Region:Europe

Author(s):Shubham

Product Code:KRAB2680

Pages:92

Published On:October 2025

By Type:The market is segmented into various types, including Vehicles, Real Estate, Electronics, Furniture, Services, Jobs, Fashion & Accessories, Home & Garden, and Others. Each of these segments caters to different consumer needs and preferences, with specific trends influencing their growth. For instance, the Vehicles segment has seen a surge in demand due to the increasing number of individuals seeking personal transportation options, while Real Estate remains a strong contender due to ongoing urban development. The broader e-commerce market in Poland shows that Hobby & Leisure is the leading category overall, but within classifieds, Vehicles and Real Estate continue to drive significant activity. Electronics, Furniture, and Services also see steady engagement, reflecting the diversification of online consumer behavior.

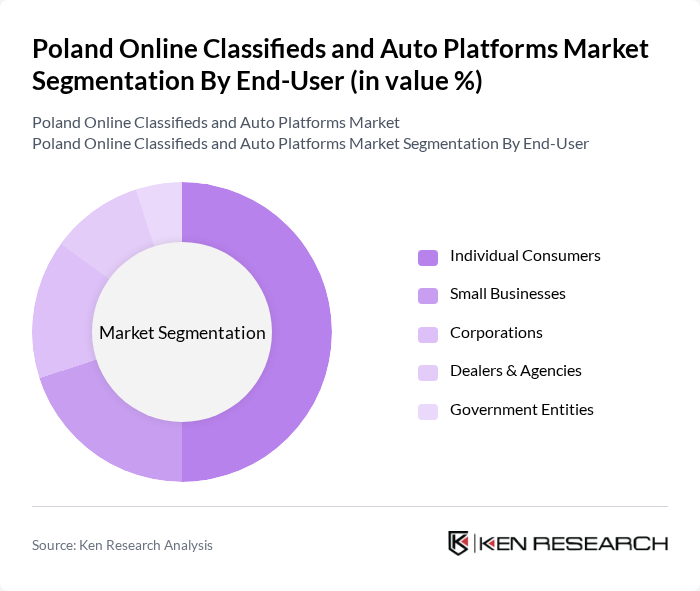

By End-User:The end-user segmentation includes Individual Consumers, Small Businesses, Corporations, Dealers & Agencies, and Government Entities. Individual Consumers represent the largest segment, driven by the growing trend of online shopping and the convenience of accessing various products and services from home. Small Businesses and Dealers & Agencies also play a significant role, leveraging online platforms to reach a broader audience and enhance their sales channels. The rise of user-generated content and peer-to-peer transactions has further solidified the position of individual consumers and small enterprises within the market.

The Poland Online Classifieds and Auto Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as OLX.pl, Allegro.pl, Gumtree.pl, Otomoto.pl, Gratka.pl, Sprzedajemy.pl, Ceneo.pl, Morizon.pl, Nieruchomosci-online.pl, Trovit.pl, Zumi.pl, Szybko.pl, Lento.pl, AutoScout24.pl, eBay.pl contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Poland online classifieds and auto platforms market appears promising, driven by technological advancements and evolving consumer behaviors. As internet penetration continues to rise, platforms are likely to enhance their offerings with features such as AI-driven recommendations and augmented reality for vehicle viewing. Additionally, the increasing integration of social media for listings will further engage users, creating a more dynamic marketplace. These trends suggest a robust growth trajectory for the industry, fostering innovation and improved user experiences.

| Segment | Sub-Segments |

|---|---|

| By Type | Vehicles Real Estate Electronics Furniture Services Jobs Fashion & Accessories Home & Garden Others |

| By End-User | Individual Consumers Small Businesses Corporations Dealers & Agencies Government Entities |

| By Sales Channel | Direct Listings Auction Platforms Classified Ads Social Media Platforms Mobile Apps |

| By Geographic Region | Mazowieckie ?l?skie Ma?opolskie Wielkopolskie Dolno?l?skie |

| By Price Range | Low-End Mid-Range High-End |

| By Payment Method | Credit/Debit Cards Bank Transfers Cash on Delivery Digital Wallets |

| By Listing Duration | Short-Term Listings Long-Term Listings Permanent Listings |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Online Classifieds User Insights | 100 | Frequent Users, Occasional Users, New Users |

| Automotive Platform Engagement | 80 | Car Buyers, Sellers, Dealership Representatives |

| Market Trends in Vehicle Listings | 60 | Automotive Analysts, Market Researchers |

| Consumer Preferences in Online Transactions | 90 | General Consumers, Tech-Savvy Users |

| Impact of Digital Marketing on Classifieds | 50 | Marketing Professionals, Digital Strategists |

The Poland Online Classifieds and Auto Platforms Market is valued at approximately USD 1.6 billion, reflecting significant growth driven by increased internet penetration and changing consumer behaviors favoring online transactions over traditional methods.