Region:Asia

Author(s):Rebecca

Product Code:KRAC0190

Pages:94

Published On:August 2025

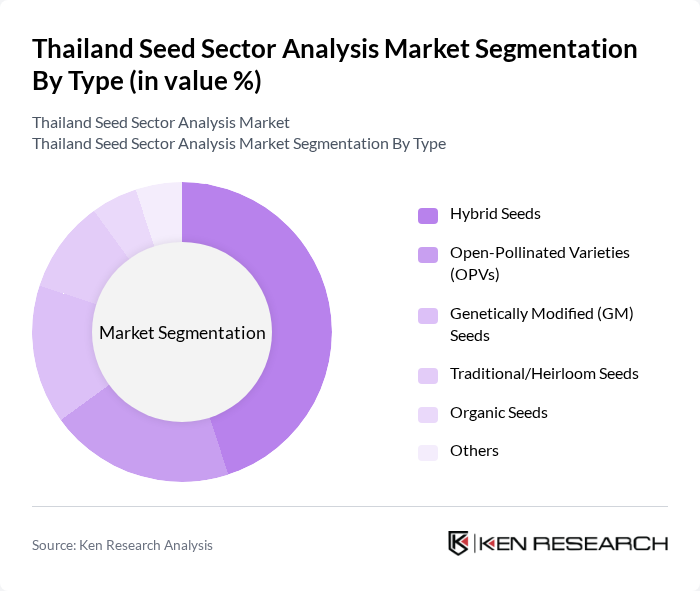

By Type:This segmentation includes various seed types that cater to different agricultural needs. The subsegments are Hybrid Seeds, Open-Pollinated Varieties (OPVs), Genetically Modified (GM) Seeds, Traditional/Heirloom Seeds, Organic Seeds, and Others. Each type serves distinct purposes in agriculture, with hybrid seeds being particularly popular due to their high yield potential and disease resistance. Hybrid seeds are widely adopted in both field and horticultural crops, while organic seeds are gaining traction due to increasing health consciousness and demand for organic produce.

The hybrid seeds segment dominates the market due to their ability to produce higher yields and resist diseases, making them a preferred choice among farmers. The increasing adoption of modern agricultural practices and the need for food security have further propelled the demand for hybrid seeds. Additionally, the trend towards sustainable farming practices has led to a growing interest in organic seeds, although they currently hold a smaller market share. Overall, hybrid seeds are expected to continue leading the market due to their effectiveness in enhancing agricultural productivity.

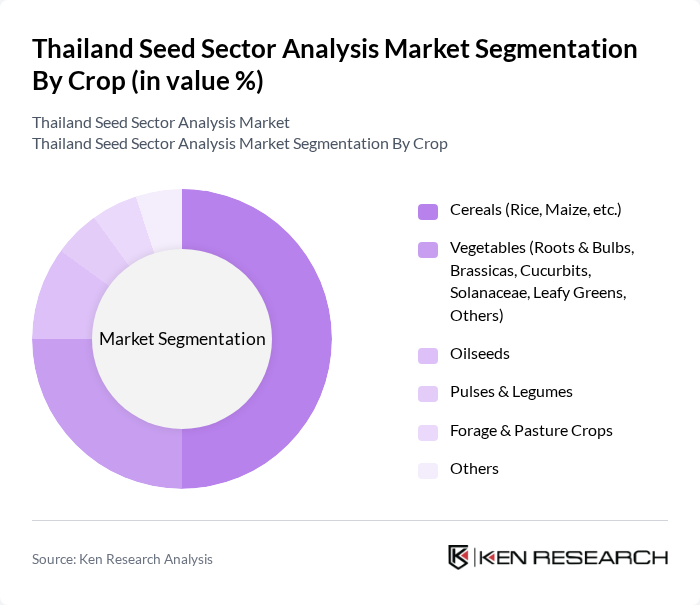

By Crop:This segmentation encompasses various crop types, including Cereals (Rice, Maize, etc.), Vegetables (Roots & Bulbs, Brassicas, Cucurbits, Solanaceae, Leafy Greens, Others), Oilseeds, Pulses & Legumes, Forage & Pasture Crops, and Others. Each crop type has unique requirements and market dynamics. Cereals, especially rice, are the leading crop segment due to Thailand's position as a major rice exporter. Vegetables hold a substantial share driven by rising consumer preference for fresh and organic produce, while oilseeds, pulses, and forage crops represent smaller but growing segments.

Cereals, particularly rice, dominate the crop segment due to Thailand's status as one of the world's leading rice exporters. The high demand for rice, both domestically and internationally, drives the need for quality seeds. Vegetables also represent a significant portion of the market, reflecting the growing consumer preference for fresh produce and organic options. The increasing focus on health and nutrition has led to a rise in the cultivation of various vegetables, further supporting this segment's growth. Overall, cereals remain the leading crop type, driven by both local consumption and export opportunities.

The Thailand Seed Sector Analysis Market is characterized by a dynamic mix of regional and international players. Leading participants such as Chia Tai Company Limited, East-West Seed Company Limited, Syngenta Group (Thailand), Bayer CropScience (Thailand) Co., Ltd., Advanta Seeds (UPL Thailand), Charoen Pokphand Group (CP Group), Groupe Limagrain (Vilmorin & Cie, Thailand), Known-You Seed (Thailand) Co., Ltd., BASF Agricultural Solutions (Thailand), Seed Asia Co., Ltd., Bioseed (Thailand) Co., Ltd., Thai Vegetable Seed Co., Ltd., Pacific Seeds (Thailand) Co., Ltd., Thai Organic Seed Co., Ltd., Thai Seed Trade Association contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Thailand seed sector appears promising, driven by increasing investments in research and development and a growing emphasis on sustainable agricultural practices. As farmers become more aware of the benefits of high-quality and climate-resilient seeds, demand is expected to rise. Additionally, the collaboration between local seed companies and international firms is likely to enhance innovation, leading to the development of advanced seed varieties that can meet both domestic and export market needs.

| Segment | Sub-Segments |

|---|---|

| By Type | Hybrid Seeds Open-Pollinated Varieties (OPVs) Genetically Modified (GM) Seeds Traditional/Heirloom Seeds Organic Seeds Others |

| By Crop | Cereals (Rice, Maize, etc.) Vegetables (Roots & Bulbs, Brassicas, Cucurbits, Solanaceae, Leafy Greens, Others) Oilseeds Pulses & Legumes Forage & Pasture Crops Others |

| By Cultivation Mechanism | Open Field Cultivation Protected Cultivation (Greenhouse/Net House) |

| By Application | Commercial Agriculture Smallholder Farming Organic Farming Research & Development |

| By Distribution Channel | Direct Sales Retail Outlets/Agro-Dealers Online Platforms Cooperatives Others |

| By End-User | Farmers & Growers Agricultural Exporters Research & Development Institutes Others |

| By Region | Central Thailand Northern Thailand Northeastern Thailand Southern Thailand |

| By Price Range | Low Price Mid Price High Price |

| By Certification Type | Certified Seeds Non-Certified Seeds Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hybrid Seed Producers | 80 | Product Managers, Sales Directors |

| Farmers Using Commercial Seeds | 120 | Smallholder Farmers, Large-scale Farmers |

| Seed Distributors and Retailers | 60 | Distribution Managers, Retail Store Owners |

| Agricultural Research Institutions | 40 | Research Scientists, Agronomists |

| Government Agricultural Policy Makers | 40 | Policy Analysts, Agricultural Officers |

The Thailand Seed Sector Analysis Market is valued at approximately USD 700 million, reflecting a significant growth driven by the demand for high-yield and disease-resistant seeds, as well as advancements in agricultural practices and biotechnology.