Region:Middle East

Author(s):Dev

Product Code:KRAC3366

Pages:96

Published On:October 2025

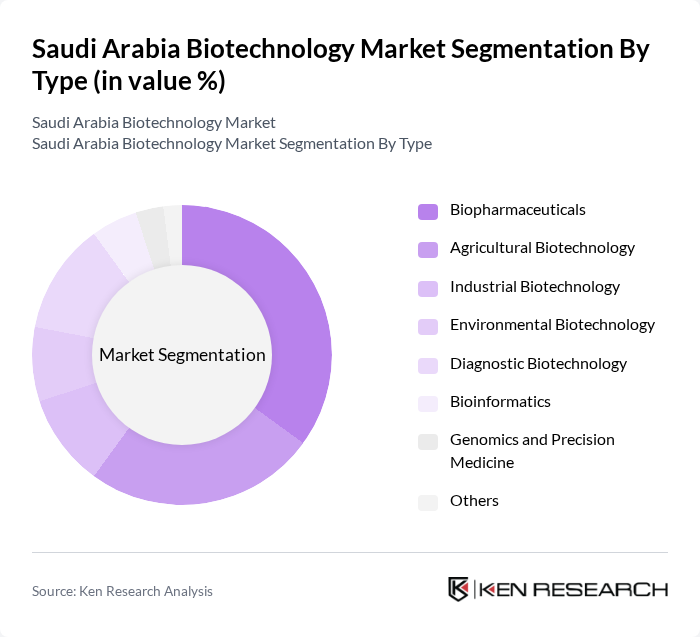

By Type:The biotechnology market in Saudi Arabia can be segmented into various types, including Biopharmaceuticals, Agricultural Biotechnology, Industrial Biotechnology, Environmental Biotechnology, Diagnostic Biotechnology, Bioinformatics, Genomics and Precision Medicine, and Others. Each of these segments plays a crucial role in addressing specific needs within the healthcare and agricultural sectors, contributing to the overall growth of the market. Biopharmaceuticals and agricultural biotechnology represent the largest segments, driven by demand for advanced therapeutics and sustainable agricultural solutions .

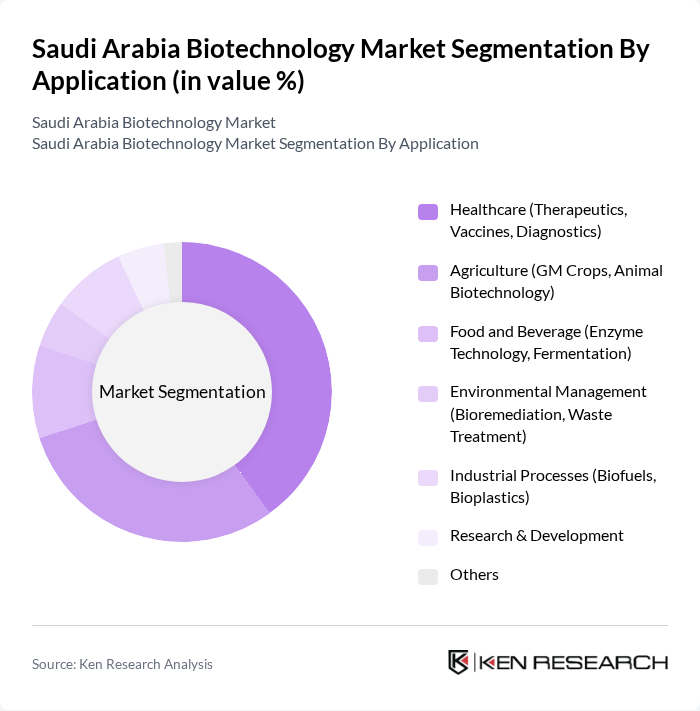

By Application:The applications of biotechnology in Saudi Arabia encompass Healthcare (Therapeutics, Vaccines, Diagnostics), Agriculture (GM Crops, Animal Biotechnology), Food and Beverage (Enzyme Technology, Fermentation), Environmental Management (Bioremediation, Waste Treatment), Industrial Processes (Biofuels, Bioplastics), Research & Development, and Others. These applications are vital for enhancing productivity and sustainability across various sectors. Healthcare applications dominate, reflecting the country's focus on advanced therapeutics and diagnostics as part of Vision 2030 .

The Saudi Arabia Biotechnology Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Bio, King Faisal Specialist Hospital & Research Centre (KFSHRC), Lifera, Saudi Pharmaceutical Industries and Medical Appliances Corporation (SPIMACO), SABIC Life Sciences, King Abdulaziz City for Science and Technology (KACST), BioArabia, Novo Nordisk Saudi Arabia, Pfizer Saudi Arabia, Roche Saudi Arabia, Johnson & Johnson Saudi Arabia, Al-Jazeera Pharmaceutical Industries, Tabuk Pharmaceuticals, Jamjoom Pharma, National Industrialization Company (Tasnee) contribute to innovation, geographic expansion, and service delivery in this space .

The future of the biotechnology market in Saudi Arabia appears promising, driven by advancements in personalized medicine and the integration of artificial intelligence in research processes. As the government continues to invest in healthcare infrastructure and R&D, the sector is expected to attract more international collaborations. Additionally, the growing focus on sustainable agricultural practices will likely spur innovations in agricultural biotechnology, enhancing food security and economic resilience in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Biopharmaceuticals Agricultural Biotechnology Industrial Biotechnology Environmental Biotechnology Diagnostic Biotechnology Bioinformatics Genomics and Precision Medicine Others |

| By Application | Healthcare (Therapeutics, Vaccines, Diagnostics) Agriculture (GM Crops, Animal Biotechnology) Food and Beverage (Enzyme Technology, Fermentation) Environmental Management (Bioremediation, Waste Treatment) Industrial Processes (Biofuels, Bioplastics) Research & Development Others |

| By End-User | Pharmaceutical & Biotechnology Companies Academic & Research Institutions Agricultural Enterprises Government & Regulatory Agencies Hospitals & Diagnostic Centers Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Outlets Others |

| By Region | Central Region (Riyadh, Qassim) Eastern Region (Dammam, Al Khobar) Western Region (Jeddah, Makkah, Madinah) Southern Region (Asir, Jazan) Northern Region Others |

| By Investment Source | Government Funding Private Investments International Grants Venture Capital Public-Private Partnerships Others |

| By Policy Support | Subsidies Tax Incentives Research Grants Regulatory Support Innovation Hubs & Clusters Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Biotechnology | 100 | R&D Directors, Regulatory Affairs Managers |

| Agricultural Biotechnology | 60 | Agronomists, Crop Scientists |

| Environmental Biotechnology | 50 | Environmental Engineers, Sustainability Managers |

| Biotechnology Startups | 40 | Founders, Business Development Managers |

| Healthcare Biotechnology | 90 | Clinical Research Coordinators, Hospital Administrators |

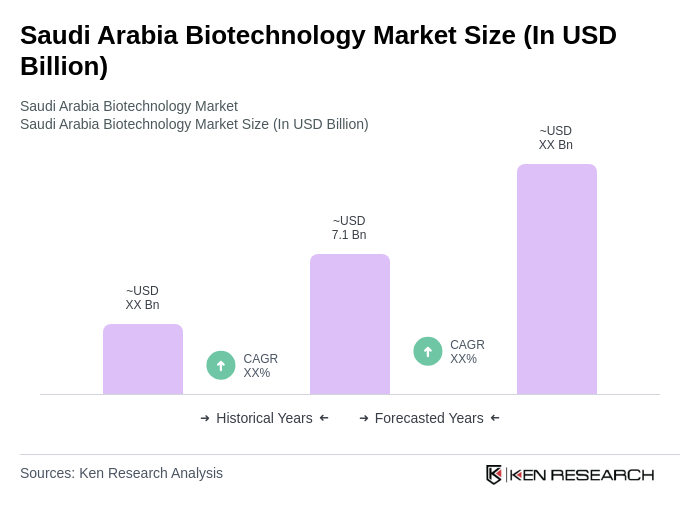

The Saudi Arabia Biotechnology Market is valued at approximately USD 7.1 billion, reflecting significant growth driven by investments in healthcare, agricultural advancements, and government initiatives aimed at fostering innovation in biotechnology.