Region:Europe

Author(s):Rebecca

Product Code:KRAB1808

Pages:86

Published On:October 2025

By Type:The market is segmented into various types of baby food products, including milk formula, prepared baby food, dried baby food, fruit and vegetable purees, dairy-based products, snacks and finger foods, organic baby food, gluten-free options, and others. Among these, milk formula is the leading sub-segment due to its essential role in infant nutrition, especially for working parents who prefer convenient feeding options. The increasing trend towards organic and gluten-free products is also notable, as parents are becoming more health-conscious and seeking high-quality, nutritious options for their children .

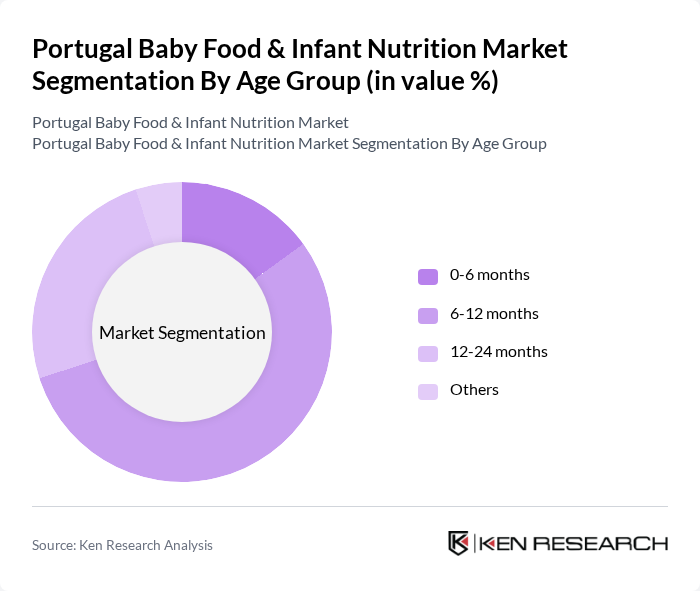

By Age Group:The market is also segmented by age group, including 0-6 months, 6-12 months, 12-24 months, and others. The 6-12 months age group is the most significant segment, as this is the period when infants transition to solid foods and require a variety of nutritional options. Parents are increasingly looking for products that cater to this age group, focusing on taste, texture, and nutritional value to support their child's growth and development .

The Portugal Baby Food & Infant Nutrition Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nestlé S.A., Danone S.A., Hero Group (Hero Baby Portugal), Lactalis Group (Nutrilac, Portugal), Abbott Laboratories, Mead Johnson Nutrition (Reckitt Benckiser Group plc), FrieslandCampina, HIPP GmbH & Co. Vertrieb KG, Ordesa Group (Blemil, Blevit), Nutricia (Danone Portugal), Blédina (Danone Group), Humana GmbH, Milupa (Danone Group), Plasmon (Heinz Italia S.p.A.), SMA Nutrition (Nestlé) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Portugal baby food and infant nutrition market appears promising, driven by evolving consumer preferences and technological advancements. The increasing focus on health and sustainability will likely shape product offerings, with brands innovating to meet these demands. Additionally, the rise of digital marketing and e-commerce platforms will facilitate greater consumer engagement, allowing brands to tailor their products to specific needs, thus enhancing market penetration and growth potential in future.

| Segment | Sub-Segments |

|---|---|

| By Type | Milk formula Prepared baby food (wet meals & others) Dried baby food (cereal-based) Fruit and vegetable purees Dairy-based products Snacks and finger foods Organic baby food Gluten-free options Others |

| By Age Group | 6 months 12 months 24 months Others |

| By Distribution Channel | Supermarkets and hypermarkets Pharmacies Convenience stores Online retail Specialty stores Others |

| By Packaging Type | Jars Pouches Tetra packs Cans Others |

| By Brand Type | National brands Private labels Premium brands Others |

| By Nutritional Content | High protein Low sugar Fortified with vitamins Others |

| By Price Range | Economy Mid-range Premium Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Baby Food Sales | 80 | Store Managers, Category Buyers |

| Healthcare Professional Insights | 60 | Pediatricians, Nutritionists |

| Parental Purchasing Behavior | 100 | Parents of infants aged 0-24 months |

| Market Trends in Organic Baby Food | 40 | Health-Conscious Parents, Organic Product Advocates |

| Consumer Attitudes Towards Baby Food Safety | 70 | Caregivers, Childcare Providers |

The Portugal Baby Food & Infant Nutrition Market is valued at approximately USD 95 million, reflecting a growing awareness among parents regarding infant nutrition and a rising trend towards convenience and organic food products.