Region:Middle East

Author(s):Dev

Product Code:KRAA9672

Pages:93

Published On:November 2025

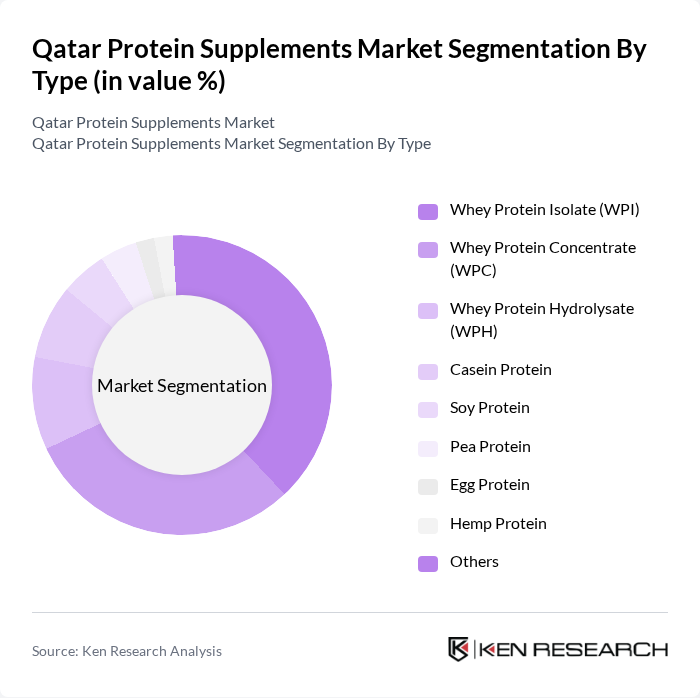

By Type:The protein supplements market can be segmented into various types, including Whey Protein Concentrate (WPC), Whey Protein Isolate (WPI), Whey Protein Hydrolysate (WPH), Casein Protein, Soy Protein, Pea Protein, Egg Protein, Hemp Protein, and Others. Among these, Whey Protein Isolate (WPI) is the leading sub-segment due to its high protein content, low fat and lactose levels, and popularity among athletes and health-conscious consumers. The increasing trend of fitness and bodybuilding, as well as the demand for lactose-free options, has significantly contributed to the demand for WPI, making it a preferred choice for protein supplementation .

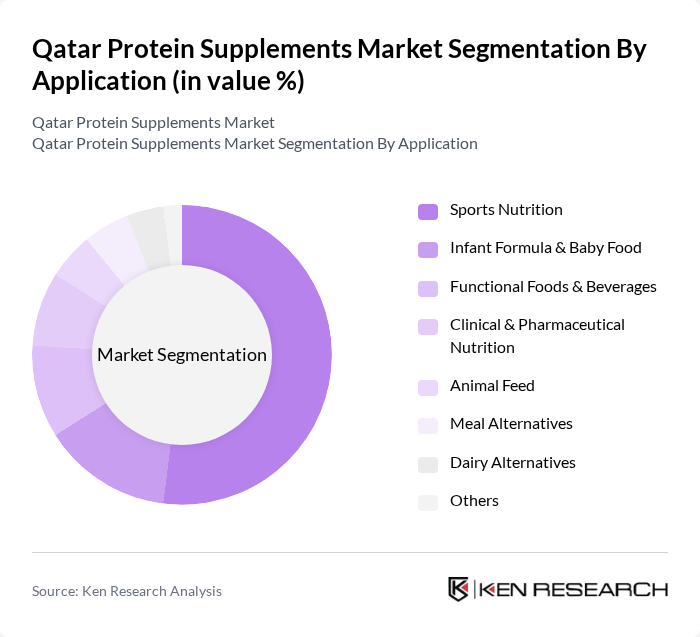

By Application:The applications of protein supplements are diverse, including Sports Nutrition, Infant Formula & Baby Food, Functional Foods & Beverages, Clinical & Pharmaceutical Nutrition, Animal Feed, Meal Alternatives, Dairy Alternatives, and Others. Sports Nutrition is the dominant application segment, driven by the increasing number of fitness enthusiasts and athletes seeking to enhance their performance and recovery through protein supplementation. The growing awareness of the benefits of protein in muscle building and recovery, as well as the expansion of fitness centers and specialized nutrition stores, has led to a surge in demand for sports nutrition products .

The Qatar Protein Supplements Market is characterized by a dynamic mix of regional and international players. Leading participants such as Baladna Food Industries, Health Plus, Botanic Supplements, BIOVEA Qatar, Optimum Nutrition (Glanbia Performance Nutrition), MyProtein (The Hut Group), Dymatize Nutrition, MuscleTech (Iovate Health Sciences), GNC Holdings, Inc., Arla Foods, Almarai Company, Fonterra Co-operative Group, FrieslandCampina, Lactalis Group, Nutricia Middle East contribute to innovation, geographic expansion, and service delivery in this space .

The Qatar protein supplements market is poised for significant growth, driven by evolving consumer preferences towards health and wellness. As the population becomes increasingly aware of the benefits of protein supplementation, demand for innovative products, particularly plant-based options, is expected to rise. Additionally, the integration of technology in product development and marketing strategies will enhance consumer engagement, while sustainability trends will shape packaging solutions, ensuring that the market remains dynamic and responsive to consumer needs.

| Segment | Sub-Segments |

|---|---|

| By Type | Whey Protein Concentrate (WPC) Whey Protein Isolate (WPI) Whey Protein Hydrolysate (WPH) Casein Protein Soy Protein Pea Protein Egg Protein Hemp Protein Others |

| By Application | Sports Nutrition Infant Formula & Baby Food Functional Foods & Beverages Clinical & Pharmaceutical Nutrition Animal Feed Meal Alternatives Dairy Alternatives Others |

| By End-User | Athletes Bodybuilders Health-Conscious Consumers Seniors Teenagers/Young Adults General Consumers Others |

| By Distribution Channel | Online Retail Supermarkets/Hypermarkets Specialty Nutrition Stores Pharmacies Health and Wellness Stores Others |

| By Packaging Type | Pouches Tubs Sachets Bottles Bulk Packaging Others |

| By Flavor | Chocolate Vanilla Strawberry Unflavored/Natural Others |

| By Age Group | Baby Kids & Teens Young Adults & Mid Age Old Age 24 Years 34 Years 44 Years Years and Above Others |

| By Price Range | Budget Mid-Range Premium Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Protein Supplement Sales | 60 | Store Managers, Sales Representatives |

| Consumer Preferences in Protein Types | 70 | Health-conscious Consumers, Fitness Enthusiasts |

| Distribution Channel Insights | 50 | Distributors, Wholesalers |

| Market Trends and Innovations | 40 | Product Development Managers, Brand Strategists |

| Regulatory Impact Assessment | 40 | Regulatory Affairs Specialists, Compliance Officers |

The Qatar Protein Supplements Market is valued at approximately USD 20 million, reflecting a growing trend driven by health consciousness, fitness activities, and the rise of e-commerce platforms offering protein supplements.