Region:Middle East

Author(s):Rebecca

Product Code:KRAC1106

Pages:84

Published On:October 2025

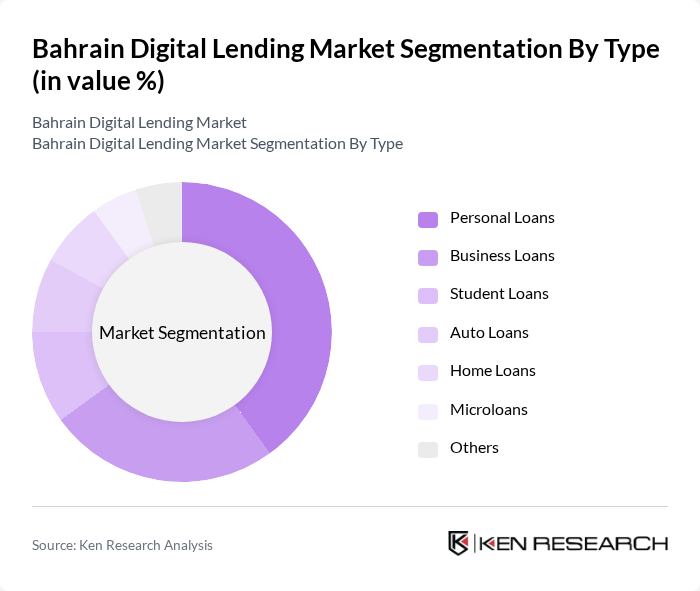

By Type:The digital lending market is segmented into personal loans, business loans, student loans, auto loans, home loans, microloans, and others. Personal loans lead the market due to their flexibility, ease of online application, and quick disbursement, meeting the immediate financial needs of individuals. Business loans, particularly for SMEs, are also significant, driven by government initiatives and the growth of entrepreneurship, with small business loans being the most favored due to lower risk and higher demand from retail and service sectors. Microloans, while smaller in share, cater to niche segments and startups, supporting financial inclusion.

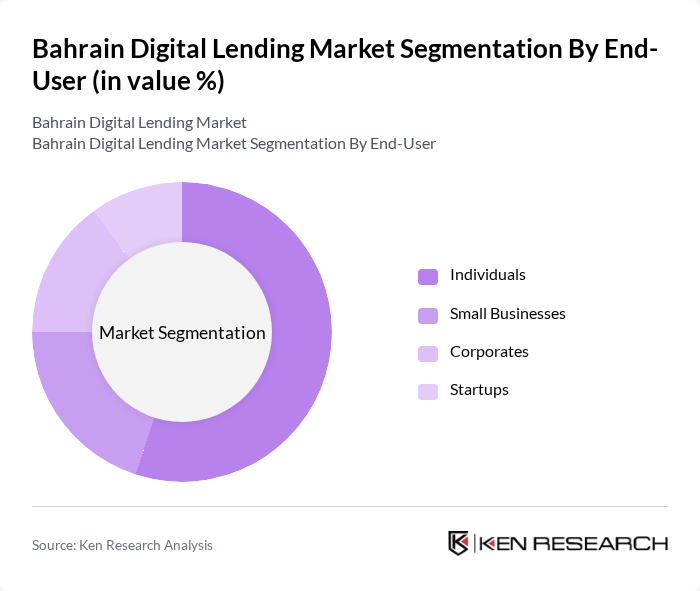

By End-User:The market serves individuals, small businesses, corporates, and startups. Individuals are the largest segment, driven by demand for personal loans for education, home improvement, and emergencies. Small businesses, especially in retail and services, are increasingly turning to digital platforms for working capital and expansion, supported by the rise of e-commerce and digital payment solutions. Corporates and startups, while smaller in share, benefit from tailored financing options and government support programs.

The Bahrain Digital Lending Market features a dynamic mix of regional and international players. Leading participants include Tamweelcom, Bahrain Islamic Bank, Al Baraka Banking Group, Gulf Finance House, Bank of Bahrain and Kuwait, Bahrain Development Bank, Aion Digital, FinTech Bahrain, Beehive, Rain Financial, Ethis Crowd, Liwwa, YAPILI, Fawry, and Kiva. These entities drive innovation, geographic expansion, and service delivery in the digital lending space.

The future of the Bahrain digital lending market appears promising, driven by technological advancements and evolving consumer preferences. As artificial intelligence and machine learning become more integrated into lending processes, lenders can enhance risk assessment and customer service. Additionally, the increasing collaboration between fintech companies and traditional banks is expected to create innovative lending solutions, further expanding market reach and improving customer experiences in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Personal Loans Business Loans Student Loans Auto Loans Home Loans Microloans Others |

| By End-User | Individuals Small Businesses Corporates Startups |

| By Loan Amount | Up to BHD 1,000 BHD 1,001 - BHD 5,000 BHD 5,001 - BHD 10,000 Above BHD 10,000 |

| By Loan Duration | Short-term Loans Medium-term Loans Long-term Loans |

| By Interest Rate Type | Fixed Rate Variable Rate |

| By Distribution Channel | Online Platforms Mobile Applications Traditional Banks |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Digital Lending Usage | 120 | Individuals aged 18-45 who have used digital lending services |

| Small Business Lending Insights | 60 | Owners and financial managers of SMEs utilizing digital loans |

| Regulatory Impact Assessment | 40 | Regulatory officials and compliance officers in financial institutions |

| Fintech Expert Opinions | 40 | Industry analysts and fintech consultants with expertise in the Bahrain market |

| Consumer Attitudes Towards Digital Lending | 100 | General consumers with varying levels of financial literacy |

The Bahrain Digital Lending Market is valued at approximately BHD 1.2 billion, primarily driven by the SME financing landscape, which is a significant segment of digital lending in the country.