Region:Asia

Author(s):Dev

Product Code:KRAD7637

Pages:87

Published On:December 2025

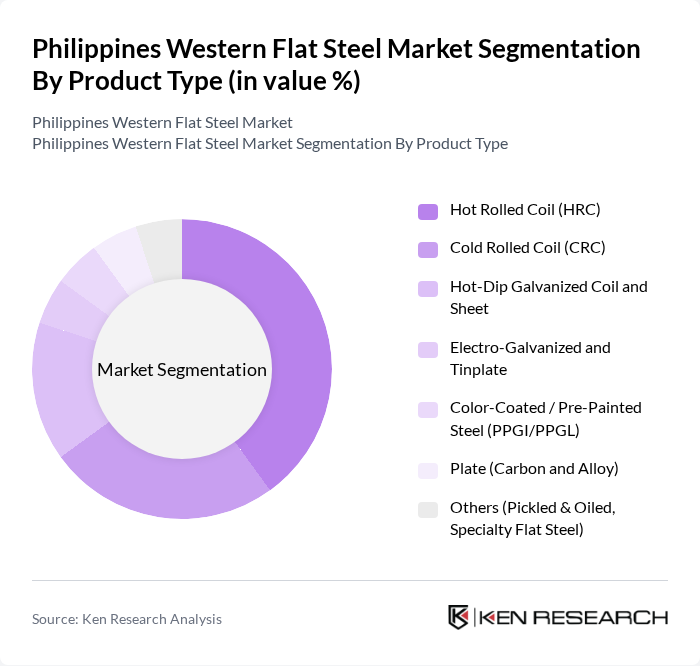

By Product Type:The product type segmentation includes various categories such as Hot Rolled Coil (HRC), Cold Rolled Coil (CRC), Hot-Dip Galvanized Coil and Sheet, Electro-Galvanized and Tinplate, Color-Coated / Pre-Painted Steel (PPGI/PPGL), Plate (Carbon and Alloy), and Others (Pickled & Oiled, Specialty Flat Steel). This structure is consistent with standard flat steel classifications used in global and Asia–Pacific market studies, where hot-rolled, cold-rolled, coated, and plate segments are the primary product groupings. Among these, Hot Rolled Coil (HRC) is the leading subsegment due to its extensive use in building frames, shipbuilding, heavy fabrication, and general engineering, driven by its cost-effectiveness, weldability, and versatility in structural and industrial applications in the Philippines and across the region.

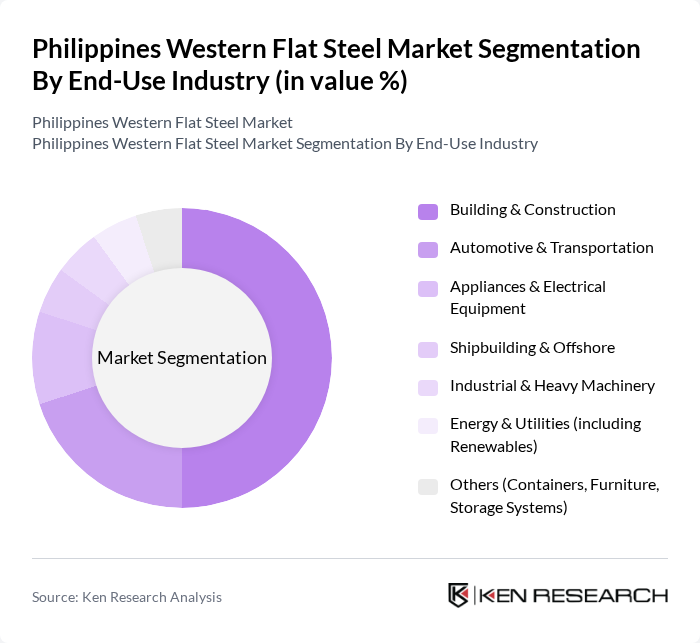

By End-Use Industry:The end-use industry segmentation encompasses Building & Construction, Automotive & Transportation, Appliances & Electrical Equipment, Shipbuilding & Offshore, Industrial & Heavy Machinery, Energy & Utilities (including Renewables), and Others (Containers, Furniture, Storage Systems). This segmentation aligns with the principal demand centers for flat steel identified in global and regional analyses, where construction, automotive, machinery, shipbuilding, and energy are the core consuming sectors. The Building & Construction sector is the dominant segment, driven by ongoing public infrastructure works, residential and commercial real estate development, and industrial facilities, which significantly increase the demand for flat steel products for roofing, wall cladding, decking, structural plate, and fabricated building components in the Philippines.

The Philippines Western Flat Steel Market is characterized by a dynamic mix of regional and international players. Leading participants such as Philippine Steel Rolling Mills Association (PSRMA), Puyat Steel Corporation, PhilSteel Holdings Corporation (Philsteel), SteelAsia Manufacturing Corporation, TKSI – TKC Steel International (Philippines), Inc., CHIYODA Philippines Corporation (Steel & Industrial Fabrication Division), JFE Steel Corporation, Nippon Steel Corporation, POSCO, China Steel Corporation (CSC) – Philippines Operations, Maruichi Metal Products Co., Ltd. – Philippine Group, Global Steel Philippines, Inc., Grand Steel Corporation (Philippines), Capitol Steel Corporation, Sonic Steel Industries Inc. contribute to innovation, geographic expansion, and service delivery in this space, supplying a range of galvanized, pre-painted, cold-rolled, and other flat steel products often through import-based distribution and local processing facilities.

The Philippines Western Flat Steel Market is poised for growth, driven by increasing infrastructure investments and a robust construction sector. As the government continues to prioritize industrial development, local manufacturers are likely to benefit from enhanced production capabilities. Additionally, the shift towards sustainable practices and eco-friendly products will shape the market landscape, encouraging innovation and adaptation. Strategic partnerships and technological advancements will further bolster the industry's resilience, ensuring a competitive edge in the evolving market environment.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Hot Rolled Coil (HRC) Cold Rolled Coil (CRC) Hot-Dip Galvanized Coil and Sheet Electro-Galvanized and Tinplate Color-Coated / Pre-Painted Steel (PPGI/PPGL) Plate (Carbon and Alloy) Others (Pickled & Oiled, Specialty Flat Steel) |

| By End-Use Industry | Building & Construction Automotive & Transportation Appliances & Electrical Equipment Shipbuilding & Offshore Industrial & Heavy Machinery Energy & Utilities (including Renewables) Others (Containers, Furniture, Storage Systems) |

| By Application | Structural and Fabricated Components Roofing, Cladding, and Decking Pipes & Tubes (from Flat Steel) Body Panels and Chassis Parts Appliances Cabinets and Enclosures Storage Tanks and Industrial Equipment Others |

| By Distribution Channel | Direct Sales to OEMs and Fabricators Service Centers and Coil Processors Traders and Stockists Online and E-Marketplaces Others |

| By Region | Luzon Visayas Mindanao |

| By Import vs Domestic Supply | Imported Flat Steel Locally Produced Flat Steel Hybrid / Toll-Processed Supply |

| By Customer Type | Large Integrated Manufacturers Small & Medium Fabricators Traders & Distributors Government & Infrastructure Projects Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Sector Flat Steel Usage | 100 | Project Managers, Procurement Officers |

| Automotive Industry Steel Requirements | 80 | Manufacturing Engineers, Supply Chain Managers |

| Manufacturing Sector Steel Consumption | 90 | Operations Managers, Product Development Heads |

| Distribution Channel Insights | 70 | Logistics Coordinators, Sales Directors |

| Market Trends and Forecasts | 60 | Industry Analysts, Economic Researchers |

The Philippines Western Flat Steel Market is valued at approximately USD 4.5 billion, reflecting a significant growth trend driven by demand in construction, automotive, and manufacturing sectors, alongside government infrastructure initiatives.