Region:Middle East

Author(s):Dev

Product Code:KRAA2211

Pages:93

Published On:August 2025

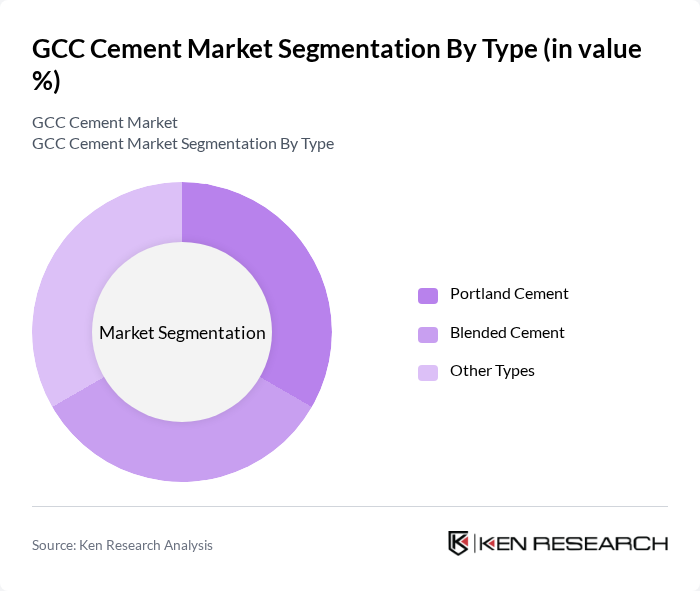

By Type:

The cement market is segmented into Portland Cement, Blended Cement, and Other Types. Among these, Portland Cement is the leading sub-segment, primarily due to its widespread use in various construction applications. Its versatility and strength make it the preferred choice for residential and commercial projects. Blended Cement is gaining traction as well, driven by the increasing demand for sustainable construction materials. Other types, while important, hold a smaller market share compared to the dominant Portland Cement .

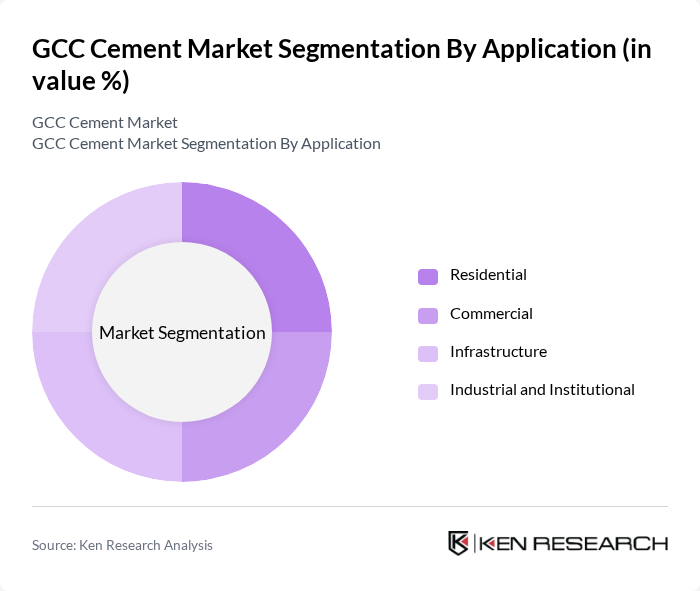

By Application:

The market is categorized into Residential, Commercial, Infrastructure, and Industrial and Institutional applications. The Infrastructure segment is the largest, driven by significant government investments in roads, bridges, and public facilities. Residential construction is also a major contributor, fueled by population growth and urbanization. Commercial applications are expanding due to increasing retail and office space demands, while Industrial and Institutional applications are growing steadily, supported by ongoing industrial projects .

The GCC Cement Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Cement Company, Southern Province Cement Company, Yanbu Cement Company, Arabian Cement Company, Najran Cement Company, Eastern Province Cement Company, Al Jouf Cement Company, Qassim Cement Company, Qatar National Cement Company, Oman Cement Company, Raysut Cement Company, Kuwait Cement Company, Union Cement Company, National Cement Company (UAE), Lafarge Emirates Cement contribute to innovation, geographic expansion, and service delivery in this space.

The GCC cement market is poised for transformative growth driven by technological advancements and sustainability initiatives. As digital transformation reshapes production processes, companies are expected to adopt smart manufacturing techniques, enhancing efficiency and reducing costs. Additionally, the increasing emphasis on eco-friendly building materials will likely lead to a surge in demand for sustainable cement products. These trends indicate a dynamic market landscape, where innovation and environmental responsibility will play crucial roles in shaping future developments.

| Segment | Sub-Segments |

|---|---|

| By Type | Portland Cement Blended Cement Other Types |

| By Application | Residential Commercial Infrastructure Industrial and Institutional |

| By Geography | Saudi Arabia United Arab Emirates Qatar Oman Kuwait Bahrain |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cement Production Insights | 60 | Plant Managers, Production Supervisors |

| Construction Sector Demand | 100 | Project Managers, Architects |

| Distribution and Logistics | 50 | Logistics Coordinators, Supply Chain Managers |

| Regulatory Compliance and Standards | 40 | Compliance Officers, Quality Assurance Managers |

| Market Trends and Innovations | 45 | R&D Managers, Product Development Leads |

The GCC Cement Market is valued at approximately USD 8.5 billion, driven by rapid urbanization, infrastructure development, and government initiatives aimed at enhancing construction activities across the region.