences Center, Dasman Diabetes Institute, Al-Diwan Medical Group, Gulf Medical Company, GE HealthCare (Kuwait) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait nuclear medicine market appears promising, driven by ongoing advancements in technology and increasing healthcare investments. The integration of artificial intelligence in diagnostics is expected to enhance imaging accuracy and efficiency. Additionally, the shift towards outpatient services will likely improve patient access and convenience. As the government continues to prioritize healthcare infrastructure, the market is poised for significant growth, addressing both current challenges and emerging opportunities in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Diagnostics Therapeutics Biochemistry Research Others |

| By End-User | Hospitals and Clinics Diagnostic Centers Research Institutes Others |

| By Application | Oncology Cardiology Neurology Thyroid Others |

| By Technology / Modality | Single Photon Emission Computed Tomography (SPECT) Positron Emission Tomography (PET) Gamma Cameras Alpha Emitters Beta Emitters Brachytherapy Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | Capital Governorate Hawalli Governorate Al Ahmadi Governorate Others |

| By Policy Support | Government Subsidies Tax Incentives Research Grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Nuclear Medicine Departments in Hospitals | 45 | Nuclear Medicine Physicians, Department Heads |

| Healthcare Procurement Managers | 40 | Procurement Officers, Supply Chain Managers |

| Patients Undergoing Nuclear Medicine Procedures | 50 | Patients, Caregivers |

| Healthcare Policy Makers | 40 | Health Ministry Officials, Regulatory Bodies |

| Medical Equipment Suppliers | 45 | Sales Representatives, Product Managers |

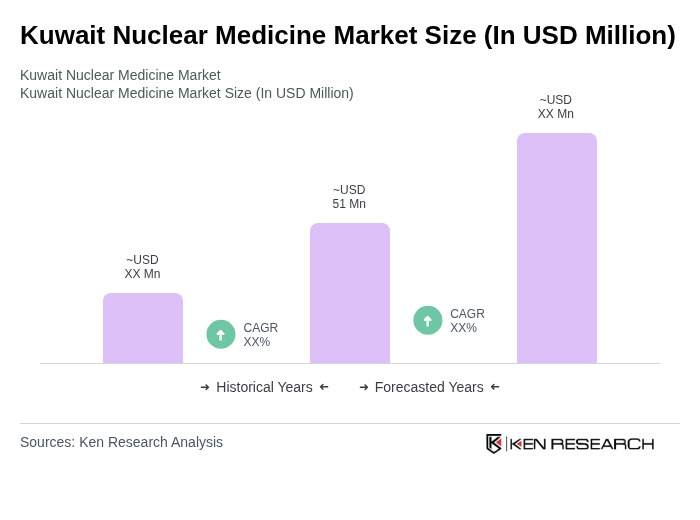

The Kuwait Nuclear Medicine Market is valued at approximately USD 51 million, reflecting growth driven by advancements in diagnostic imaging technologies, increasing chronic disease prevalence, and enhanced healthcare infrastructure.