Region:Europe

Author(s):Rebecca

Product Code:KRAA5591

Pages:94

Published On:September 2025

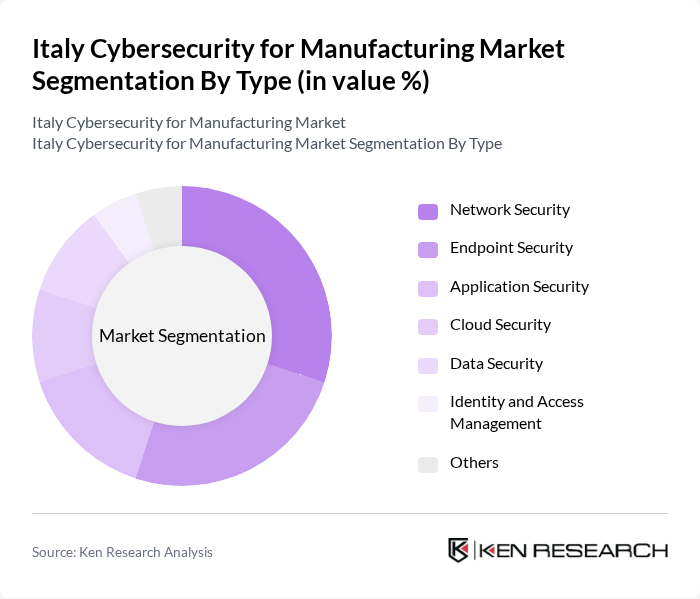

By Type:This segmentation includes various cybersecurity solutions tailored for the manufacturing sector, focusing on protecting networks, endpoints, applications, and data. The increasing complexity of cyber threats has led to a heightened demand for comprehensive security measures across these categories.

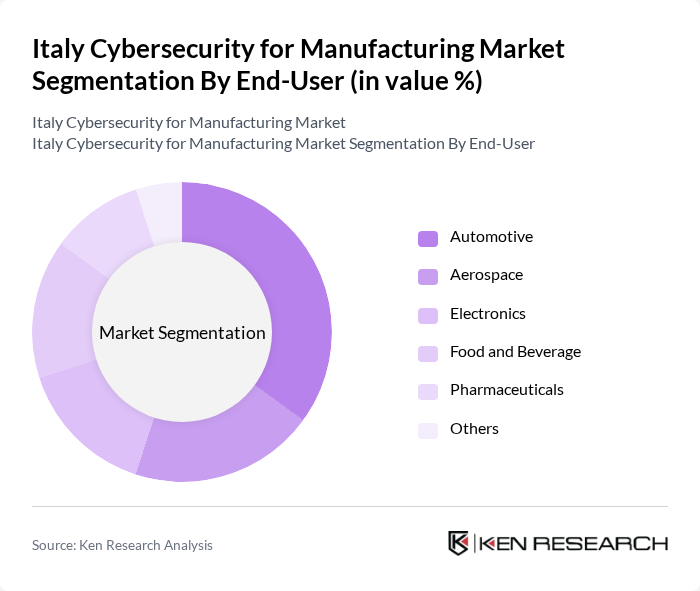

By End-User:This segmentation categorizes the market based on the various industries utilizing cybersecurity solutions, including automotive, aerospace, electronics, food and beverage, and pharmaceuticals. Each sector has unique security needs driven by regulatory requirements and the critical nature of their operations.

The Italy Cybersecurity for Manufacturing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Cisco Systems, Inc., Palo Alto Networks, Inc., Fortinet, Inc., Check Point Software Technologies Ltd., IBM Corporation, McAfee Corp., Trend Micro Incorporated, FireEye, Inc., CrowdStrike Holdings, Inc., Sophos Group plc, RSA Security LLC, CyberArk Software Ltd., Splunk Inc., Proofpoint, Inc., Darktrace plc contribute to innovation, geographic expansion, and service delivery in this space.

The future of the cybersecurity landscape in Italy's manufacturing sector appears promising, driven by technological advancements and increasing awareness of cyber risks. As firms continue to embrace digital transformation, the integration of AI and machine learning into cybersecurity solutions will enhance threat detection and response capabilities. Additionally, the shift towards zero trust security models will redefine security frameworks, ensuring that every access request is verified, thereby strengthening overall security posture in the manufacturing industry.

| Segment | Sub-Segments |

|---|---|

| By Type | Network Security Endpoint Security Application Security Cloud Security Data Security Identity and Access Management Others |

| By End-User | Automotive Aerospace Electronics Food and Beverage Pharmaceuticals Others |

| By Industry Size | Large Enterprises Medium Enterprises Small Enterprises |

| By Compliance Requirement | ISO 27001 NIST Cybersecurity Framework PCI DSS HIPAA |

| By Service Type | Consulting Services Implementation Services Managed Security Services Training and Awareness Services |

| By Deployment Mode | On-Premises Cloud-Based Hybrid |

| By Pricing Model | Subscription-Based One-Time License Fee Pay-As-You-Go |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Manufacturing Cybersecurity | 100 | IT Security Managers, Compliance Officers |

| Aerospace Sector Cyber Defense | 80 | Cybersecurity Analysts, Risk Management Directors |

| Electronics Manufacturing Security Solutions | 90 | Operations Managers, IT Directors |

| Pharmaceutical Manufacturing Cybersecurity | 70 | Quality Assurance Managers, IT Security Leads |

| Food and Beverage Manufacturing Cybersecurity | 60 | Production Managers, Cybersecurity Consultants |

The Italy Cybersecurity for Manufacturing Market is valued at approximately USD 2.5 billion, reflecting significant growth driven by increased digitization, rising cyber threats, and compliance with stringent regulations in the manufacturing sector.