Region:Europe

Author(s):Geetanshi

Product Code:KRAB5140

Pages:84

Published On:October 2025

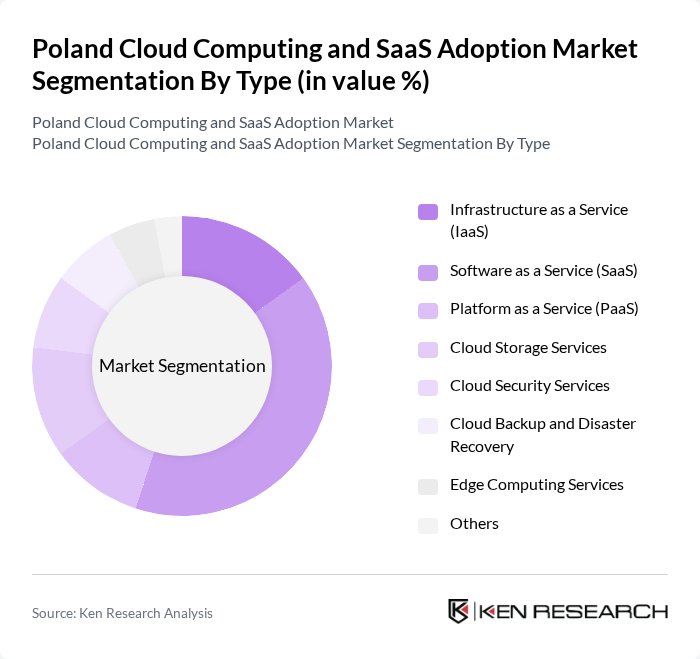

By Type:The market is segmented into various types, including Infrastructure as a Service (IaaS), Software as a Service (SaaS), Platform as a Service (PaaS), Cloud Storage Services, Cloud Security Services, Cloud Backup and Disaster Recovery, Edge Computing Services, and Others. Among these, SaaS is the leading segment due to its flexibility, cost-effectiveness, and ease of use, making it particularly appealing to businesses of all sizes. The market is also witnessing a rise in hybrid cloud solutions and edge computing, which offer enhanced scalability and data processing capabilities.

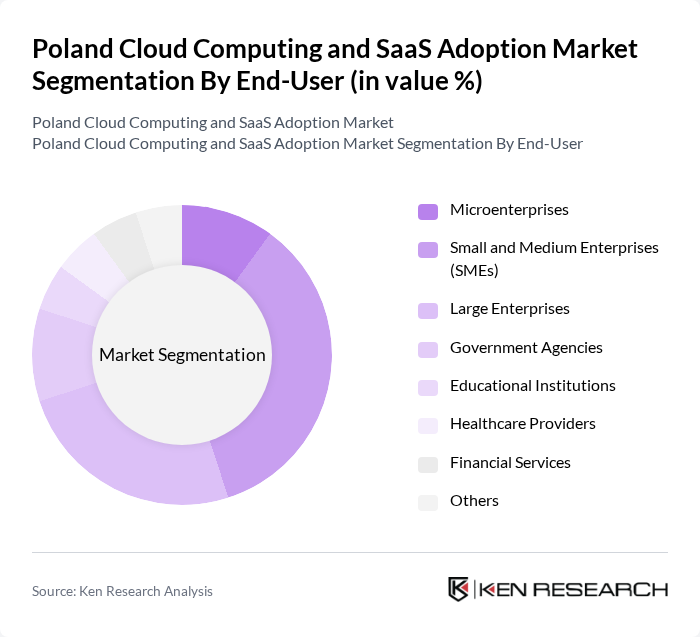

By End-User:The end-user segmentation includes Microenterprises, Small and Medium Enterprises (SMEs), Large Enterprises, Government Agencies, Educational Institutions, Healthcare Providers, Financial Services, and Others. SMEs are the dominant end-user segment, driven by their increasing reliance on cloud solutions to enhance operational efficiency and reduce IT costs.

The Poland Cloud Computing and SaaS Adoption Market is characterized by a dynamic mix of regional and international players. Leading participants such as Microsoft Corporation, Amazon Web Services, Inc., Google Cloud Platform, IBM Cloud, Oracle Corporation, SAP SE, Atos SE, T-Systems International GmbH, Comarch S.A., Asseco Poland S.A., CloudFerro S.A., OVHcloud, DigitalOcean, Inc., Rackspace Technology, Inc., Beyond.pl Sp. z o.o., Netia S.A., Orange Polska S.A., Polcom Sp. z o.o., Chmura Krajowa (Operator Chmury Krajowej Sp. z o.o.) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the cloud computing and SaaS market in Poland appears promising, driven by ongoing digital transformation and increasing reliance on remote work solutions. As businesses continue to prioritize data security and compliance, the demand for innovative cloud services is expected to rise. Additionally, the expansion of cloud infrastructure into rural areas will facilitate broader access, while government initiatives will further incentivize cloud adoption, fostering a more competitive and dynamic market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Infrastructure as a Service (IaaS) Software as a Service (SaaS) Platform as a Service (PaaS) Cloud Storage Services Cloud Security Services Cloud Backup and Disaster Recovery Edge Computing Services Others |

| By End-User | Microenterprises Small and Medium Enterprises (SMEs) Large Enterprises Government Agencies Educational Institutions Healthcare Providers Financial Services Others |

| By Industry Vertical | IT and Telecommunications Retail and E-commerce Manufacturing Transportation and Logistics Media and Entertainment Energy and Utilities Healthcare Banking, Financial Services, and Insurance (BFSI) Public Sector Others |

| By Deployment Model | Public Cloud Private Cloud Hybrid Cloud Multi-Cloud Others |

| By Service Model | Managed Services Professional Services Consulting Services Support and Maintenance Services Others |

| By Pricing Model | Subscription-Based Pricing Pay-As-You-Go Pricing Tiered Pricing Freemium Model Others |

| By Geographic Distribution | Central Poland Northern Poland Southern Poland Eastern Poland Western Poland Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Enterprise SaaS Adoption | 120 | IT Managers, CTOs, Digital Transformation Leads |

| SME Cloud Utilization | 90 | Business Owners, Operations Managers, IT Consultants |

| Public Sector Cloud Strategies | 70 | Government IT Officials, Policy Makers, Project Managers |

| Healthcare SaaS Solutions | 60 | Healthcare IT Directors, Practice Managers, Compliance Officers |

| Financial Services Cloud Adoption | 80 | Finance Executives, Risk Managers, IT Security Officers |

The Poland Cloud Computing and SaaS Adoption Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by digital transformation, remote work trends, and the demand for scalable IT solutions across various sectors.