Region:Central and South America

Author(s):Rebecca

Product Code:KRAB6392

Pages:95

Published On:October 2025

By Type:The market is segmented into various types of baby food products, including cereal-based, fruit-based, vegetable-based, meat-based, dairy-based, organic, and others. Each type caters to different nutritional needs and consumer preferences, reflecting the diverse dietary requirements of infants.

The cereal-based segment is currently dominating the market due to its high nutritional value and ease of preparation. Parents often prefer cereal-based products as they are rich in essential vitamins and minerals, making them a staple in infant diets. The convenience of these products, combined with their affordability, has led to increased consumer preference, driving significant sales in this category.

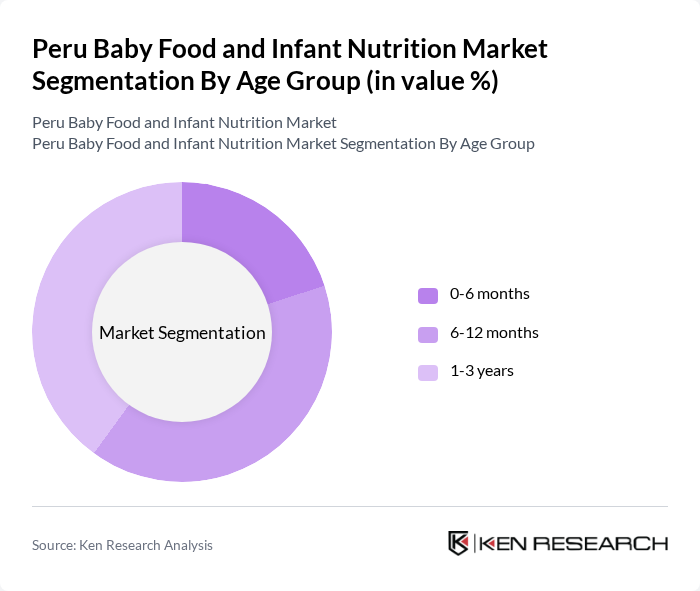

By Age Group:The market is segmented by age group into three categories: 0-6 months, 6-12 months, and 1-3 years. Each age group has specific nutritional needs that influence the types of products offered and the marketing strategies employed by manufacturers.

The 6-12 months age group is leading the market, as this is a critical period for introducing solid foods to infants. Parents are increasingly seeking nutritious and convenient options for their babies during this stage, leading to a surge in demand for products tailored to this age group. The focus on developmental milestones and nutritional adequacy drives purchasing decisions, making this segment particularly lucrative.

The Peru Baby Food and Infant Nutrition Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nestlé S.A., Danone S.A., Abbott Laboratories, Mead Johnson Nutrition Company, Hero Group, Hain Celestial Group, Beech-Nut Nutrition Company, Plum Organics, Earth's Best, Gerber Products Company, Nutricia, Bledina, Friso, Baby Gourmet Foods, Little Spoon contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Peru baby food and infant nutrition market appears promising, driven by evolving consumer preferences and economic growth. As disposable incomes rise, families are increasingly seeking high-quality, nutritious options for their infants. Additionally, the trend towards organic and fortified products is expected to gain momentum, reflecting a broader shift towards health-conscious consumption. E-commerce platforms will likely play a crucial role in expanding market reach, providing convenient access to a diverse range of baby food products for consumers across the country.

| Segment | Sub-Segments |

|---|---|

| By Type | Cereal-based Fruit-based Vegetable-based Meat-based Dairy-based Organic Others |

| By Age Group | 6 months 12 months 3 years |

| By Packaging Type | Jars Pouches Tins Boxes |

| By Distribution Channel | Supermarkets/Hypermarkets Online Retail Convenience Stores Pharmacies |

| By Brand Type | National Brands Private Labels |

| By Nutritional Content | High Protein Low Sugar Fortified |

| By Price Range | Premium Mid-range Economy |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Professionals | 100 | Pediatricians, Nutritionists, Child Health Specialists |

| Parents and Caregivers | 150 | New Parents, Expecting Parents, Caregivers of Infants |

| Retailers and Distributors | 80 | Store Managers, Supply Chain Coordinators, Product Buyers |

| Market Analysts | 50 | Industry Analysts, Market Researchers, Economic Advisors |

| NGO Representatives | 30 | Child Nutrition Advocates, Health Program Coordinators |

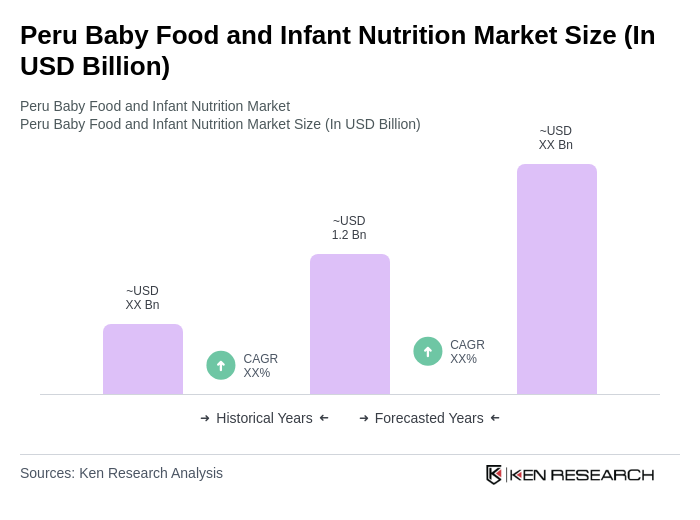

The Peru Baby Food and Infant Nutrition Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by urbanization, rising disposable incomes, and increased awareness of infant nutrition among parents.