Region:Asia

Author(s):Shubham

Product Code:KRAC2135

Pages:95

Published On:October 2025

By Type:The market is segmented into various types of radiation therapy, including External Beam Radiation Therapy, Internal Radiation Therapy (Brachytherapy), Stereotactic Radiosurgery (SRS)/Stereotactic Body Radiotherapy (SBRT), Proton Therapy, Systemic Radiotherapy/Radiopharmaceuticals, and Others. Each of these sub-segments plays a crucial role in addressing different cancer types and treatment needs. External Beam Radiation Therapy remains the most widely utilized modality, particularly for common cancers such as breast, lung, and prostate, while SRS/SBRT is increasingly adopted for precise, high-dose treatments in fewer sessions. Proton Therapy and radiopharmaceuticals are emerging but remain limited to select centers due to high costs and infrastructure requirements .

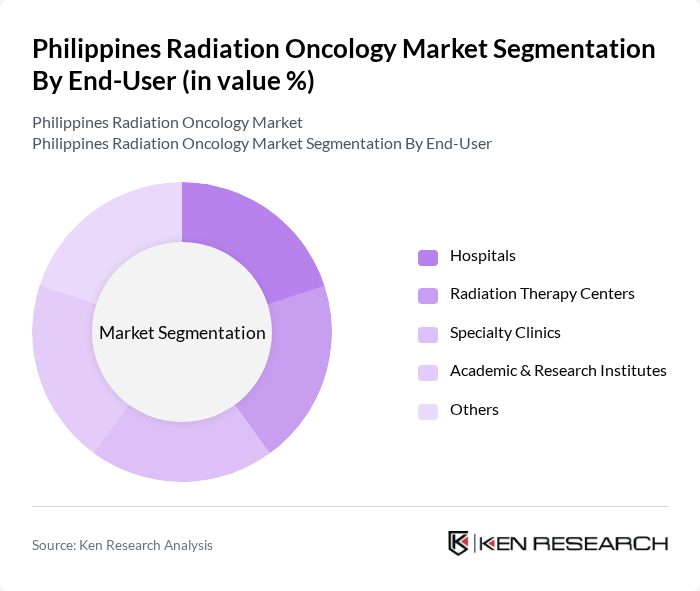

By End-User:The end-user segmentation includes Hospitals, Radiation Therapy Centers, Specialty Clinics, Academic & Research Institutes, and Others. Hospitals are the primary providers of radiation oncology services, accounting for the largest market share due to their comprehensive cancer care capabilities and access to advanced equipment. Dedicated radiation therapy centers are expanding, particularly in urban areas, to meet growing demand for specialized outpatient treatments. Specialty clinics and academic institutes contribute to research, training, and niche services .

The Philippines Radiation Oncology Market is characterized by a dynamic mix of regional and international players. Leading participants such as Philippine General Hospital, St. Luke's Medical Center, Makati Medical Center, Asian Hospital and Medical Center, The Medical City, Cardinal Santos Medical Center, University of Santo Tomas Hospital, Cebu Doctors' University Hospital, Davao Doctors Hospital, Chong Hua Hospital, Manila Doctors Hospital, Research Institute for Tropical Medicine, Philippine Cancer Society, Medical City Clark, Southern Philippines Medical Center, Elekta AB, Varian Medical Systems, Inc. (Siemens Healthineers), Accuray Incorporated, RaySearch Laboratories AB, Canon Medical Systems Corporation, GE HealthCare, Hitachi Ltd., Mevion Medical Systems, Inc., Ion Beam Applications SA (IBA), RefleXion Medical, Isoray Inc., Nordion Inc., ALCEN (PMB) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the radiation oncology market in the Philippines appears promising, driven by ongoing technological advancements and increased government support. As healthcare facilities expand and modernize, the integration of telemedicine and personalized treatment plans will likely enhance patient access and engagement. Furthermore, the growing emphasis on research and development will foster innovative treatment options, ultimately improving patient outcomes and solidifying the market's position as a critical component of the healthcare system in the Philippines.

| Segment | Sub-Segments |

|---|---|

| By Type | External Beam Radiation Therapy Internal Radiation Therapy (Brachytherapy) Stereotactic Radiosurgery (SRS)/Stereotactic Body Radiotherapy (SBRT) Proton Therapy Systemic Radiotherapy/Radiopharmaceuticals Others |

| By End-User | Hospitals Radiation Therapy Centers Specialty Clinics Academic & Research Institutes Others |

| By Application | Breast Cancer Lung Cancer Prostate Cancer Colorectal Cancer Brain Cancer Cervical Cancer Liver Cancer Lymphoma Thyroid Cancer Spine Cancer Others |

| By Treatment Stage | Early Stage Advanced Stage Palliative Care |

| By Distribution Channel | Direct Tenders Third Party Distributors Others |

| By Pricing Model | Fixed Pricing Variable Pricing Bundled Pricing |

| By Policy Support | Government Subsidies Tax Incentives Grants for Research |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Radiation Oncology Departments | 60 | Radiation Oncologists, Department Heads |

| Cancer Treatment Centers | 50 | Medical Physicists, Oncology Nurses |

| Healthcare Administrators | 40 | Hospital Administrators, Financial Officers |

| Patient Experience Surveys | 100 | Cancer Patients, Caregivers |

| Technology Providers in Radiation Therapy | 45 | Product Managers, Sales Executives |

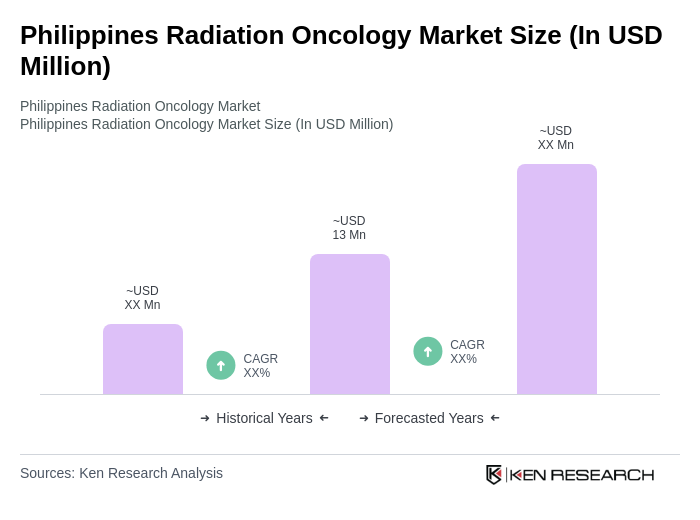

The Philippines Radiation Oncology Market is valued at approximately USD 13 million, reflecting a significant investment in cancer treatment facilities and advanced radiation therapy technologies over the past five years.