Region:Middle East

Author(s):Shubham

Product Code:KRAC2116

Pages:90

Published On:October 2025

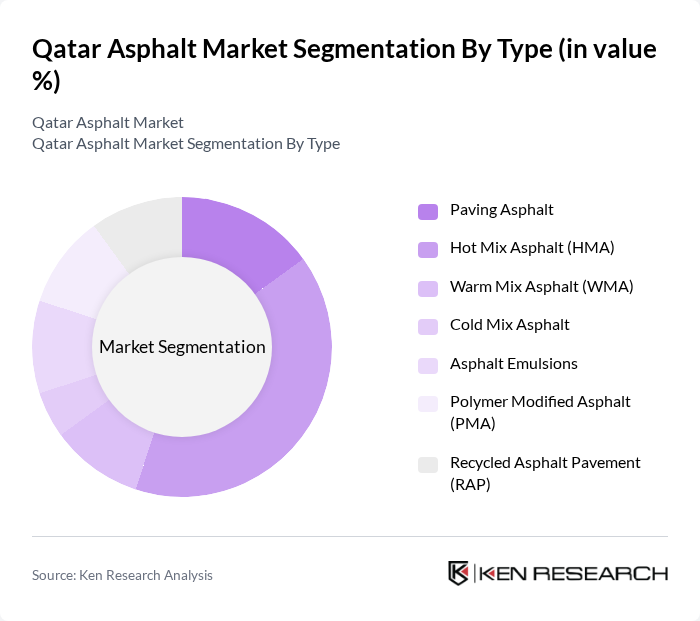

By Type:The asphalt market is segmented into various types, including Paving Asphalt, Hot Mix Asphalt (HMA), Warm Mix Asphalt (WMA), Cold Mix Asphalt, Asphalt Emulsions, Polymer Modified Asphalt (PMA), and Recycled Asphalt Pavement (RAP). Among these, Hot Mix Asphalt (HMA) is the leading sub-segment due to its superior performance in road construction and maintenance, making it the preferred choice for contractors and government projects. The demand for HMA is driven by its durability and ability to withstand heavy traffic loads, which is essential for Qatar's expanding road network.

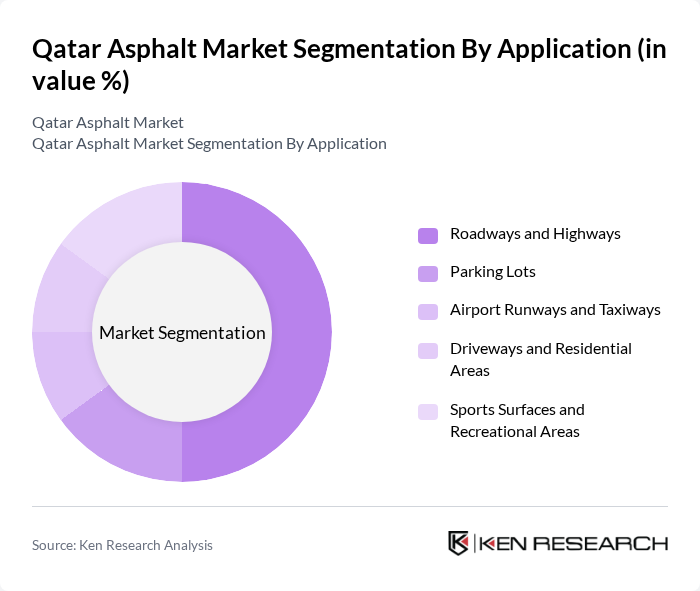

By Application:The asphalt market is also segmented by application, which includes Roadways and Highways, Parking Lots, Airport Runways and Taxiways, Driveways and Residential Areas, and Sports Surfaces and Recreational Areas. The Roadways and Highways application dominates the market due to the extensive road network development in Qatar, driven by urbanization and the need for improved transportation infrastructure. This segment is crucial for supporting the country's economic growth and facilitating trade and mobility.

The Qatar Asphalt Market is characterized by a dynamic mix of regional and international players. Leading participants such as Qatar Primary Materials Company (QPMC), Gulf Contracting Company W.L.L., Bin Omran Trading and Contracting, HBK Contracting Company W.L.L., Al Jaber Engineering, Nasser Bin Khaled and Sons Holding Company, Consolidated Contractors Company (CCC), Midmac Contracting Company W.L.L., Ashghal (Public Works Authority), Qatar Building Company (QBC), Al Darwish Engineering, UrbaCon Trading and Contracting, Boom General Contracting and Trading, Galfar Al Misnad Engineering & Contracting, Sixco Qatar W.L.L. contribute to innovation, geographic expansion, and service delivery in this space.

The Qatar asphalt market is poised for significant transformation driven by technological advancements and sustainability initiatives. As the government continues to invest in infrastructure, the adoption of recycled asphalt and warm mix technologies is expected to gain traction. Additionally, the integration of digital tools in supply chain management will enhance efficiency and reduce costs. These trends indicate a shift towards more sustainable practices, aligning with global environmental goals while meeting the growing demand for high-quality asphalt products in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Paving Asphalt Hot Mix Asphalt (HMA) Warm Mix Asphalt (WMA) Cold Mix Asphalt Asphalt Emulsions Polymer Modified Asphalt (PMA) Recycled Asphalt Pavement (RAP) |

| By Application | Roadways and Highways Parking Lots Airport Runways and Taxiways Driveways and Residential Areas Sports Surfaces and Recreational Areas |

| By End-User | Government and Public Works Commercial Construction Industrial Projects Residential Development |

| By Distribution Channel | Direct Sales to Contractors Through Asphalt Mixing Plants Distributors and Suppliers |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value-Based Pricing |

| By Geographic Region | Doha Al Rayyan Al Wakrah Others |

| By Policy Support | Subsidies Tax Exemptions Grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Road Construction Projects | 100 | Project Managers, Civil Engineers |

| Asphalt Manufacturing Sector | 60 | Production Managers, Quality Control Officers |

| Infrastructure Development Authorities | 50 | Government Officials, Urban Planners |

| Roofing and Paving Contractors | 50 | Contractors, Business Owners |

| Environmental Impact Assessors | 40 | Environmental Consultants, Sustainability Managers |

The Qatar Asphalt Market is valued at approximately USD 1.2 billion, driven by significant infrastructure development, including roads and highways, supported by government investments and urbanization trends.