Region:Europe

Author(s):Rebecca

Product Code:KRAB3500

Pages:93

Published On:October 2025

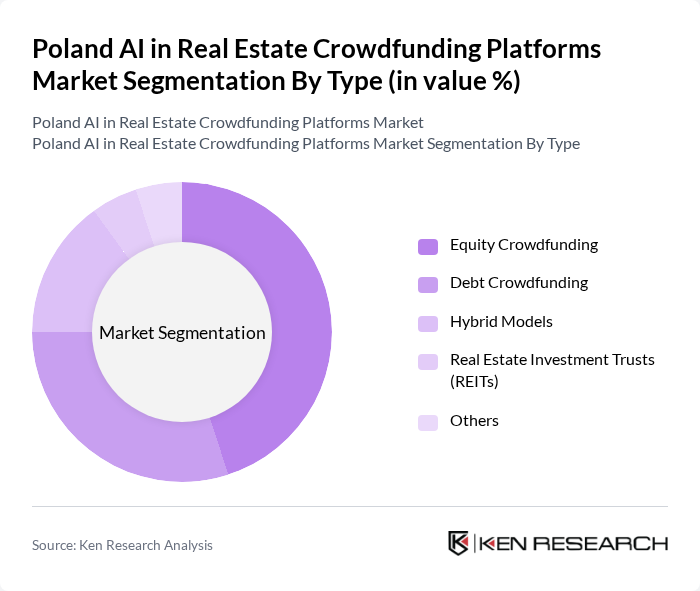

By Type:The market is segmented into various types, including Equity Crowdfunding, Debt Crowdfunding, Hybrid Models, Real Estate Investment Trusts (REITs), and Others. Among these,Equity Crowdfundinghas emerged as the leading sub-segment, driven by its appeal to individual investors seeking ownership stakes in real estate projects.Debt Crowdfundingis also gaining traction, particularly among institutional investors looking for fixed returns. Hybrid models and REITs are increasingly popular as they offer diversified investment opportunities and risk profiles.

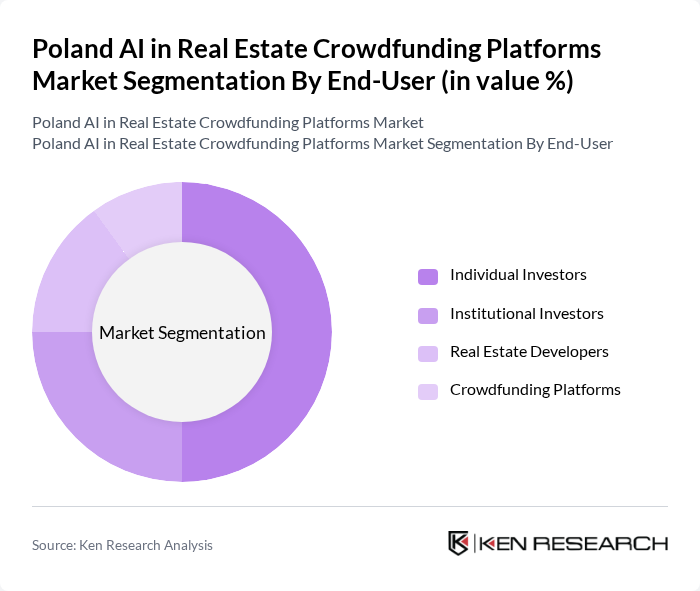

By End-User:The end-user segmentation includes Individual Investors, Institutional Investors, Real Estate Developers, and Crowdfunding Platforms.Individual Investorsdominate the market, driven by the increasing accessibility of crowdfunding platforms and the desire for alternative investment options. Institutional Investors are also significant players, often seeking larger stakes in projects. Real Estate Developers leverage these platforms to raise capital efficiently, while Crowdfunding Platforms facilitate transactions and provide digital infrastructure.

The Poland AI in Real Estate Crowdfunding Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Crowd Real Estate, Crowdestate, EstateGuru, Reinvest24, and Bulkestate contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Poland AI in real estate crowdfunding market appears promising, driven by technological advancements and regulatory support. As AI continues to enhance investment analytics, platforms will likely see increased investor engagement. Furthermore, the focus on sustainability in real estate projects is expected to attract socially conscious investors. The integration of blockchain technology for transparency will also play a crucial role in building trust and expanding the investor base, fostering a more robust market environment.

| Segment | Sub-Segments |

|---|---|

| By Type | Equity Crowdfunding Debt Crowdfunding Hybrid Models Real Estate Investment Trusts (REITs) Others |

| By End-User | Individual Investors Institutional Investors Real Estate Developers Crowdfunding Platforms |

| By Investment Size | Small Investments (up to €10,000) Medium Investments (€10,001 - €50,000) Large Investments (above €50,000) |

| By Property Type | Residential Properties Commercial Properties Industrial Properties Mixed-Use Developments |

| By Geographic Focus | Urban Areas Suburban Areas Rural Areas |

| By Funding Source | Private Investors Institutional Funds Government Grants |

| By Regulatory Compliance Level | Fully Compliant Platforms Partially Compliant Platforms Non-Compliant Platforms |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Real Estate Crowdfunding Investors | 120 | Individual Investors, Financial Advisors |

| Platform Operators | 60 | CEOs, Product Managers of Crowdfunding Platforms |

| Real Estate Developers | 50 | Project Managers, Business Development Executives |

| Regulatory Bodies | 40 | Policy Makers, Compliance Officers |

| Market Analysts | 45 | Industry Analysts, Economic Researchers |

The Poland AI in Real Estate Crowdfunding Platforms Market is valued at approximately USD 19 million, reflecting a growing interest in technology-driven investment opportunities and the expansion of digital financial platforms in the real estate sector.