Region:Asia

Author(s):Dev

Product Code:KRAD0490

Pages:97

Published On:August 2025

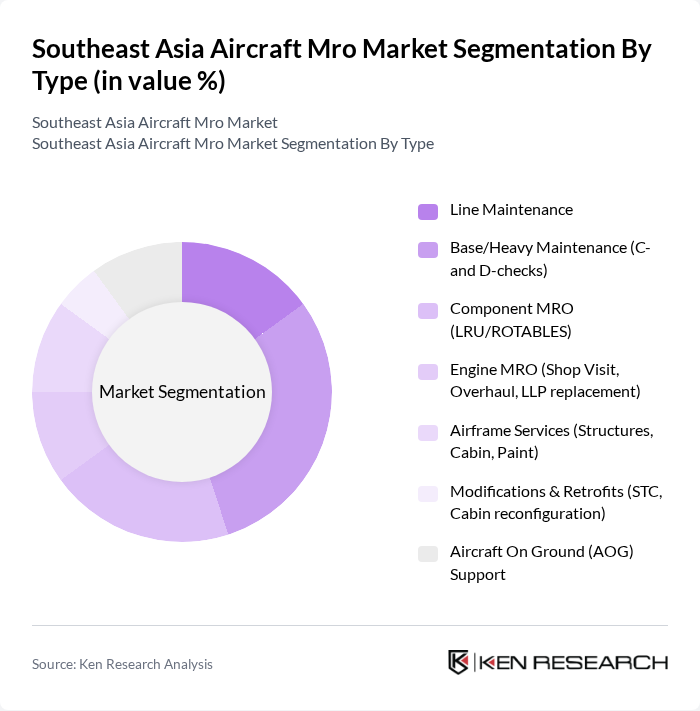

By Type:The market is segmented into various types of maintenance services, including Line Maintenance, Base/Heavy Maintenance, Component MRO, Engine MRO, Airframe Services, Modifications & Retrofits, and Aircraft On Ground (AOG) Support. Among these, Base/Heavy Maintenance is currently the leading sub-segment due to the increasing number of aircraft undergoing C- and D-checks as airlines expand their fleets and enhance operational reliability.

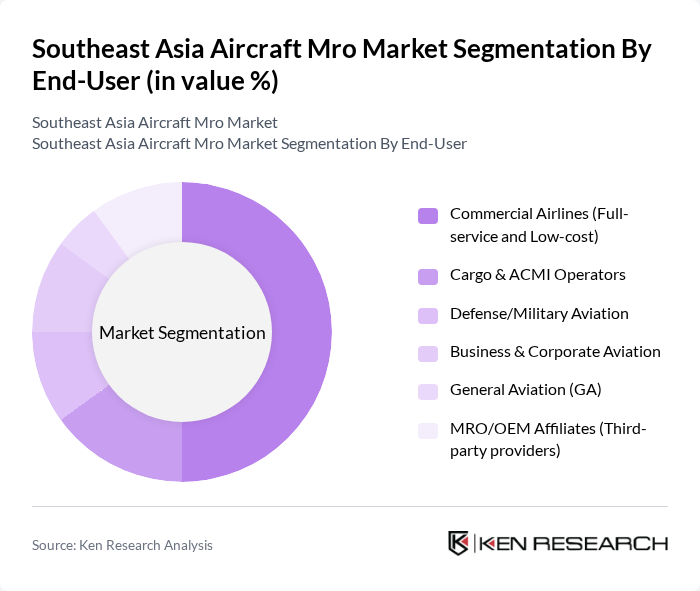

By End-User:The market is segmented by end-users, including Commercial Airlines, Cargo & ACMI Operators, Defense/Military Aviation, Business & Corporate Aviation, General Aviation, and MRO/OEM Affiliates. The Commercial Airlines segment is the dominant player, driven by the increasing number of passengers and the need for regular maintenance to ensure safety and compliance with aviation regulations.

The Southeast Asia Aircraft MRO market is characterized by a dynamic mix of regional and international players. Leading participants such as ST Engineering Aerospace (Singapore Technologies Engineering Ltd.), SIA Engineering Company (SIAEC), GMF AeroAsia (Garuda Maintenance Facility), Indonesia, Thai Airways Technical (Thai Airways International PCL), SR Technics Malaysia (Subang) / Asia Aerotechnic, Malaysia, Asia Digital Engineering (Capital A), Malaysia, Sepang Aircraft Engineering (Airbus Malaysia), Malaysia, Cebu Pacific – Aviation Partnership Philippines (Aplus) / SIAEP, Vietnam Airlines Engineering Company (VAECO), Vietjet Engineering (VJ Engineering Services), Lion Air Group – Batam Aero Technic (Indonesia), MAINCO (Philippine Airlines) – MacroAsia Corporation, Airbus Services Asia-Pacific (Singapore), Rolls-Royce Singapore (Seletar Campus – Trent engine services), Pratt & Whitney Eagle Services Asia (Singapore) contribute to innovation, geographic expansion, and service delivery in this space.

Additional notes: - Market size source triangulated against multiple industry trackers that place Southeast Asia MRO in the range of roughly USD 5–6 billion in recent years; Mordor Intelligence provides the most current point estimate. - CAAS regulatory materials and airworthiness notices reflect ongoing enhancements to maintenance organization requirements and safety systems relevant to MRO providers operating in Singapore.

The Southeast Asia Aircraft MRO market is poised for significant transformation, driven by technological advancements and evolving industry needs. As airlines increasingly adopt predictive maintenance strategies, MRO providers will need to invest in advanced analytics and AI-driven solutions to enhance operational efficiency. Additionally, the push for sustainability will drive the adoption of eco-friendly practices, reshaping service offerings. The integration of digital technologies will streamline processes, ensuring that the region remains competitive in the global MRO landscape while addressing emerging challenges effectively.

| Segment | Sub-Segments |

|---|---|

| By Type | Line Maintenance Base/Heavy Maintenance (C- and D-checks) Component MRO (LRU/ROTABLES) Engine MRO (Shop Visit, Overhaul, LLP replacement) Airframe Services (Structures, Cabin, Paint) Modifications & Retrofits (STC, Cabin reconfiguration) Aircraft On Ground (AOG) Support |

| By End-User | Commercial Airlines (Full-service and Low-cost) Cargo & ACMI Operators Defense/Military Aviation Business & Corporate Aviation General Aviation (GA) MRO/OEM Affiliates (Third-party providers) |

| By Region | Indonesia Malaysia Thailand Singapore Vietnam Philippines Others (Cambodia, Laos, Myanmar, Brunei, Timor-Leste) |

| By Service Type | Scheduled Maintenance Unscheduled/Corrective Maintenance Modifications, Upgrades & Retrofits |

| By Component | Airframe Avionics & Electrical Engines & APUs Landing Gear & Wheels/Brakes Interiors & Cabin Systems |

| By Sales Channel | Direct Contracts (Airline-MRO) Brokers/Agents Digital Platforms & e-Marketplaces |

| By Pricing Model | Fixed-Price (Not-to-Exceed) Time & Materials (T&M) Power-by-the-Hour/Cost-per-Flight-Hour Performance-Based/Outcome-Based |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Aircraft MRO Services | 120 | MRO Managers, Airline Operations Directors |

| Helicopter Maintenance Services | 80 | Helicopter Fleet Managers, Maintenance Supervisors |

| Regional Jet MRO Operations | 90 | Procurement Managers, Technical Directors |

| Component Repair and Overhaul | 70 | Quality Assurance Managers, Repair Shop Supervisors |

| Emerging Technologies in MRO | 60 | Innovation Managers, R&D Engineers |

The Southeast Asia Aircraft MRO market is valued at approximately USD 5.3 billion, driven by increasing air traffic, fleet recovery, and the expansion of low-cost carriers, alongside rising maintenance needs for operational efficiency and safety compliance.