Region:Asia

Author(s):Geetanshi

Product Code:KRAD3915

Pages:87

Published On:November 2025

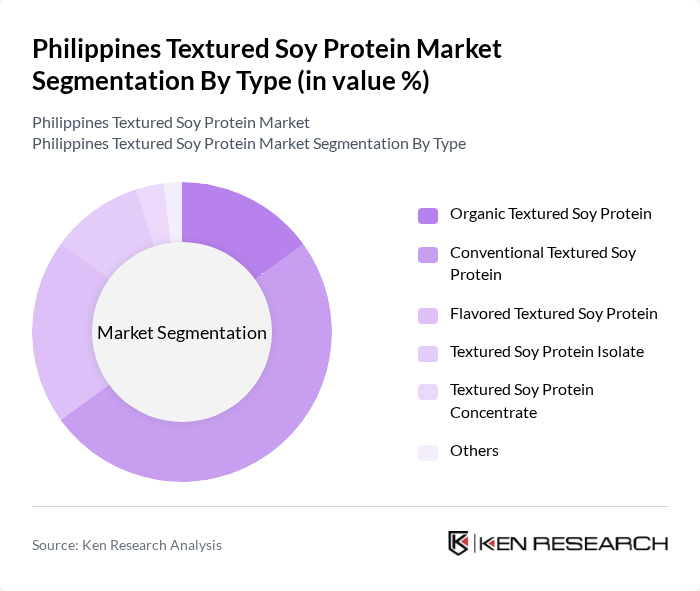

By Type:The market is segmented into various types of textured soy protein, including Organic Textured Soy Protein, Conventional Textured Soy Protein, Flavored Textured Soy Protein, Textured Soy Protein Isolate, Textured Soy Protein Concentrate, and Others. Among these, Conventional Textured Soy Protein is the most widely used due to its cost-effectiveness and availability. Organic variants are gaining traction as health-conscious consumers seek natural and non-GMO options. Flavored Textured Soy Protein is also emerging as a popular choice among younger consumers looking for innovative food products.

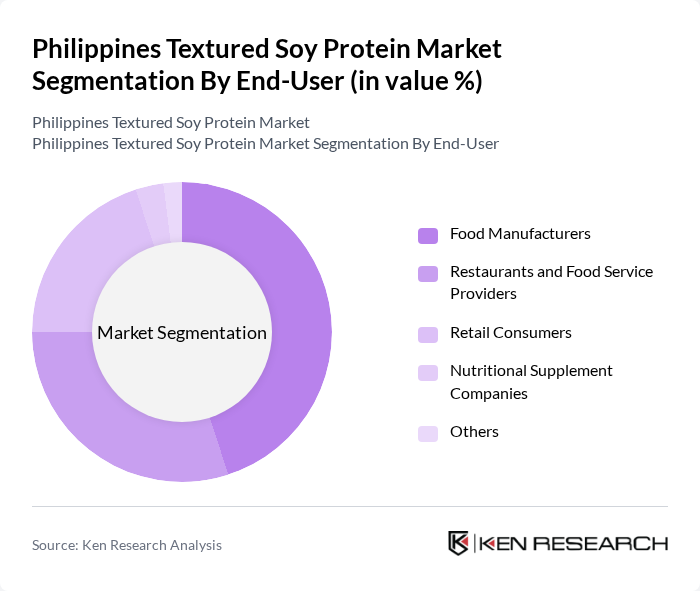

By End-User:The end-user segmentation includes Food Manufacturers, Restaurants and Food Service Providers, Retail Consumers, Nutritional Supplement Companies, and Others. Food Manufacturers dominate the market as they incorporate textured soy protein into various products, including meat alternatives and snacks. Restaurants and food service providers are also significant consumers, driven by the rising trend of plant-based menus. Retail consumers are increasingly purchasing textured soy protein for home cooking, reflecting a shift towards healthier eating habits.

The Philippines Textured Soy Protein Market is characterized by a dynamic mix of regional and international players. Leading participants such as San Miguel Foods, Inc., Purefoods Hormel Company, Inc., Cargill Philippines, Inc., Universal Robina Corporation, AgriNurture, Inc., NutriAsia, Inc., The Pure Food Company, Greenfield International, Dole Philippines, Inc., Del Monte Philippines, Inc., Jollibee Foods Corporation, Monde Nissin Corporation, Century Pacific Food, Inc., CDO Foodsphere, Inc., Fresh Options contribute to innovation, geographic expansion, and service delivery in this space.

The future of the textured soy protein market in the Philippines appears promising, driven by increasing consumer awareness of health and sustainability. As the trend towards plant-based diets continues to grow, innovations in product formulations and marketing strategies will be crucial. Additionally, the rise of e-commerce platforms is expected to enhance product accessibility, allowing companies to reach a broader audience. This evolving landscape presents opportunities for growth and expansion in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Organic Textured Soy Protein Conventional Textured Soy Protein Flavored Textured Soy Protein Textured Soy Protein Isolate Textured Soy Protein Concentrate Others |

| By End-User | Food Manufacturers Restaurants and Food Service Providers Retail Consumers Nutritional Supplement Companies Others |

| By Application | Meat Alternatives Snack Foods Dairy Alternatives Protein Bars and Shakes Others |

| By Distribution Channel | Online Retail Supermarkets and Hypermarkets Health Food Stores Direct Sales Others |

| By Packaging Type | Bulk Packaging Retail Packaging Eco-friendly Packaging Others |

| By Region | Luzon Visayas Mindanao Others |

| By Consumer Demographics | Age Group (18-24, 25-34, 35-44, 45+) Income Level (Low, Middle, High) Lifestyle Preferences (Health-conscious, Convenience-seeking) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food Manufacturing Sector | 100 | Production Managers, Quality Assurance Officers |

| Retail Distribution Channels | 80 | Category Managers, Supply Chain Coordinators |

| Consumer Preferences | 120 | Health-conscious Consumers, Vegetarian and Vegan Groups |

| Food Service Industry | 70 | Restaurant Owners, Menu Planners |

| Import and Export Stakeholders | 60 | Trade Analysts, Import Managers |

The Philippines Textured Soy Protein Market is valued at approximately USD 185 million, reflecting a significant growth trend driven by increasing demand for plant-based protein sources and rising health consciousness among consumers.