Region:Europe

Author(s):Rebecca

Product Code:KRAA4838

Pages:86

Published On:September 2025

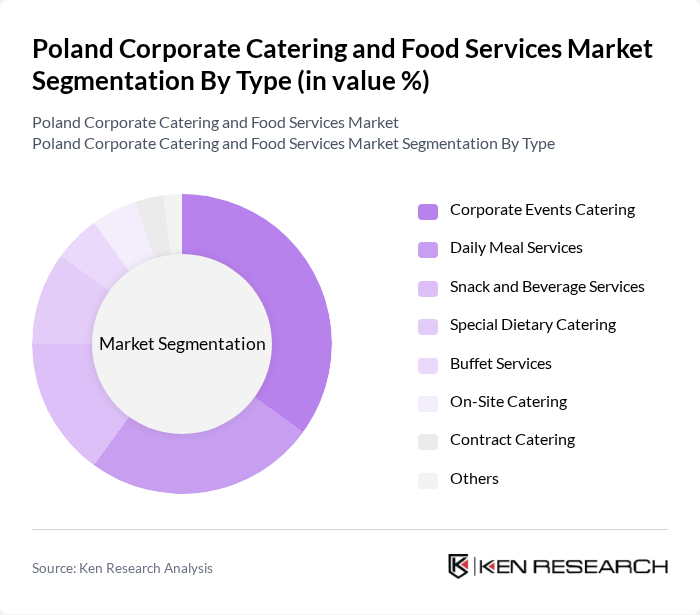

By Type:The market is segmented into various types of catering services, including Corporate Events Catering, Daily Meal Services, Snack and Beverage Services, Special Dietary Catering, Buffet Services, On-Site Catering, Contract Catering, and Others. Among these, Corporate Events Catering is the leading segment, driven by the increasing number of corporate events and functions requiring professional catering services. The demand for tailored menus and high-quality service is pushing this segment to the forefront, as companies seek to impress clients and employees alike. The rise of hybrid work models and frequent team-building activities further support the growth of this segment, as businesses prioritize employee engagement and wellness through premium food offerings .

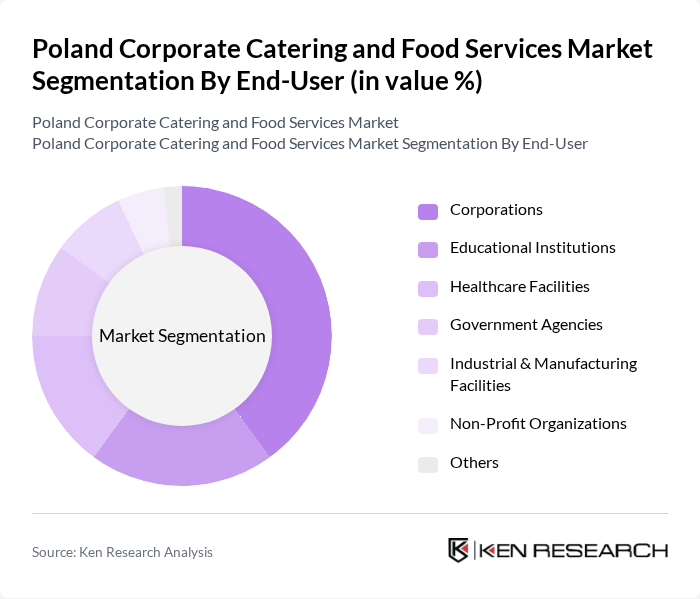

By End-User:The end-user segmentation includes Corporations, Educational Institutions, Healthcare Facilities, Government Agencies, Industrial & Manufacturing Facilities, Non-Profit Organizations, and Others. Corporations dominate this segment, as they frequently require catering services for meetings, conferences, and employee events. The increasing focus on employee wellness and satisfaction is driving corporations to invest in high-quality catering services that offer diverse and healthy meal options. Educational institutions and healthcare facilities are also significant consumers, reflecting the broader adoption of professional catering in public and private sectors .

The Poland Corporate Catering and Food Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Sodexo Polska Sp. z o.o., Compass Group Polska Sp. z o.o., Aramark Sp. z o.o., Gastromall Group Sp. z o.o., Food Service Polska Sp. z o.o., M&M Catering Sp. z o.o., GASTRO-MAX Sp. z o.o., Katering24.pl Sp. z o.o., Pyszne.pl Sp. z o.o., B2B Catering Sp. z o.o., Dussmann Polska Sp. z o.o., Eurest Poland Sp. z o.o., Bon Appetit Polska Sp. z o.o., Catering Warszawski Sp. z o.o., Fresh Catering Sp. z o.o. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the corporate catering market in Poland appears promising, driven by evolving consumer preferences and technological advancements. As companies increasingly prioritize employee well-being, the demand for healthy and sustainable meal options is expected to rise. Additionally, the integration of technology in food services, such as online ordering and delivery platforms, will enhance operational efficiency. These trends indicate a dynamic market landscape, where adaptability and innovation will be crucial for catering providers to thrive in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Corporate Events Catering Daily Meal Services Snack and Beverage Services Special Dietary Catering Buffet Services On-Site Catering Contract Catering Others |

| By End-User | Corporations Educational Institutions Healthcare Facilities Government Agencies Industrial & Manufacturing Facilities Non-Profit Organizations Others |

| By Service Model | In-House Catering Outsourced Catering Hybrid Model Others |

| By Meal Type | Breakfast Lunch Dinner Snacks Beverages Others |

| By Pricing Model | Fixed Pricing Variable Pricing Subscription-Based Pricing Others |

| By Delivery Method | On-Site Delivery Off-Site Delivery Pickup Services Others |

| By Region | Central Poland Southern Poland Northern Poland Eastern Poland Western Poland Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Catering Services | 100 | Catering Managers, Procurement Officers |

| Event Catering for Corporates | 60 | Event Planners, HR Managers |

| Food Service Management in Corporates | 50 | Facility Managers, Office Administrators |

| Employee Meal Programs | 40 | Wellness Coordinators, Employee Engagement Officers |

| Corporate Catering Trends | 50 | Market Analysts, Industry Experts |

The Poland Corporate Catering and Food Services Market is valued at approximately USD 1.8 billion, reflecting a significant growth trend driven by the demand for convenient meal solutions and healthier eating options among businesses and organizations.