Region:Middle East

Author(s):Rebecca

Product Code:KRAA5363

Pages:96

Published On:September 2025

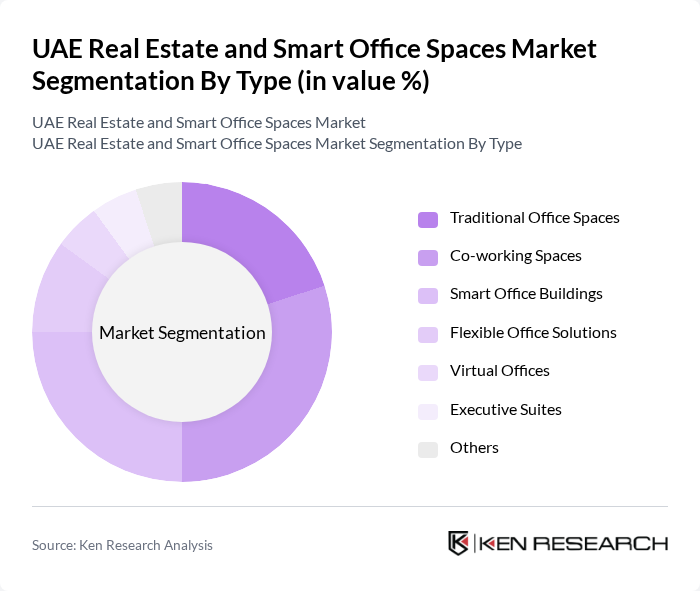

By Type:The market is segmented into various types, including Traditional Office Spaces, Co-working Spaces, Smart Office Buildings, Flexible Office Solutions, Virtual Offices, Executive Suites, and Others. Among these, Co-working Spaces have gained significant traction due to the rise of startups and freelancers seeking cost-effective and flexible work environments. The demand for Smart Office Buildings is also increasing as companies prioritize technology integration and sustainability in their operations.

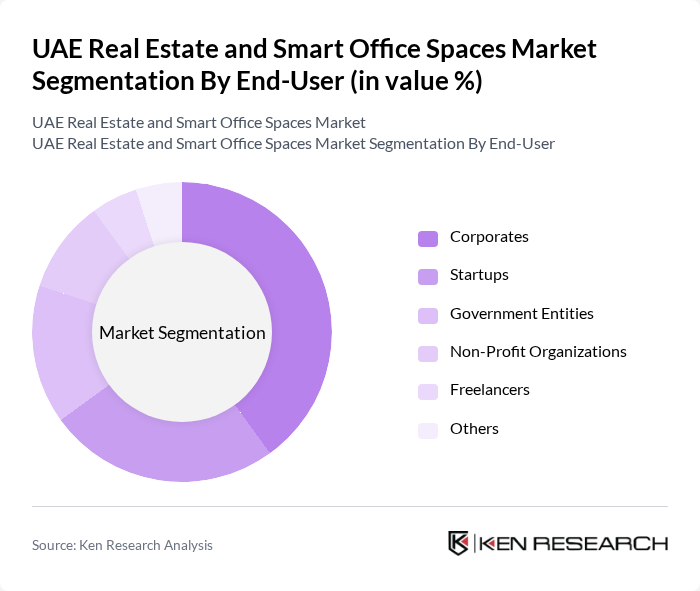

By End-User:The end-user segmentation includes Corporates, Startups, Government Entities, Non-Profit Organizations, Freelancers, and Others. Corporates dominate the market as they seek modern office solutions to enhance productivity and employee satisfaction. Startups are also a significant segment, leveraging co-working spaces for flexibility and networking opportunities. The increasing trend of remote work has further diversified the end-user landscape.

The UAE Real Estate and Smart Office Spaces Market is characterized by a dynamic mix of regional and international players. Leading participants such as Emaar Properties, Aldar Properties, Dubai Investments, Nakheel Properties, Majid Al Futtaim, JLL (Jones Lang LaSalle), CBRE Group, Colliers International, Knight Frank, Savills, DAMAC Properties, Meraas Holding, Arada, Union Properties, Azizi Developments contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE real estate and smart office spaces market appears promising, driven by ongoing technological advancements and a shift towards hybrid work models. As companies increasingly adopt flexible work arrangements, the demand for innovative office solutions is expected to rise. Additionally, the government's commitment to sustainability and smart city initiatives will likely create new opportunities for developers to integrate advanced technologies into office spaces, enhancing efficiency and employee satisfaction.

| Segment | Sub-Segments |

|---|---|

| By Type | Traditional Office Spaces Co-working Spaces Smart Office Buildings Flexible Office Solutions Virtual Offices Executive Suites Others |

| By End-User | Corporates Startups Government Entities Non-Profit Organizations Freelancers Others |

| By Location | Urban Areas Suburban Areas Business Districts Others |

| By Size of Office Space | Small (up to 500 sq ft) Medium (500 to 2000 sq ft) Large (2000 sq ft and above) |

| By Service Type | Managed Office Services Virtual Office Services Meeting Room Rentals Others |

| By Lease Type | Short-term Leases Long-term Leases Flexible Leasing Options |

| By Investment Type | Direct Investments Joint Ventures Public-Private Partnerships Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Clients in Smart Office Spaces | 150 | Facility Managers, Office Administrators |

| Real Estate Developers Focused on Smart Technologies | 100 | Project Managers, Business Development Executives |

| Technology Providers for Smart Office Solutions | 80 | Product Managers, Sales Directors |

| Industry Experts and Consultants | 60 | Real Estate Analysts, Smart Technology Consultants |

| Government Officials in Urban Development | 50 | Urban Planners, Policy Makers |

The UAE Real Estate and Smart Office Spaces Market is valued at approximately USD 45 billion, driven by urbanization, foreign investments, and government initiatives focused on smart city developments and innovative office solutions.