Region:Asia

Author(s):Dev

Product Code:KRAA2238

Pages:96

Published On:August 2025

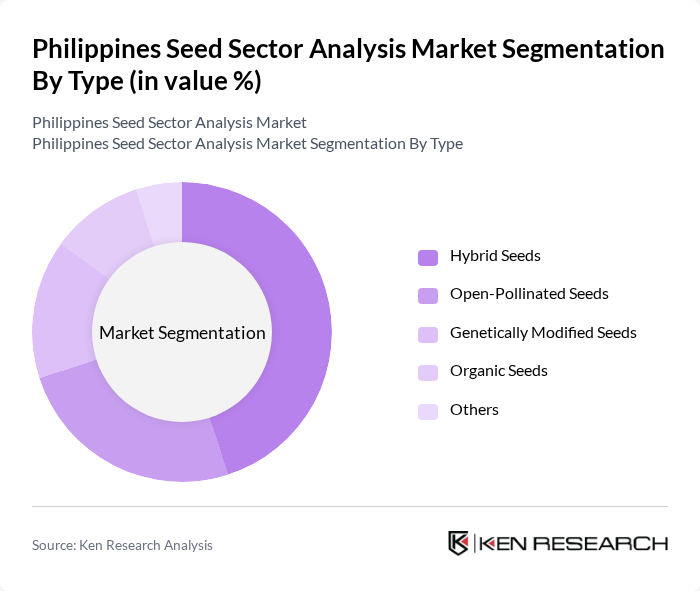

By Type:The seed market can be segmented into various types, including hybrid seeds, open-pollinated seeds, genetically modified seeds, organic seeds, and others. Hybrid seeds are particularly popular due to their higher yields and resistance to pests and diseases. Open-pollinated seeds are favored by smallholder farmers for their cost-effectiveness and ability to save seeds for future planting. Genetically modified seeds are gaining traction due to their enhanced traits, while organic seeds cater to the growing demand for sustainable farming practices. The "Others" category includes specialty seeds that cater to niche markets .

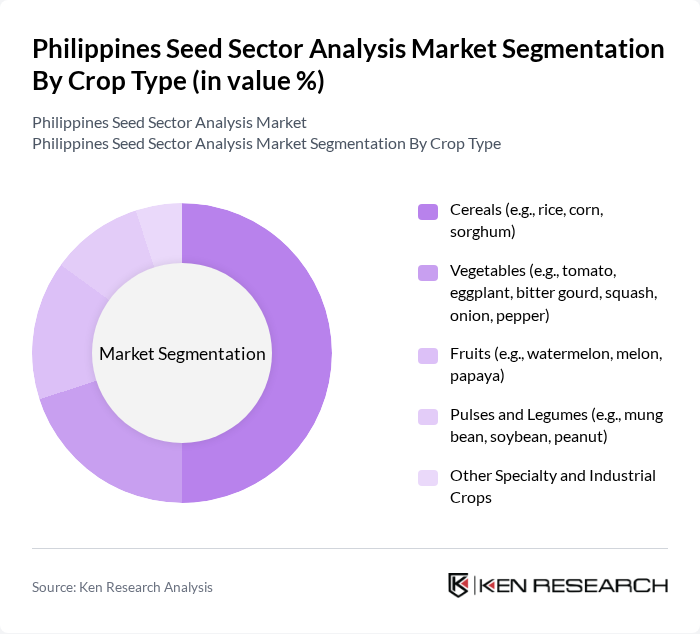

By Crop Type:The seed market is also segmented by crop type, which includes cereals, vegetables, fruits, pulses and legumes, and other specialty and industrial crops. Cereals, particularly rice and corn, dominate the market due to their staple food status in the Philippines. Vegetables are also significant, driven by both local consumption and export opportunities. Fruits, especially tropical varieties, are gaining popularity in international markets. Pulses and legumes are essential for crop rotation and soil health, while specialty crops cater to specific market demands .

The Philippines Seed Sector Analysis Market is characterized by a dynamic mix of regional and international players. Leading participants such as Syngenta Philippines, Inc., Bayer CropScience, Inc., Corteva Agriscience Philippines (Pioneer Hi-Bred Philippines, Inc.), East-West Seed Company, Inc., SeedWorks Philippines, Inc., BASF Philippines, Inc., Allied Botanical Corporation, UPL Philippines, Inc. (Advanta Seeds Philippines Inc.), Rijk Zwaan Zaadteelt en Zaadhandel B.V., Harbest Agribusiness Corporation, Charoen Pokphand Group (CP Group), Bioseed Research Philippines, Inc. (DCM Shriram Ltd.), International Rice Research Institute (IRRI), Philippine Seed Industry Association (PSIA), Unifrutti Tropical Philippines, Inc. contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Philippines seed sector is poised for transformation, driven by technological advancements and a focus on sustainability. As farmers increasingly adopt precision agriculture techniques, the demand for innovative seed solutions will rise. Additionally, the government's commitment to enhancing agricultural productivity through research and development will likely lead to the introduction of more resilient seed varieties. This evolving landscape presents opportunities for local seed companies to thrive and meet the growing needs of the agricultural sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Hybrid Seeds Open-Pollinated Seeds Genetically Modified Seeds Organic Seeds Others |

| By Crop Type | Cereals (e.g., rice, corn, sorghum) Vegetables (e.g., tomato, eggplant, bitter gourd, squash, onion, pepper) Fruits (e.g., watermelon, melon, papaya) Pulses and Legumes (e.g., mung bean, soybean, peanut) Other Specialty and Industrial Crops |

| By Distribution Channel | Direct Sales (company to farmer) Retail Outlets (agro-dealers, farm supply stores) Online Platforms (e-commerce, digital marketplaces) Agricultural Cooperatives and Associations Government Distribution Programs |

| By End-User | Commercial Farmers Smallholder Farmers Agricultural Enterprises (plantations, contract growers) Research Institutions and Government Agencies NGOs and Development Organizations |

| By Region | Luzon Visayas Mindanao Other Islands/Regions |

| By Seed Treatment | Chemical Treatment Biological Treatment Physical Treatment Untreated Seeds |

| By Price Range | Low Price Mid Price High Price Premium/Value-Added Seeds |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Seed Producers | 80 | Farm Owners, Production Managers |

| Seed Distributors | 60 | Distribution Managers, Sales Representatives |

| Farmers | 120 | Smallholder Farmers, Commercial Farmers |

| Agricultural Extension Workers | 50 | Field Officers, Agricultural Advisors |

| Research Institutions | 40 | Researchers, Agronomists |

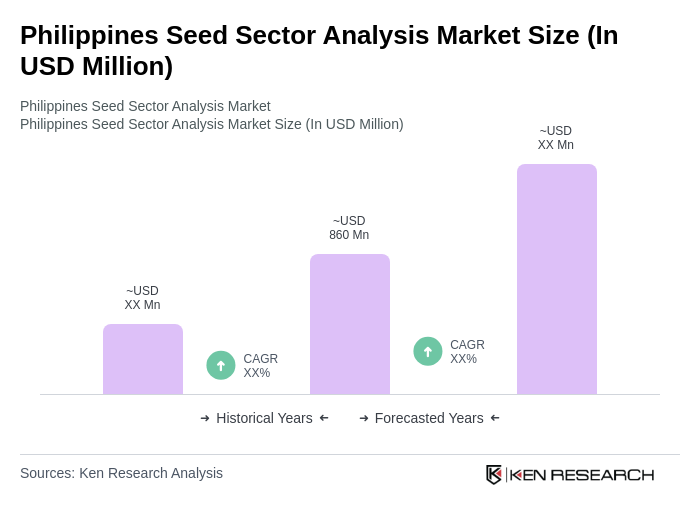

The Philippines Seed Sector Analysis Market is valued at approximately USD 860 million, reflecting significant growth driven by the demand for high-yield and disease-resistant seeds, alongside government initiatives for agricultural modernization and food security.