Region:Europe

Author(s):Rebecca

Product Code:KRAB5929

Pages:89

Published On:October 2025

By Solution Type:The solution type segmentation includes various subsegments such as Network Security, Endpoint Security, Application Security, Cloud Security, Data Security, Identity and Access Management, Infrastructure Security, and Others. Among these, Network Security is currently the leading subsegment due to the increasing need for secure communication channels and protection against unauthorized access. The rise in cyberattacks targeting manufacturing networks has driven companies to invest heavily in network security solutions to safeguard their operations. This is consistent with broader market trends, where integrated solutions such as firewalls, intrusion detection, and encryption are prioritized by manufacturing firms .

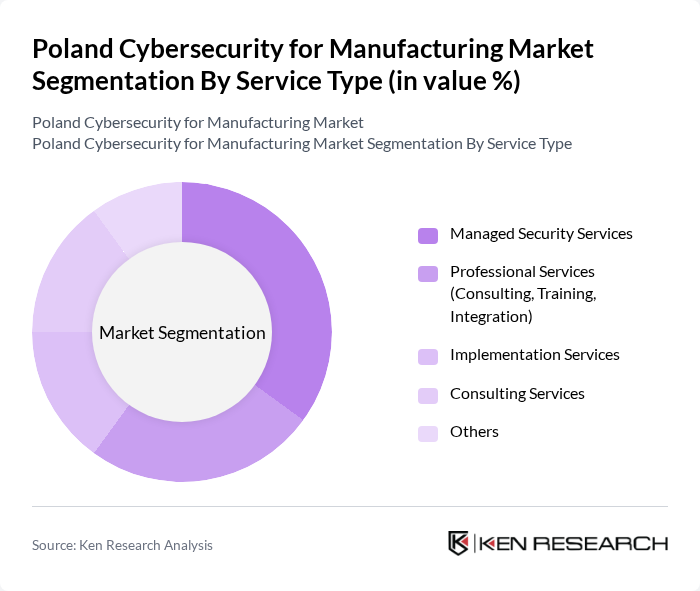

By Service Type:The service type segmentation encompasses Managed Security Services, Professional Services (Consulting, Training, Integration), Implementation Services, Consulting Services, and Others. Managed Security Services are leading this segment as organizations increasingly outsource their cybersecurity needs to specialized providers. This trend is driven by the complexity of cybersecurity threats, a shortage of in-house cybersecurity skills, and the need for continuous monitoring and rapid response capabilities. The services segment overall is experiencing rapid growth, in line with the broader Polish market, as businesses seek 24/7 protection and expertise .

The Poland Cybersecurity for Manufacturing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Asseco Poland S.A., Comarch S.A., NASK (Naukowa i Akademicka Sie? Komputerowa), Orange Polska S.A., Microsoft Sp. z o.o., IBM Polska Sp. z o.o., Cisco Systems Poland Sp. z o.o., Kaspersky Lab Poland, Fortinet Poland Sp. z o.o., Palo Alto Networks Poland, Check Point Software Technologies Poland, Bitdefender Poland, Trend Micro Poland, CyberArk Software Poland, CrowdStrike Poland contribute to innovation, geographic expansion, and service delivery in this space.

The future of the cybersecurity market in Poland's manufacturing sector appears promising, driven by technological advancements and increasing awareness of cyber threats. As manufacturers continue to adopt digital transformation strategies, the demand for integrated cybersecurity solutions will rise. Additionally, the growing emphasis on data privacy and compliance will further propel investments in cybersecurity infrastructure, ensuring that manufacturers can safeguard their operations against evolving threats while maintaining regulatory compliance.

| Segment | Sub-Segments |

|---|---|

| By Solution Type | Network Security Endpoint Security Application Security Cloud Security Data Security Identity and Access Management Infrastructure Security Others |

| By Service Type | Managed Security Services Professional Services (Consulting, Training, Integration) Implementation Services Consulting Services Others |

| By Deployment Mode | On-Premises Cloud-Based Hybrid |

| By End-User Industry | Automotive Electronics Food and Beverage Pharmaceuticals Machinery and Equipment Aerospace and Defense Energy and Utilities Healthcare Retail Others |

| By Security Type | Threat Intelligence Incident Response Vulnerability Management Application Security Endpoint Security Network Security Cloud Security Data Security Others |

| By Enterprise Size | SMEs Large Enterprises |

| By Type of Threat | Malware Denial-of-Service (DoS) Distributed Denial-of-Service (DDoS) Zero-Day Exploits Man-in-the-Middle (MITM) Attacks Others |

| By Geography (Region) | Greater Poland Kuyavian-Pomeranian Lesser Poland ?ód? Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Manufacturing Cybersecurity | 60 | IT Security Managers, Compliance Officers |

| Electronics Manufacturing Cybersecurity | 50 | Network Administrators, Risk Management Directors |

| Food Processing Cybersecurity | 40 | Operational Technology Specialists, IT Directors |

| Pharmaceutical Manufacturing Cybersecurity | 40 | Quality Assurance Managers, Cybersecurity Analysts |

| Textile Manufacturing Cybersecurity | 40 | Production Managers, IT Support Staff |

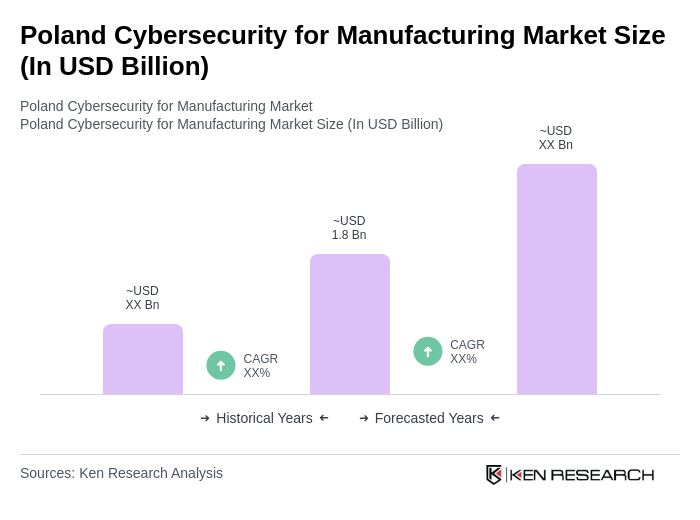

The Poland Cybersecurity for Manufacturing Market is valued at approximately USD 1.8 billion, reflecting significant growth driven by increased digitization, rising cyber threats, and compliance with stringent regulations in the manufacturing sector.