Region:Middle East

Author(s):Shubham

Product Code:KRAC4950

Pages:95

Published On:October 2025

Market.png)

By Product Type:

The product type segmentation of the Qatar CPG market includes various categories such as Food, Beverage, and Tobacco Products; Personal Care and Household Care Products; Apparel, Footwear, and Accessories; Furniture, Toys, and Hobby Products; Electronic and Household Appliances; and Other Consumer Packaged Goods. Among these, Food, Beverage, and Tobacco Products dominate the market due to the essential nature of food items and the growing trend of convenience foods. The increasing health consciousness among consumers has also led to a rise in demand for organic and healthy food options, further solidifying this subsegment's leadership.

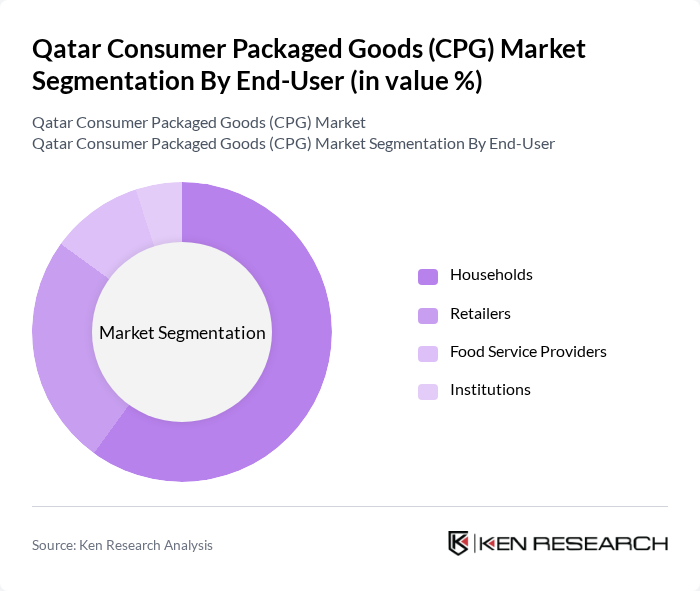

By End-User:

The end-user segmentation of the Qatar CPG market includes Households, Retailers, Food Service Providers, and Institutions. Households represent the largest segment, driven by the increasing population and the growing trend of home cooking and dining. The rise in disposable income has led to higher spending on consumer goods, particularly in food and personal care categories. Retailers also play a significant role, as they are the primary distribution channel for CPG products, catering to the diverse needs of consumers.

The Qatar Consumer Packaged Goods (CPG) Market is characterized by a dynamic mix of regional and international players. Leading participants such as Qatar National Food Company (QNF), Al Meera Consumer Goods Company, Qatar Distribution Company, Baladna Food Industries, Widam Food Company, Al Watania International Holdings, Al Wajba Dairy, Nestlé Qatar, Unilever Qatar, Procter & Gamble Qatar, PepsiCo Qatar, Coca-Cola Qatar, Mondelez International Qatar, Al-Futtaim Group, Al-Ahli Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Qatar CPG market appears promising, driven by urbanization and rising disposable incomes. As consumers increasingly prioritize health and sustainability, companies will need to adapt their product offerings to meet these evolving preferences. The integration of technology in retail, particularly through e-commerce, will further enhance market accessibility. Additionally, the government's focus on diversifying the economy will likely create new opportunities for CPG brands to innovate and expand their reach in underserved segments.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Food, Beverage, and Tobacco Products Personal Care and Household Care Products Apparel, Footwear, and Accessories Furniture, Toys, and Hobby Products Electronic and Household Appliances Other Consumer Packaged Goods |

| By End-User | Households Retailers Food Service Providers Institutions |

| By Sales Channel | Supermarkets and Hypermarkets Convenience Stores Online Retail Specialty Stores Department Stores Others (Drugstores, Cash and Carry, Wholesalers) |

| By Distribution Mode | Direct Distribution Indirect Distribution |

| By Price Range | Economy Mid-Range Premium Luxury |

| By Packaging Type | Plastic Packaging Glass Packaging Metal Packaging Paper & Cardboard Packaging Resealable Bags Pouches Cans |

| By Brand Ownership | National Brands Private Labels International Brands |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food and Beverage Sector | 120 | Brand Managers, Product Development Leads |

| Personal Care Products | 90 | Marketing Executives, Retail Buyers |

| Household Goods | 60 | Category Managers, Supply Chain Analysts |

| Health and Wellness Products | 50 | Consumer Insights Managers, Sales Directors |

| Online Retail Trends | 70 | E-commerce Managers, Digital Marketing Specialists |

The Qatar Consumer Packaged Goods (CPG) Market is valued at approximately USD 5.3 billion, reflecting a robust growth trajectory driven by urbanization, rising disposable incomes, and an expanding expatriate population.