Region:Asia

Author(s):Geetanshi

Product Code:KRAA7901

Pages:97

Published On:September 2025

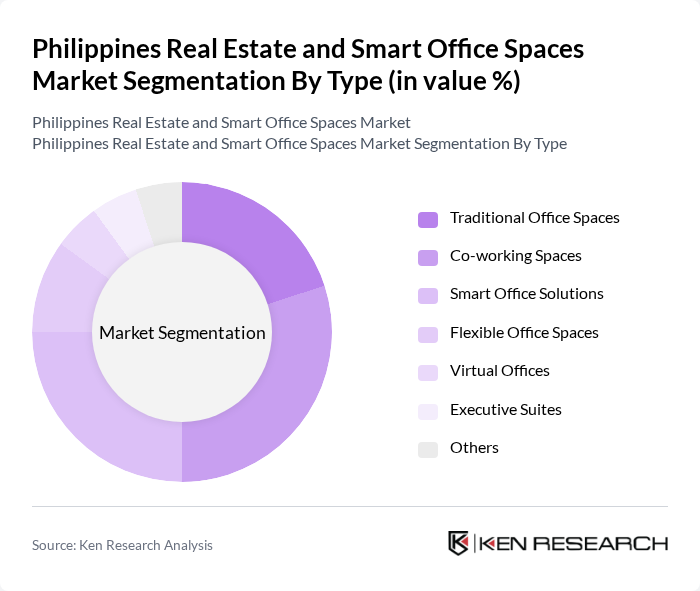

By Type:The market is segmented into various types, including Traditional Office Spaces, Co-working Spaces, Smart Office Solutions, Flexible Office Spaces, Virtual Offices, Executive Suites, and Others. Among these, Co-working Spaces have gained significant traction due to the increasing number of startups and freelancers seeking flexible work environments. Smart Office Solutions are also on the rise, driven by the demand for technology integration in workspaces.

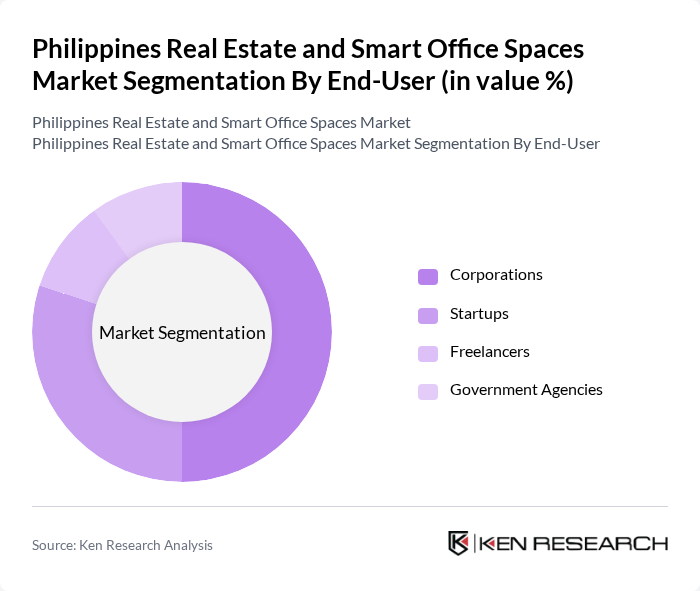

By End-User:The end-user segmentation includes Corporations, Startups, Freelancers, and Government Agencies. Corporations dominate the market as they increasingly adopt flexible work arrangements and smart office solutions to enhance employee productivity. Startups are also a significant segment, leveraging co-working spaces for cost-effective office solutions.

The Philippines Real Estate and Smart Office Spaces Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ayala Land, Inc., Megaworld Corporation, SM Prime Holdings, Inc., Robinsons Land Corporation, DM Wenceslao and Associates, Inc., Vista Land & Lifescapes, Inc., Federal Land, Inc., Rockwell Land Corporation, DoubleDragon Properties Corp., Filinvest Development Corporation, Ortigas & Company, Ltd., Cebu Landmasters, Inc., Empire East Land Holdings, Inc., Aboitiz InfraCapital, Inc., Greenfield Development Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The Philippines real estate market is poised for significant transformation as it adapts to evolving work patterns and technological advancements. In the future, the integration of smart technologies and sustainable practices will become essential for attracting tenants. Additionally, the demand for flexible workspaces will continue to rise, driven by the ongoing shift towards hybrid work models. As urbanization accelerates, developers will need to focus on creating innovative office solutions that meet the needs of a diverse workforce while addressing environmental concerns.

| Segment | Sub-Segments |

|---|---|

| By Type | Traditional Office Spaces Co-working Spaces Smart Office Solutions Flexible Office Spaces Virtual Offices Executive Suites Others |

| By End-User | Corporations Startups Freelancers Government Agencies |

| By Investment Source | Domestic Investments Foreign Direct Investments (FDI) Public-Private Partnerships (PPP) Government Grants |

| By Application | Office Leasing Facility Management Real Estate Development Property Management |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value-based Pricing |

| By Location | Metro Manila Cebu Davao Other Major Cities |

| By Policy Support | Tax Incentives Subsidies for Green Buildings Regulatory Support for Smart Technologies Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Tenants of Smart Office Spaces | 150 | Office Managers, Facility Directors |

| Real Estate Developers Focused on Smart Offices | 100 | Project Managers, Business Development Executives |

| Property Management Firms | 80 | Property Managers, Operations Directors |

| Technology Providers for Smart Office Solutions | 70 | Product Managers, Sales Executives |

| Urban Planners and Policy Makers | 60 | Urban Development Officers, City Planners |

The Philippines Real Estate and Smart Office Spaces Market is valued at approximately USD 15 billion, driven by urbanization, demand for flexible workspaces, and technology integration in office solutions.