Region:Asia

Author(s):Geetanshi

Product Code:KRAE0709

Pages:93

Published On:December 2025

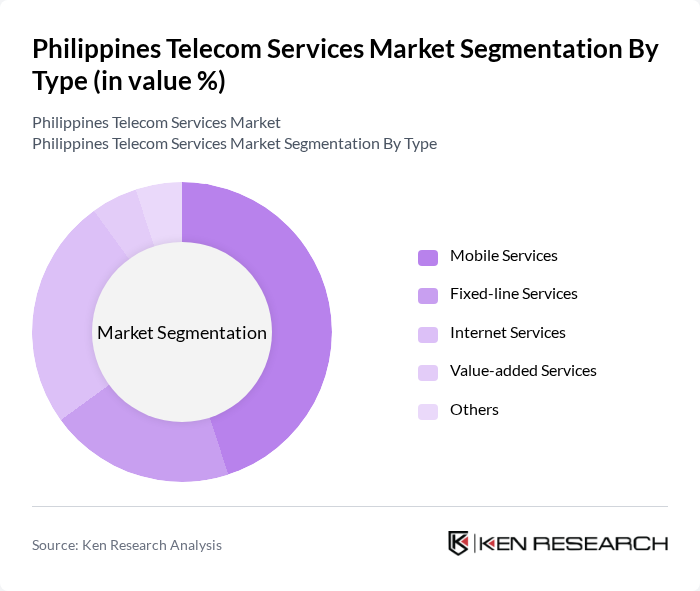

By Type:The telecom services market is segmented into various types, including mobile services, fixed-line services, internet services, value-added services, and others. Among these, mobile services dominate the market due to the high penetration of mobile devices and the increasing demand for mobile data. The rapid adoption of smartphones and the expansion of 4G and 5G networks have further fueled the growth of mobile services, making them a critical component of the telecom landscape.

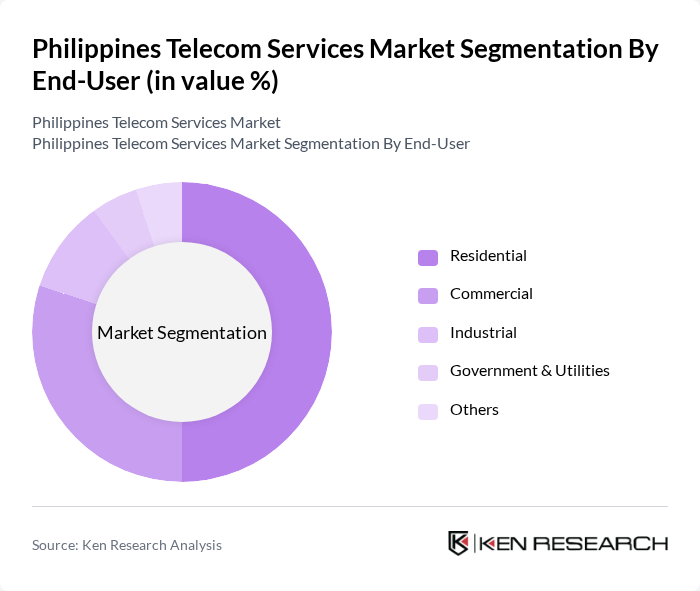

By End-User:The end-user segmentation includes residential, commercial, industrial, government & utilities, and others. The residential segment holds the largest share, driven by the increasing demand for internet connectivity and mobile services among households. The rise of remote work and online education has further accelerated the need for reliable telecom services in residential areas, making this segment a key driver of market growth.

The Philippines Telecom Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as PLDT Inc., Globe Telecom, Inc., DITO Telecommunity Corporation, Converge ICT Solutions Inc., Smart Communications, Inc., Bayan Telecommunications, Inc., Eastern Telecommunications Philippines, Inc., Sky Cable Corporation, Digitel Mobile Philippines, Inc., Now Telecom Company, Inc., Globe Telecom Business, PLDT Enterprise, Smart Bro, Converge Business, ePLDT, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The Philippines telecom services market is poised for transformative growth driven by technological advancements and increasing digital adoption. With the government prioritizing digital infrastructure, investments in 5G and fiber-optic networks are expected to enhance connectivity. Additionally, the rise of e-commerce and online services will further stimulate demand for reliable telecom solutions. As service providers focus on improving customer experience and leveraging AI technologies, the market is likely to witness innovative service offerings that cater to evolving consumer needs.

| Segment | Sub-Segments |

|---|---|

| By Type | Mobile Services Fixed-line Services Internet Services Value-added Services Others |

| By End-User | Residential Commercial Industrial Government & Utilities Others |

| By Region | Luzon Visayas Mindanao |

| By Technology | G LTE G Fiber Optic Satellite Others |

| By Application | Voice Communication Data Communication Video Communication Others |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Policy Support | Subsidies Tax Exemptions Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Mobile Service Users | 150 | Consumers aged 18-45, Urban and Rural |

| Broadband Subscribers | 100 | Household Decision Makers, IT Managers |

| Enterprise Telecom Solutions | 80 | Business Owners, IT Directors |

| Regulatory Impact Assessment | 60 | Policy Makers, Telecom Analysts |

| Consumer Satisfaction Surveys | 120 | General Public, Telecom Service Users |

The Philippines Telecom Services Market is valued at approximately USD 12 billion, driven by the expansion of mobile data, broadband infrastructure, and the rollout of 5G networks, alongside increasing demand for digital services like streaming and mobile banking.