Region:Middle East

Author(s):Rebecca

Product Code:KRAC3332

Pages:88

Published On:October 2025

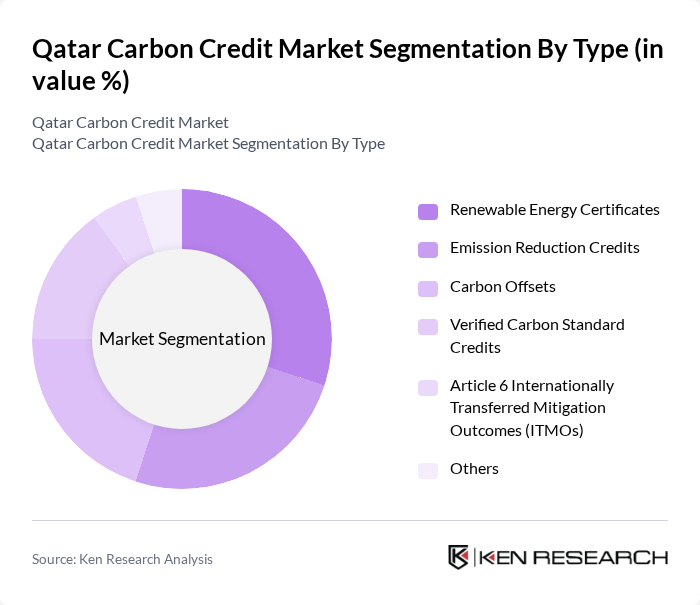

By Type:The market is segmented into various types of carbon credits, including Renewable Energy Certificates, Emission Reduction Credits, Carbon Offsets, Verified Carbon Standard Credits, Article 6 Internationally Transferred Mitigation Outcomes (ITMOs), and others. Each type serves a unique purpose in the carbon trading ecosystem, catering to different regulatory requirements and market demands. The compliance segment dominates due to mandatory emission reduction targets, while voluntary credits are increasingly adopted for corporate ESG strategies.

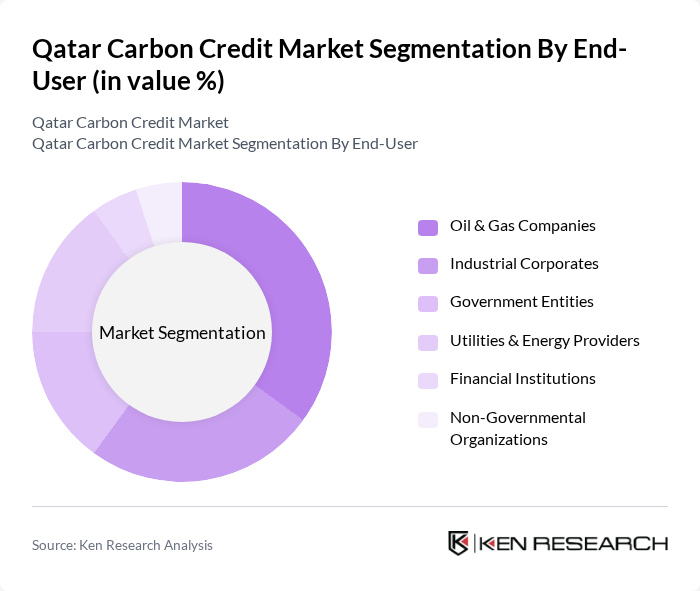

By End-User:The end-user segmentation includes Oil & Gas Companies, Industrial Corporates, Government Entities, Utilities & Energy Providers, Financial Institutions, and Non-Governmental Organizations. Each of these sectors plays a crucial role in the demand for carbon credits, driven by their respective sustainability goals and regulatory obligations. Oil & gas and industrial corporates are the largest buyers, reflecting sectoral emissions profiles and compliance requirements.

The Qatar Carbon Credit Market is characterized by a dynamic mix of regional and international players. Leading participants such as QatarEnergy, Qatar National Bank, Qatar Electricity and Water Company (QEWC), Qatar Investment Authority, Global Carbon Council (GCC), Qatar Environment and Energy Research Institute (QEERI), Qatar Green Building Council, Qatar Free Zones Authority, Qatar Science and Technology Park, Qatar Airways, Masdar (Abu Dhabi Future Energy Company), Regional Voluntary Carbon Market Company (RVCMC), Bee’ah Group, ACWA Power, Oman Oil Company (OQ) contribute to innovation, geographic expansion, and service delivery in this space.

The Qatar Carbon Credit Market is expected to evolve significantly in the coming years, driven by increasing corporate commitments to sustainability and government regulations aimed at emission reductions. As awareness grows, more companies are likely to engage in carbon trading, fostering a more robust market. Additionally, technological advancements in carbon capture and storage will enhance project viability, while international collaborations may open new avenues for carbon credit trading, positioning Qatar as a regional leader in sustainability efforts.

| Segment | Sub-Segments |

|---|---|

| By Type | Renewable Energy Certificates Emission Reduction Credits Carbon Offsets Verified Carbon Standard Credits Article 6 Internationally Transferred Mitigation Outcomes (ITMOs) Others |

| By End-User | Oil & Gas Companies Industrial Corporates Government Entities Utilities & Energy Providers Financial Institutions Non-Governmental Organizations |

| By Application | Industrial Emissions LNG and Gas Processing Power Generation Transportation Sector Agriculture and Land Use Waste Management |

| By Investment Source | Private Investments Public Funding International Grants Sovereign Green Bonds Corporate Sponsorships |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Frameworks International Agreements (e.g., Paris Agreement, CORSIA) |

| By Market Channel | Direct Sales Online Platforms Auctions (e.g., Article 6 Carbon Credit Auctions) Bilateral Agreements |

| By Certification Standard | ISO Standards Verified Carbon Standard (VCS) Gold Standard Global Carbon Council Standard Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Government Policy Makers | 50 | Environmental Policy Analysts, Regulatory Affairs Managers |

| Corporate Sustainability Officers | 60 | Sustainability Managers, Corporate Social Responsibility Heads |

| Carbon Credit Traders | 40 | Traders, Financial Analysts in Carbon Markets |

| Renewable Energy Project Developers | 45 | Project Managers, Business Development Executives |

| Environmental NGOs | 40 | Research Analysts, Advocacy Coordinators |

The Qatar Carbon Credit Market is valued at approximately USD 220 million, reflecting a significant growth driven by sustainability initiatives, renewable energy projects, and the need for companies to offset carbon emissions in compliance with international climate agreements.