Qatar Baby Food and Infant Nutrition Market Overview

- The Qatar Baby Food and Infant Nutrition Market is valued at USD 150 million, based on a five-year historical analysis. This growth is primarily driven by increasing awareness among parents regarding the nutritional needs of infants, coupled with a rise in disposable income and urbanization. The demand for high-quality baby food products has surged as parents seek convenient and healthy options for their children.

- Doha is the dominant city in the Qatar Baby Food and Infant Nutrition Market, primarily due to its high population density and concentration of expatriates. The city’s affluent demographic and growing number of working parents contribute to the demand for baby food products. Additionally, the presence of major retail chains and supermarkets in Doha facilitates easy access to a variety of baby food options.

- In 2023, the Qatari government implemented regulations mandating stricter quality control measures for baby food products. This regulation requires manufacturers to adhere to specific nutritional standards and labeling requirements, ensuring that all baby food products are safe and nutritious for infants. The initiative aims to enhance consumer confidence and promote healthier eating habits among infants.

Qatar Baby Food and Infant Nutrition Market Segmentation

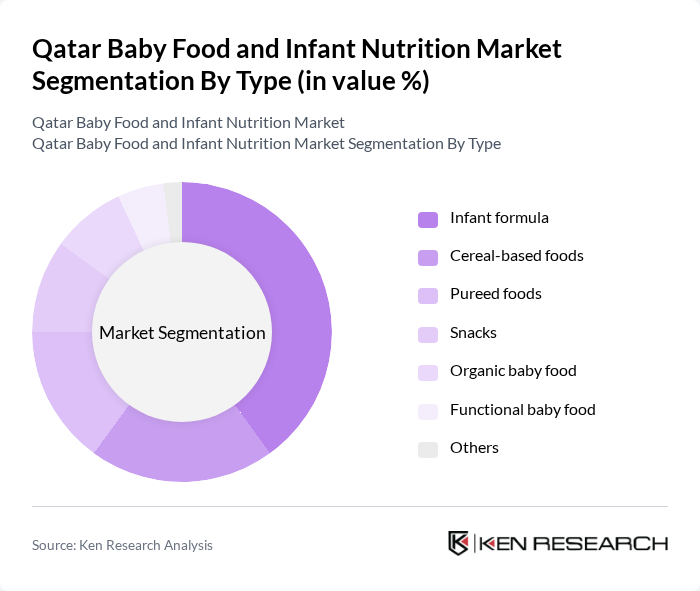

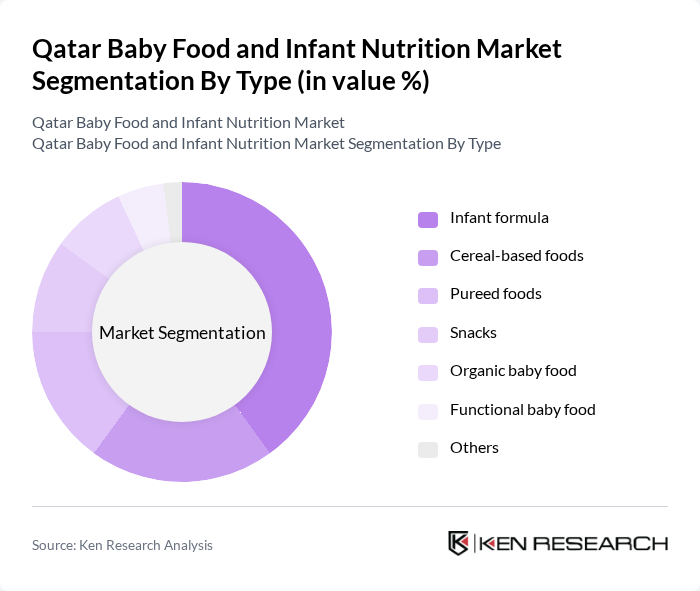

By Type:The market is segmented into various types of baby food products, including infant formula, cereal-based foods, pureed foods, snacks, organic baby food, functional baby food, and others. Among these, infant formula is the leading sub-segment due to its essential role in infant nutrition, especially for working parents who prefer convenient feeding options. The increasing trend towards organic and functional baby foods is also notable, as parents are becoming more health-conscious and seeking products that offer additional nutritional benefits.

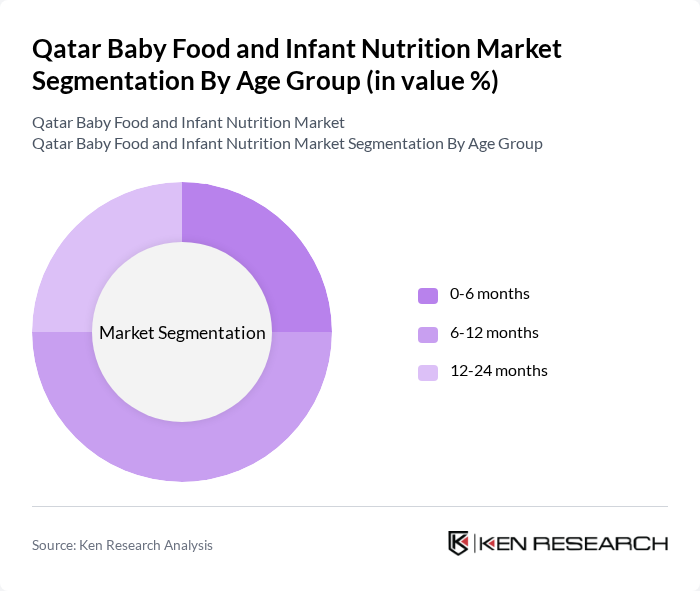

By Age Group:The market is categorized by age groups, including 0-6 months, 6-12 months, and 12-24 months. The 6-12 months age group dominates the market, as this is a critical period for introducing solid foods to infants. Parents are increasingly looking for nutritious and easy-to-digest options for their babies during this stage, leading to a higher demand for products tailored to this age group. The trend towards organic and fortified foods is also prominent among parents of infants in this age range.

Qatar Baby Food and Infant Nutrition Market Competitive Landscape

The Qatar Baby Food and Infant Nutrition Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nestlé S.A., Danone S.A., Abbott Laboratories, Mead Johnson Nutrition Company, Hero Group, Hain Celestial Group, Inc., FrieslandCampina, Perrigo Company plc, Bledina (part of Danone), Bellamy's Organic, Earth’s Best (part of Hain Celestial), Plum Organics (part of Campbell Soup Company), Sprout Organic Foods, Little Spoon, Baby Gourmet Foods Inc. contribute to innovation, geographic expansion, and service delivery in this space.

Qatar Baby Food and Infant Nutrition Market Industry Analysis

Growth Drivers

- Increasing Awareness of Infant Nutrition:The growing awareness of the importance of infant nutrition is a significant driver in Qatar. According to the Qatar National Health Strategy 2018-2022, 70% of parents are now more informed about nutritional needs. This shift is supported by educational campaigns from health authorities, leading to a 15% increase in demand for fortified baby food products. As parents prioritize nutrition, the market for high-quality infant nutrition is expected to expand significantly.

- Rising Disposable Incomes:Qatar's GDP per capita is projected to reach $66,000 in the future, reflecting a 10% increase from previous figures. This rise in disposable income allows families to invest more in premium baby food products. As a result, the demand for organic and specialized infant nutrition products is expected to grow, with a notable increase in sales of high-end brands. This economic trend supports the overall growth of the baby food market in Qatar.

- Growth in Working Mothers:The percentage of working mothers in Qatar has increased to 48% in the future, up from 40% in previous years. This demographic shift has led to a higher demand for convenient and nutritious baby food options. As working mothers seek quick and healthy meal solutions for their infants, the market for ready-to-eat and easy-to-prepare baby food products is expanding. This trend is driving innovation and product development in the sector.

Market Challenges

- Stringent Regulatory Requirements:The baby food industry in Qatar faces stringent regulatory requirements, including compliance with the Qatar Food Safety Law. Companies must adhere to rigorous food safety standards, which can increase operational costs. In the future, the government is expected to enforce stricter labeling regulations, requiring detailed nutritional information. This regulatory landscape poses challenges for new entrants and existing brands, impacting their market strategies and profitability.

- High Competition Among Brands:The Qatar baby food market is characterized by intense competition, with over 35 brands vying for market share. Major players like Nestlé and Danone dominate, making it difficult for smaller brands to establish a foothold. In the future, the competitive landscape is expected to intensify, with brands investing heavily in marketing and product differentiation. This competition can lead to price wars, affecting profit margins across the industry.

Qatar Baby Food and Infant Nutrition Market Future Outlook

The future of the Qatar baby food and infant nutrition market appears promising, driven by evolving consumer preferences and economic growth. As parents increasingly prioritize health and nutrition, the demand for organic and specialized products is expected to rise. Additionally, the expansion of e-commerce platforms will facilitate greater access to a variety of baby food options, enhancing consumer convenience. These trends indicate a dynamic market landscape that will continue to evolve in response to consumer needs and preferences.

Market Opportunities

- Introduction of Organic Baby Food Products:The demand for organic baby food is on the rise, with sales projected to increase by 25% in the future. Parents are increasingly seeking healthier options free from artificial additives. This trend presents a significant opportunity for brands to innovate and introduce organic lines, catering to health-conscious consumers and enhancing brand loyalty.

- Expansion into E-commerce Platforms:E-commerce sales of baby food products are expected to grow by 35% in the future, driven by increased online shopping trends. Brands can leverage this opportunity by establishing a strong online presence and utilizing digital marketing strategies. This expansion into e-commerce will not only enhance accessibility but also allow brands to reach a broader audience, driving sales growth.