Region:Middle East

Author(s):Rebecca

Product Code:KRAC8417

Pages:93

Published On:November 2025

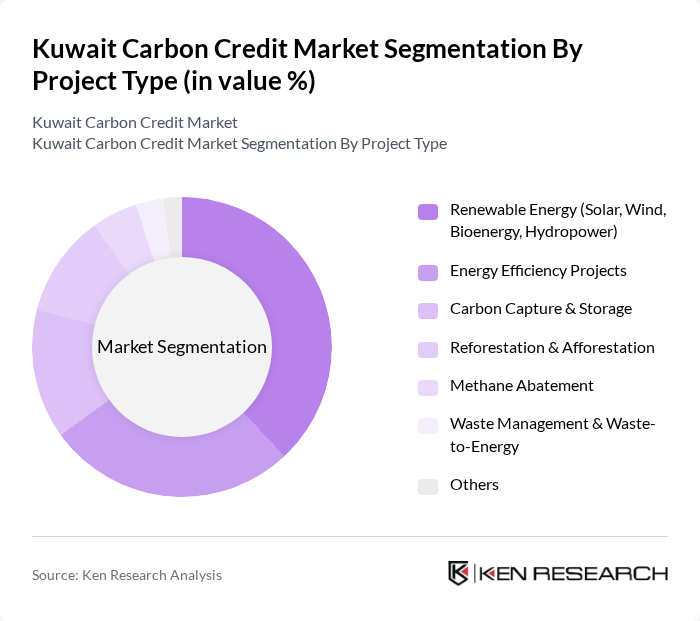

By Project Type:The market is segmented into project types that generate carbon credits, including renewable energy (solar, wind, bioenergy, hydropower), energy efficiency, carbon capture and storage, reforestation and afforestation, methane abatement, waste management and waste-to-energy, and other innovative solutions. Each project type contributes to emissions reductions and supports Kuwait’s sustainability agenda .

The Renewable Energy segment, especially solar and wind, leads the market due to Kuwait’s abundant solar resources and government incentives for clean energy. Recent trends show increased investment in large-scale solar projects and energy efficiency retrofits in commercial and industrial facilities. Energy efficiency initiatives are also gaining momentum as businesses seek to lower operational costs and comply with emissions reduction targets .

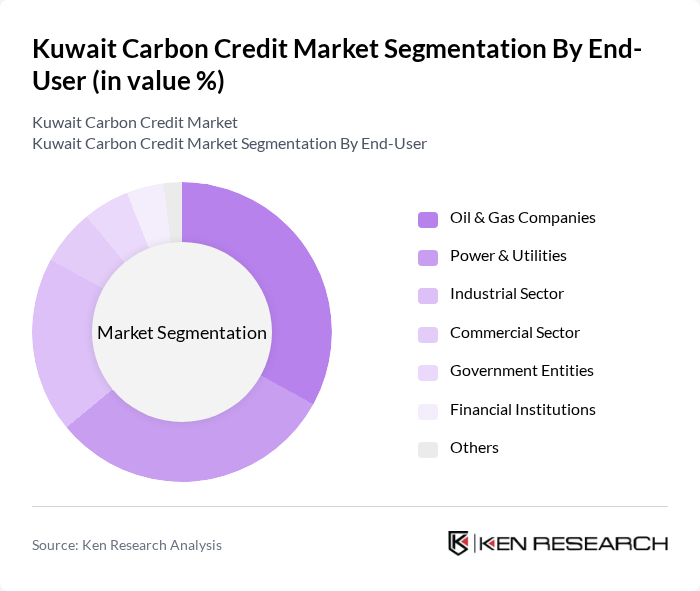

By End-User:The market is segmented by end-users: oil and gas companies, power and utilities, industrial sectors, commercial entities, government bodies, financial institutions, and others. Each segment has distinct motivations for carbon credit participation, such as regulatory compliance, corporate sustainability, and investment diversification .

The Oil & Gas sector remains the largest end-user, reflecting Kuwait’s economic structure and the sector’s need to offset significant emissions. Power and utilities are also prominent, driven by the transition to cleaner energy sources and the integration of renewables into the national grid. Industrial and commercial sectors are increasingly adopting carbon credit strategies to align with global sustainability standards and investor expectations .

The Kuwait Carbon Credit Market is characterized by a dynamic mix of regional and international players. Leading participants such as Kuwait Petroleum Corporation (KPC), Kuwait Oil Company (KOC), Kuwait National Petroleum Company (KNPC), Equate Petrochemical Company, Kuwait Institute for Scientific Research (KISR), South Pole Carbon Asset Management Ltd., Verra, Gold Standard Foundation, Global Carbon Council, AirCarbon Exchange (ACX), First Climate (ENGIE), EcoAct (Atos), ALLCOT AG, EKI Energy Services Ltd., CBL Markets (Xpansiv) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait carbon credit market appears promising, driven by increasing environmental awareness and government support for sustainability initiatives. As more businesses adopt corporate sustainability goals, the demand for carbon credits is expected to rise. Additionally, the establishment of clear regulations and the expansion of carbon trading platforms will likely enhance market participation. With ongoing investments in renewable energy and technological innovations, Kuwait is poised to become a significant player in the regional carbon credit landscape, fostering a more sustainable economy.

| Segment | Sub-Segments |

|---|---|

| By Project Type (Renewable Energy, Energy Efficiency, Carbon Capture & Storage, Reforestation, Methane Abatement, Waste Management) | Renewable Energy (Solar, Wind, Bioenergy, Hydropower) Energy Efficiency Projects Carbon Capture & Storage Reforestation & Afforestation Methane Abatement Waste Management & Waste-to-Energy Others |

| By End-User (Oil & Gas, Power & Utilities, Industrial, Commercial, Government, Financial Institutions) | Oil & Gas Companies Power & Utilities Industrial Sector Commercial Sector Government Entities Financial Institutions Others |

| By Investment Source (Domestic, Foreign Direct Investment, Public-Private Partnerships, Government Schemes) | Domestic Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes Others |

| By Application (Compliance Market, Voluntary Market, Internationally Transferred Mitigation Outcomes (ITMOs)) | Compliance Market Voluntary Market ITMOs (Article 6.2/6.4) Others |

| By Policy Support (Subsidies, Tax Exemptions, Renewable Energy Certificates (RECs), Carbon Pricing Mechanisms) | Subsidies Tax Exemptions Renewable Energy Certificates (RECs) Carbon Pricing Mechanisms Others |

| By Carbon Credit Standard (Verified Carbon Standard, Gold Standard, Global Carbon Council, Others) | Verified Carbon Standard (VCS) Gold Standard Global Carbon Council Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Government Policy Makers | 45 | Environmental Policy Analysts, Regulatory Officials |

| Corporate Sustainability Managers | 60 | Sustainability Officers, CSR Managers |

| Carbon Offset Project Developers | 40 | Project Managers, Environmental Consultants |

| Academic Experts in Environmental Economics | 25 | Professors, Researchers in Climate Policy |

| NGO Representatives Focused on Climate Action | 20 | Program Directors, Advocacy Coordinators |

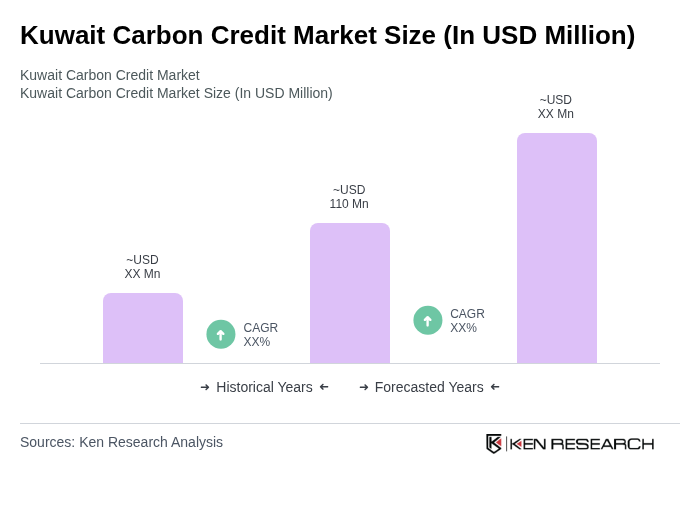

The Kuwait Carbon Credit Market is currently valued at approximately USD 110 million, reflecting a five-year historical analysis. This valuation is driven by Kuwait's commitment to sustainability and participation in international agreements like the Paris Agreement.