Region:Global

Author(s):Dev

Product Code:KRAA2591

Pages:88

Published On:August 2025

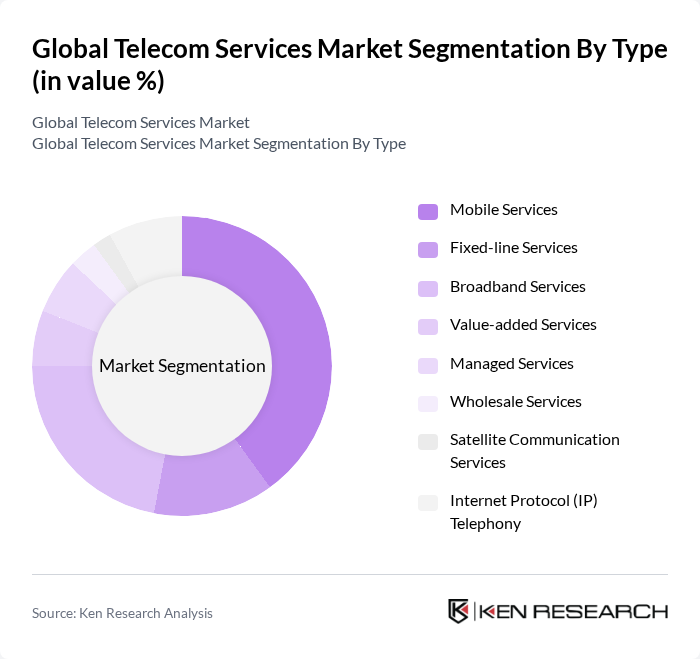

By Type:The telecom services market is segmented into mobile services, fixed-line services, broadband services, value-added services, managed services, wholesale services, satellite communication services, and Internet Protocol (IP) telephony. Mobile services are the most dominant segment, driven by the increasing adoption of smartphones, high mobile data consumption, and the ongoing shift towards 5G technology for faster and more reliable connectivity. AI-powered network management and IoT connectivity are further accelerating growth in mobile and broadband segments.

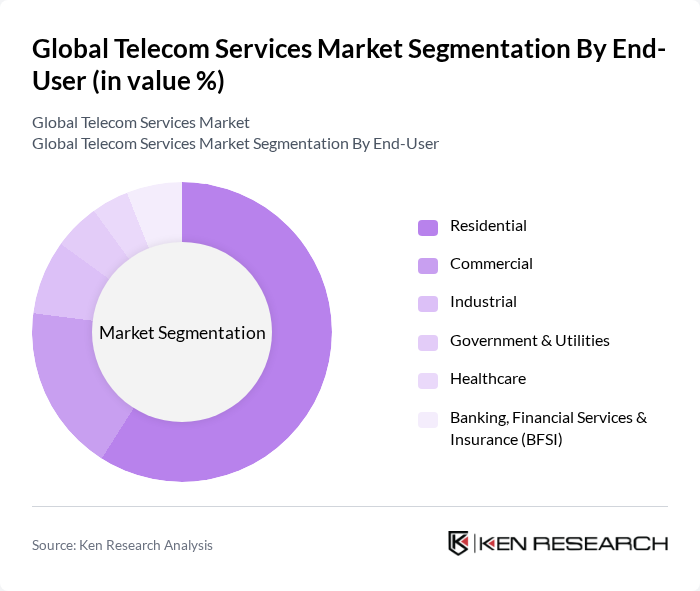

By End-User:The end-user segmentation of the telecom services market includes residential, commercial, industrial, government & utilities, healthcare, and banking, financial services & insurance (BFSI). The residential segment is the largest, driven by the increasing number of households requiring internet and mobile services. The rise in remote work, online education, and digital entertainment has further accelerated demand for reliable telecom services in residential areas. Commercial and industrial segments are also expanding due to cloud adoption, IoT, and digital transformation in enterprise operations.

The Global Telecom Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as AT&T Inc., Verizon Communications Inc., Deutsche Telekom AG, Vodafone Group Plc, China Mobile Limited, Orange S.A., Telefónica S.A., BT Group plc, T-Mobile US, Inc., Nippon Telegraph and Telephone Corporation (NTT Group), Comcast Corporation, Lumen Technologies, Inc. (formerly CenturyLink, Inc.), SoftBank Group Corp., Telstra Corporation Limited, Koninklijke KPN N.V. contribute to innovation, geographic expansion, and service delivery in this space.

The telecom services market is poised for transformative growth driven by technological advancements and evolving consumer preferences. As 5G networks become more widespread, they will facilitate new applications in various sectors, enhancing connectivity and efficiency. Additionally, the increasing integration of IoT solutions will create new revenue streams for telecom providers. Companies that prioritize customer experience and invest in innovative service offerings will likely gain a competitive edge, positioning themselves favorably in this dynamic landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Mobile Services Fixed-line Services Broadband Services Value-added Services Managed Services Wholesale Services Satellite Communication Services Internet Protocol (IP) Telephony |

| By End-User | Residential Commercial Industrial Government & Utilities Healthcare Banking, Financial Services & Insurance (BFSI) |

| By Sales Channel | Direct Sales Indirect Sales Online Sales Retail Sales |

| By Service Model | Subscription-based Pay-as-you-go Freemium Hybrid Models |

| By Customer Segment | Individual Consumers Small and Medium Enterprises (SMEs) Large Enterprises |

| By Geographic Coverage | Urban Areas Rural Areas Suburban Areas International/Global Coverage |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value-based Pricing Tiered Pricing |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Mobile Service Providers | 80 | CEOs, Marketing Directors |

| Broadband Service Providers | 60 | Operations Managers, Customer Experience Heads |

| Enterprise Telecom Solutions | 40 | IT Managers, Procurement Officers |

| Telecom Infrastructure Providers | 40 | Technical Directors, Network Engineers |

| Consumer Insights on Telecom Services | 70 | End-users, Customer Service Representatives |

The Global Telecom Services Market is valued at approximately USD 2 trillion, driven by the increasing demand for mobile and broadband services, the rapid expansion of 5G networks, and digital transformation initiatives across various sectors.