Region:Asia

Author(s):Rebecca

Product Code:KRAC3328

Pages:89

Published On:October 2025

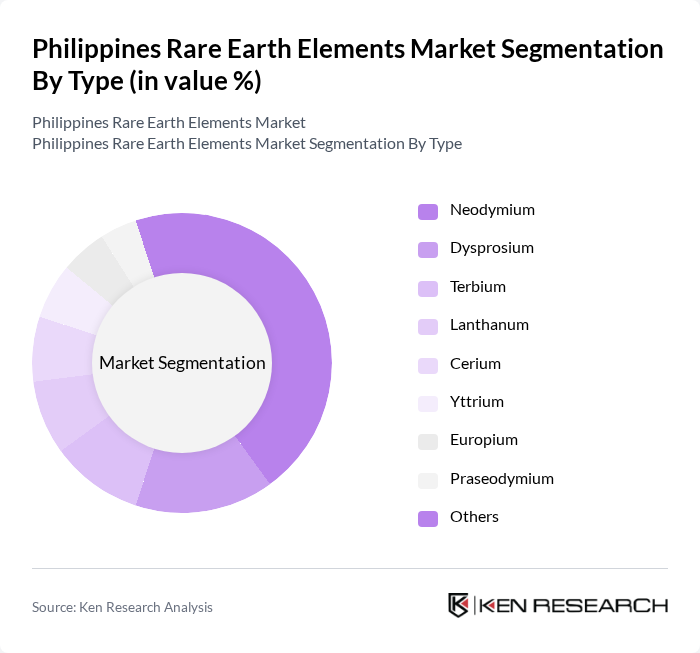

By Type:The market is segmented into various types of rare earth elements, including Neodymium, Dysprosium, Terbium, Lanthanum, Cerium, Yttrium, Europium, Praseodymium, and Others. Among these, Neodymium holds the largest share due to its critical role in high-strength permanent magnets, which are essential for electric vehicles, wind turbines, and advanced electronics. The rising adoption of clean energy technologies and electric mobility is driving Neodymium consumption, making it a pivotal element in the Philippines rare earth market .

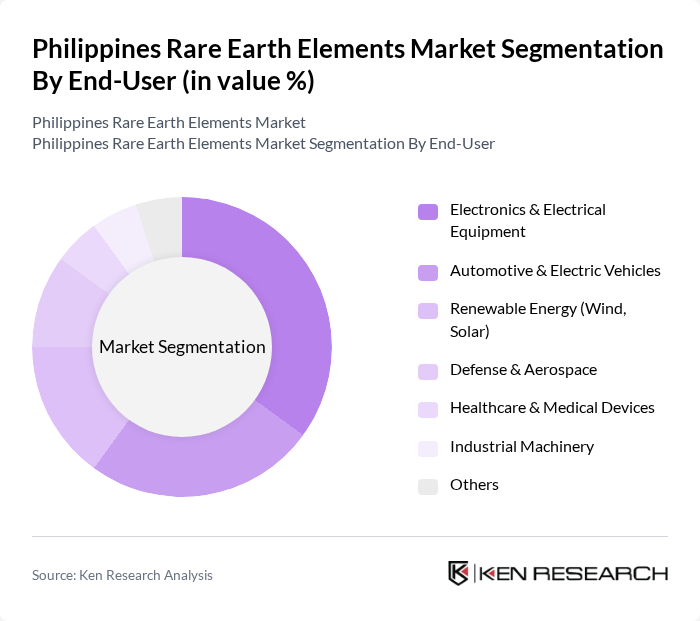

By End-User:The end-user segmentation includes Electronics & Electrical Equipment, Automotive & Electric Vehicles, Renewable Energy (Wind, Solar), Defense & Aerospace, Healthcare & Medical Devices, Industrial Machinery, and Others. The Electronics & Electrical Equipment sector is the leading end-user, supported by the growing demand for consumer electronics, advanced display technologies, and miniaturized components. The rapid expansion of electric vehicles and renewable energy installations is further accelerating rare earth consumption in these segments .

The Philippines Rare Earth Elements Market is characterized by a dynamic mix of regional and international players. Leading participants such as Philippine Mining Development Corporation (PMDC), Lynas Rare Earths Ltd., China Northern Rare Earth Group High-Tech Co., Ltd., MP Materials Corp., Arafura Rare Earths Ltd., Iluka Resources Limited, Neo Performance Materials Inc., Shenghe Resources Holding Co., Ltd., Australian Strategic Materials Ltd., Energy Fuels Inc., Ucore Rare Metals Inc., Vital Metals Limited, Great Western Minerals Group Ltd., Indian Rare Earths Limited, and Rare Element Resources Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Philippines rare earth elements market appears promising, driven by increasing global demand and supportive government policies. As the electronics and renewable energy sectors expand, the need for REEs will likely grow, presenting opportunities for local producers. Additionally, advancements in sustainable mining practices and recycling technologies may enhance the sector's viability. In the future, the Philippines could solidify its position as a key player in the global REE market, attracting investments and fostering economic growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Neodymium Dysprosium Terbium Lanthanum Cerium Yttrium Europium Praseodymium Others |

| By End-User | Electronics & Electrical Equipment Automotive & Electric Vehicles Renewable Energy (Wind, Solar) Defense & Aerospace Healthcare & Medical Devices Industrial Machinery Others |

| By Application | Permanent Magnets Catalysts Phosphors Glass and Ceramics Batteries Metallurgy & Alloys Others |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Grants |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value-Based Pricing Others |

| By Policy Support | Subsidies Tax Exemptions Research Grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Mining Operations | 60 | Mining Engineers, Operations Managers |

| Regulatory Compliance | 45 | Government Officials, Environmental Compliance Officers |

| Market Demand Analysis | 50 | Industry Analysts, Market Researchers |

| Supply Chain Management | 40 | Logistics Managers, Procurement Specialists |

| End-User Applications | 40 | Product Managers, R&D Directors in Electronics |

The Philippines Rare Earth Elements market is valued at approximately USD 7.9 billion, driven by increasing demand in sectors such as electronics, automotive, and renewable energy. This growth is supported by government initiatives and investments in exploration and recycling technologies.