Region:Middle East

Author(s):Geetanshi

Product Code:KRAA5300

Pages:90

Published On:September 2025

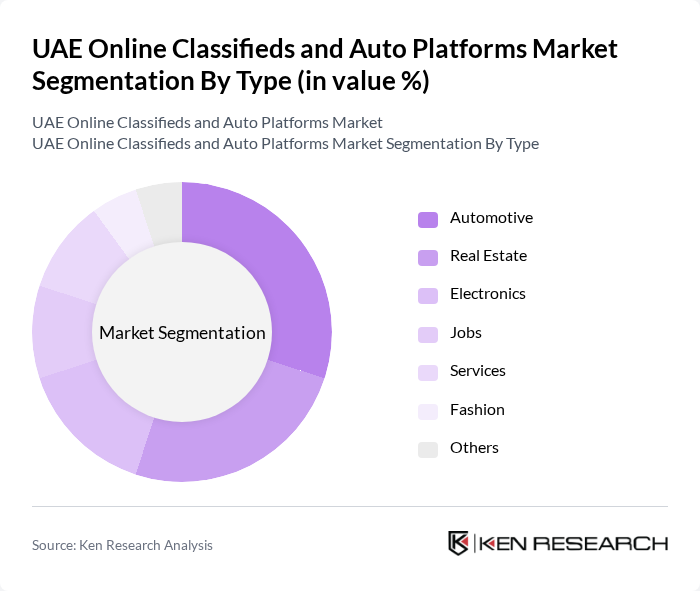

By Type:The market is segmented into various types, including Automotive, Real Estate, Electronics, Jobs, Services, Fashion, and Others. Each of these segments caters to different consumer needs and preferences, with specific trends influencing their growth. The Automotive and Real Estate segments are particularly prominent due to the high demand for vehicles and property in the UAE.

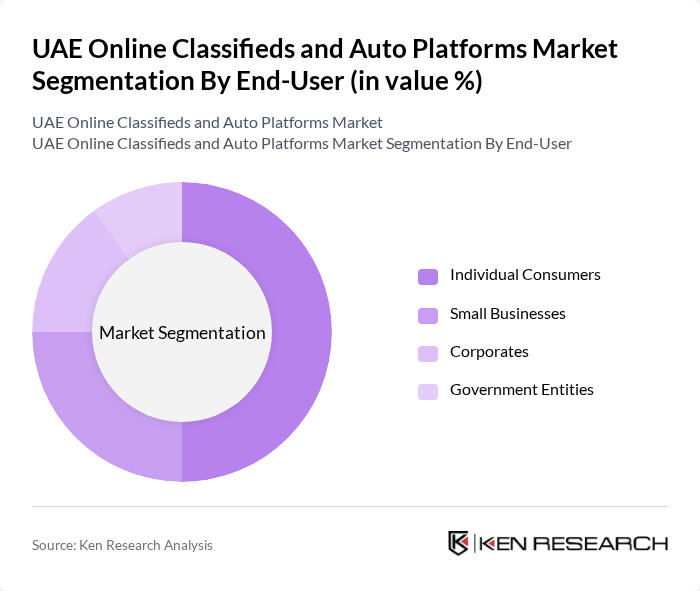

By End-User:The end-user segmentation includes Individual Consumers, Small Businesses, Corporates, and Government Entities. Each group utilizes online classifieds for different purposes, such as personal purchases, business transactions, and government services. Individual Consumers dominate the market due to the high volume of personal transactions conducted online.

The UAE Online Classifieds and Auto Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Dubizzle, CarSwitch, YallaMotor, OLX UAE, Bayut, Property Finder, AutoTrader UAE, ExpatWoman, UAE Classifieds, SellAnyCar.com, WeBuyAnyCar.com, DubiCars, Emirates Auction, JustProperty, MyBayut contribute to innovation, geographic expansion, and service delivery in this space.

The UAE online classifieds and auto platforms market is poised for significant evolution, driven by technological advancements and changing consumer behaviors. As digital transactions become more prevalent, platforms will increasingly adopt AI and machine learning to enhance user experiences and streamline operations. Additionally, the integration of augmented reality features is expected to transform how consumers interact with listings, providing immersive experiences that could redefine online shopping in this sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Automotive Real Estate Electronics Jobs Services Fashion Others |

| By End-User | Individual Consumers Small Businesses Corporates Government Entities |

| By Sales Channel | Online Platforms Mobile Applications Social Media Offline Channels |

| By Geographic Coverage | Dubai Abu Dhabi Sharjah Other Emirates |

| By Pricing Model | Free Listings Paid Listings Subscription-Based |

| By User Demographics | Age Group Income Level Education Level |

| By Product Condition | New Used Refurbished |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Online Classifieds User Insights | 150 | Frequent Users, Occasional Buyers |

| Automotive Platform Engagement | 100 | Car Buyers, Sellers, and Dealers |

| Market Trends in Vehicle Listings | 80 | Automotive Market Analysts, Industry Experts |

| Consumer Preferences in Online Shopping | 120 | General Consumers, Tech-Savvy Users |

| Advertising Effectiveness on Platforms | 90 | Marketing Managers, Brand Strategists |

The UAE Online Classifieds and Auto Platforms Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by increased internet and mobile device penetration, as well as a rising preference for online shopping and services among consumers.