Portugal Luggage & Travel Gear Market Overview

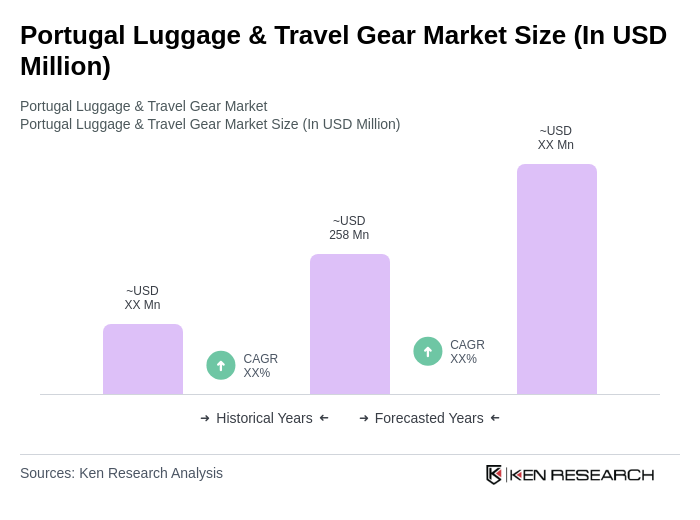

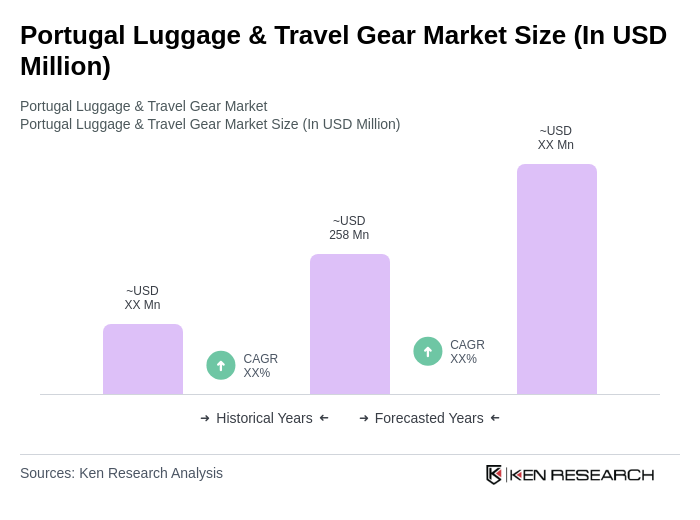

- The Portugal Luggage & Travel Gear Market is valued at USD 258 million, based on a five-year historical analysis. This growth is primarily driven by the increasing number of travelers, both domestic and international, as well as a rising trend in travel-related activities. The market has seen a surge in demand for innovative and durable luggage solutions, catering to the evolving preferences of consumers. Recent years have also seen a notable shift toward premium and smart luggage, with features such as GPS tracking, USB charging ports, and lightweight materials gaining popularity among tech-savvy travelers.

- Key cities such as Lisbon and Porto dominate the market due to their status as major travel hubs, attracting millions of tourists annually. The presence of international airports and a rich cultural heritage further enhance their appeal, making them focal points for travel gear sales. Additionally, the growing popularity of eco-friendly products has led to increased demand for sustainable luggage options in these urban centers, with brands increasingly highlighting recycled materials and carbon-neutral production processes.

- In 2023, the Portuguese government implemented the National Strategy for Sustainable Consumption and Production (ENCPP), issued by the Ministry of Environment and Climate Action, which includes specific measures to promote sustainable travel practices. This strategy encourages manufacturers to adopt eco-design principles, use recyclable and biodegradable materials, and reduce the environmental footprint of luggage production. Compliance is supported through tax incentives for certified sustainable products and public procurement guidelines favoring green travel gear, aligning with broader EU sustainability targets under the European Green Deal.

Portugal Luggage & Travel Gear Market Segmentation

By Type:The luggage and travel gear market is segmented into various types, including hard-shell luggage, soft-shell luggage, travel accessories, backpacks, duffel bags, business cases, and others. Among these, hard-shell luggage has gained significant traction due to its durability and security features, appealing to both business and leisure travelers. Soft-shell luggage, on the other hand, offers flexibility and lightweight options, making it popular among budget-conscious consumers. Travel accessories, such as packing cubes and organizers, are also increasingly sought after as travelers look for ways to enhance their travel experience. The carry-on segment, in particular, is experiencing robust growth, driven by airline baggage policies and the preference for hassle-free travel.

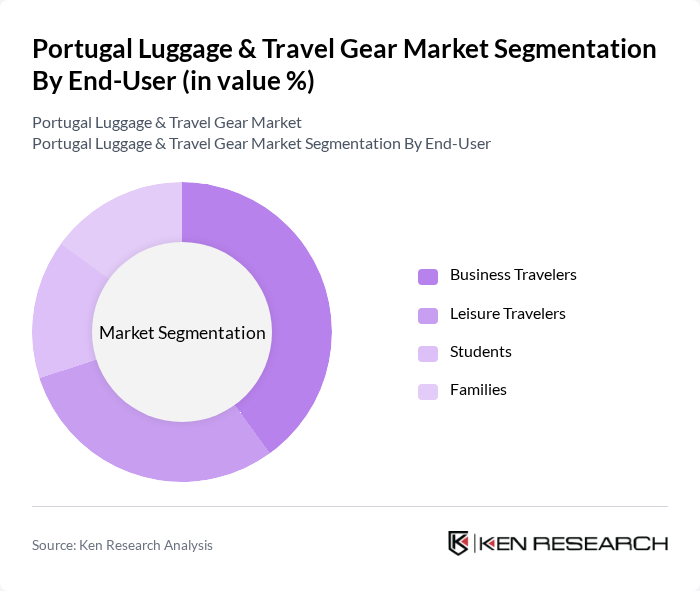

By End-User:The end-user segmentation includes business travelers, leisure travelers, students, and families. Business travelers dominate the market due to the increasing frequency of corporate travel and the demand for high-quality, durable luggage that meets airline regulations. Leisure travelers also contribute significantly, driven by the growing trend of travel experiences. Families often seek versatile and spacious luggage options, while students typically prefer budget-friendly and lightweight alternatives for their travels. The post-pandemic recovery has further amplified demand across all segments, with a noticeable uptick in hybrid travel combining business and leisure elements.

Portugal Luggage & Travel Gear Market Competitive Landscape

The Portugal Luggage & Travel Gear Market is characterized by a dynamic mix of regional and international players. Leading participants such as Samsonite International S.A., Tumi Holdings, Inc., American Tourister, Delsey S.A., Rimowa GmbH, Eastpak, Osprey Packs, Inc., The North Face, Inc., Herschel Supply Co., Travelpro International, Inc., Briggs & Riley, Victorinox AG, Antler Ltd., Crumpler, Thule Group AB, Louis Vuitton contribute to innovation, geographic expansion, and service delivery in this space.

Portugal Luggage & Travel Gear Market Industry Analysis

Growth Drivers

- Increasing Travel and Tourism Activities:In future, Portugal is projected to welcome approximately 23 million international tourists, a significant increase from 25 million in the previous year. This surge in travel is driven by the country's rich cultural heritage and favorable climate, leading to heightened demand for luggage and travel gear. The tourism sector contributes around USD 20 billion to the national economy, underscoring the direct correlation between travel activities and the growth of the luggage market.

- Rising Disposable Income:The average disposable income in Portugal is expected to reach USD 19,000 per capita in future, up from €20,500 in the previous year. This increase allows consumers to allocate more funds towards travel-related purchases, including luggage and travel gear. As disposable income rises, consumers are more likely to invest in high-quality, durable products, driving demand for premium luggage brands and innovative travel solutions.

- Growth of E-commerce Platforms:E-commerce sales in Portugal are projected to exceed USD 6 billion in future, reflecting a 15% increase from the previous year. This growth is facilitating easier access to a wide range of luggage and travel gear options for consumers. The convenience of online shopping, coupled with competitive pricing and promotional offers, is encouraging consumers to purchase travel products online, thus expanding the market reach for brands and retailers.

Market Challenges

- Intense Competition:The Portuguese luggage market is characterized by intense competition, with over 100 brands vying for market share. Major players include Samsonite, American Tourister, and local brands. This saturation leads to price wars, which can erode profit margins. In future, the average price of luggage is expected to decline by 5%, making it challenging for brands to maintain profitability while attracting price-sensitive consumers.

- Fluctuating Raw Material Prices:The luggage manufacturing sector is facing challenges due to fluctuating prices of raw materials, such as polyester and aluminum. In future, the cost of polyester is projected to rise by 10% due to supply chain disruptions. This increase can lead to higher production costs for manufacturers, potentially resulting in increased retail prices for consumers, which may dampen demand in a price-sensitive market.

Portugal Luggage & Travel Gear Market Future Outlook

The future of the Portugal luggage and travel gear market appears promising, driven by the ongoing recovery of the tourism sector and increasing consumer interest in travel. As disposable incomes rise, consumers are expected to prioritize quality and sustainability in their purchases. Additionally, the integration of technology in luggage design, such as smart features, will likely attract tech-savvy travelers. Brands that adapt to these trends will be well-positioned to capture market share and drive growth in the coming years.

Market Opportunities

- Expansion of Online Retail:The shift towards online shopping presents a significant opportunity for luggage brands. With e-commerce sales projected to grow, companies can enhance their digital presence and offer personalized shopping experiences. This strategy can lead to increased customer engagement and higher sales volumes, particularly among younger consumers who prefer online purchasing.

- Development of Smart Luggage:The demand for smart luggage solutions is on the rise, with an expected market value of USD 250 million in future. Features such as GPS tracking, built-in charging ports, and biometric locks are becoming increasingly popular. Companies that invest in innovative technology can differentiate their products and cater to the evolving needs of modern travelers, thus capturing a lucrative segment of the market.