Australia Luggage & Travel Gear Market Overview

- The Australia Luggage & Travel Gear Market is valued at approximately USD 1.5 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing number of domestic and international travelers, a surge in student and migrant arrivals, and a rising trend in travel-related activities and experiences. The demand for innovative, durable, and multifunctional luggage solutions has surged, reflecting changing consumer preferences towards quality, smart features, and sustainability. Notably, the market is witnessing rapid adoption of intelligent luggage with features such as GPS tracking, USB charging, and biometric locks, catering to tech-savvy travelers and enhancing user convenience and security .

- Key players in this market include major cities such as Sydney, Melbourne, and Brisbane, which dominate due to their status as travel hubs with significant international airports and vibrant tourism industries. The concentration of retail outlets and brand presence in these metropolitan areas further enhances their market dominance, catering to both local and international travelers .

- In 2023, the Australian government implemented the “Country of Origin Food Labelling Information Standard 2016” (as amended), administered by the Australian Competition and Consumer Commission (ACCC), which mandates clear labeling of materials and country of origin for consumer goods, including luggage and travel gear. This regulation requires manufacturers and importers to provide transparent information on product composition and origin, supporting consumer protection and promoting eco-friendly practices in the sector .

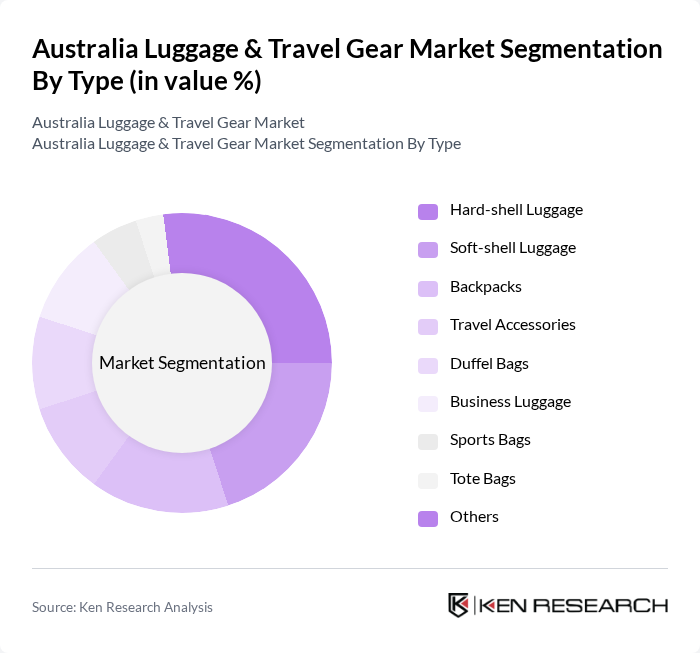

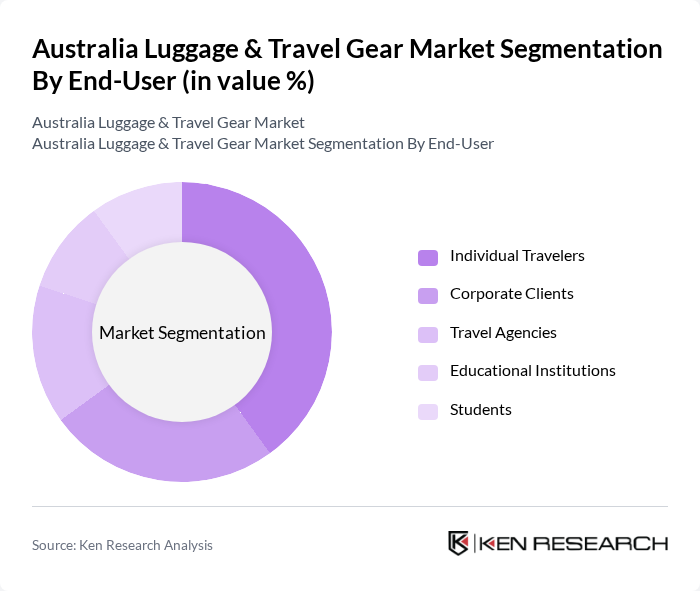

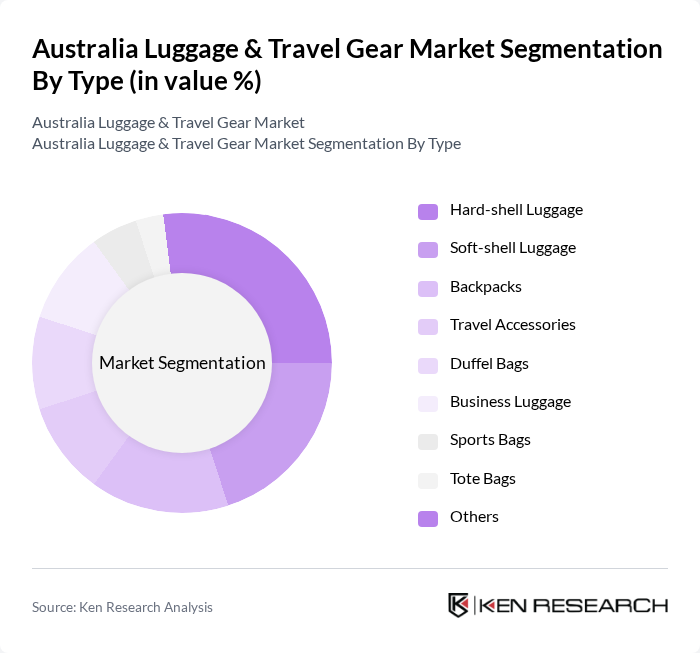

Australia Luggage & Travel Gear Market Segmentation

By Type:The luggage and travel gear market can be segmented into various types, including hard-shell luggage, soft-shell luggage, backpacks, travel accessories, duffel bags, business luggage, sports bags, tote bags, and others. Each of these subsegments caters to different consumer needs and preferences, with specific features and functionalities that appeal to various traveler demographics. The market is experiencing a notable shift toward smart and sustainable products, with hard-shell and soft-shell luggage incorporating advanced materials, anti-theft features, and modular designs to enhance durability and convenience .

By End-User:The end-user segmentation includes individual travelers, corporate clients, travel agencies, educational institutions, and students. Each group has distinct requirements and preferences, influencing their purchasing decisions and the types of luggage and travel gear they prefer. Individual travelers and students are increasingly seeking lightweight, ergonomic, and tech-integrated options, while corporate clients prioritize durability and professional aesthetics .

Australia Luggage & Travel Gear Market Competitive Landscape

The Australia Luggage & Travel Gear Market is characterized by a dynamic mix of regional and international players. Leading participants such as Samsonite Australia Pty Ltd., RIMOWA Australia Pty Ltd., July & Co Pty Ltd., The Australian Luggage Co., Antler Ltd., Crumpler Pty Ltd., Monte & Coe, Heys Australia PTY Ltd., Ella Maiden, Herschel Supply Co., Osprey Packs, Inc., The North Face, Inc., Thule Group AB, Delsey S.A., BRIC'S, Patagonia, Inc., Victorinox AG, Briggs & Riley Travelware, Eagle Creek, Inc., LVMH Moët Hennessy Louis Vuitton SE contribute to innovation, geographic expansion, and service delivery in this space.

Australia Luggage & Travel Gear Market Industry Analysis

Growth Drivers

- Increasing Travel and Tourism Activities:In future, Australia is projected to welcome approximately9.5 million international visitors, contributing significantly to the luggage and travel gear market. The tourism sector is expected to generateAUD 70 billion in revenue, driven by a resurgence in travel post-pandemic. This influx of tourists creates a heightened demand for luggage and travel accessories, as travelers seek quality products to enhance their travel experience, thereby boosting market growth.

- Rising Disposable Income:The average disposable income in Australia is forecasted to reachAUD 1,100 per week in future, reflecting a moderate increase from the previous year. This rise in disposable income allows consumers to allocate more funds towards travel-related purchases, including luggage and travel gear. As Australians prioritize travel experiences, the demand for high-quality, durable products is expected to grow, positively impacting the market.

- Growing E-commerce Sales:E-commerce sales in Australia are anticipated to exceedAUD 45 billion in future, with online retail accounting forabout 13% of total retail sales. This shift towards online shopping is particularly relevant for the luggage market, as consumers increasingly prefer the convenience of purchasing travel gear online. Enhanced digital marketing strategies and improved logistics will further facilitate this trend, driving sales growth in the luggage sector.

Market Challenges

- Intense Competition:The Australian luggage market is characterized by intense competition, withover 150 brands vying for market share. Major players like Samsonite and American Tourister dominate, but numerous smaller brands also compete aggressively. This saturation leads to price wars and reduced profit margins, making it challenging for new entrants to establish themselves and for existing companies to maintain profitability in a crowded marketplace.

- Fluctuating Raw Material Prices:The luggage manufacturing sector is heavily reliant on raw materials such as plastics and metals, which have seen price volatility due to global supply chain disruptions. In future, the cost of raw materials is expected to rise by4-8%, impacting production costs. Manufacturers may struggle to pass these costs onto consumers, potentially squeezing margins and affecting overall market stability.

Australia Luggage & Travel Gear Market Future Outlook

The future of the Australia luggage and travel gear market appears promising, driven by evolving consumer preferences and technological advancements. As travelers increasingly seek personalized and smart luggage solutions, brands that innovate and adapt to these trends will likely thrive. Additionally, the focus on sustainability will push manufacturers to develop eco-friendly products, aligning with consumer values. Overall, the market is poised for growth, supported by a robust tourism sector and rising disposable incomes.

Market Opportunities

- Expansion of Online Retail Channels:With e-commerce projected to grow, brands have the opportunity to enhance their online presence. By investing in digital marketing and user-friendly platforms, companies can reach a broader audience, increasing sales and brand loyalty. This shift allows for targeted promotions and personalized shopping experiences, catering to the evolving preferences of tech-savvy consumers.

- Development of Smart Luggage:The rise of technology in travel gear presents a significant opportunity for innovation. Smart luggage equipped with features like GPS tracking and built-in charging ports is gaining traction among tech-oriented travelers. Companies that invest in R&D to create advanced luggage solutions can capture a niche market, appealing to consumers looking for convenience and functionality in their travel gear.