Region:Middle East

Author(s):Dev

Product Code:KRAA1524

Pages:85

Published On:August 2025

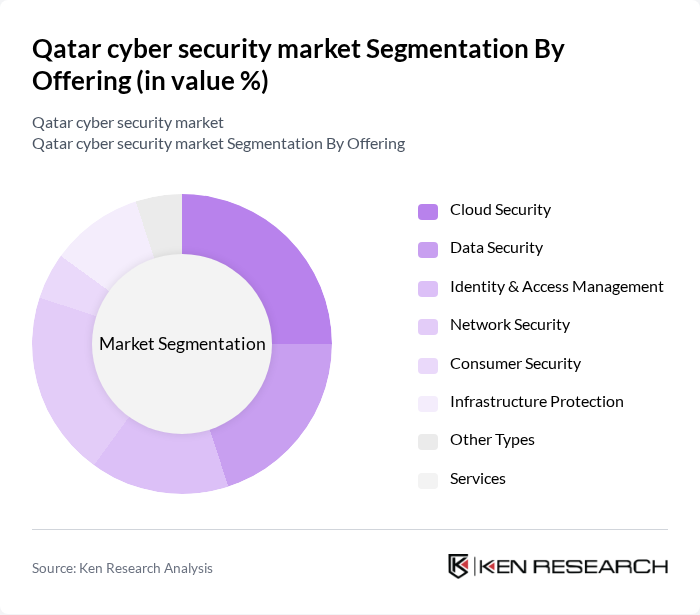

By Offering:The market is segmented into various offerings, including security types and services. The security types encompass cloud security, data security, identity & access management, network security, consumer security, infrastructure protection, and other types. The services segment includes consulting, implementation, and managed services. Cloud security and infrastructure protection are among the fastest-growing segments, reflecting increased adoption of cloud technologies and heightened focus on critical infrastructure defense .

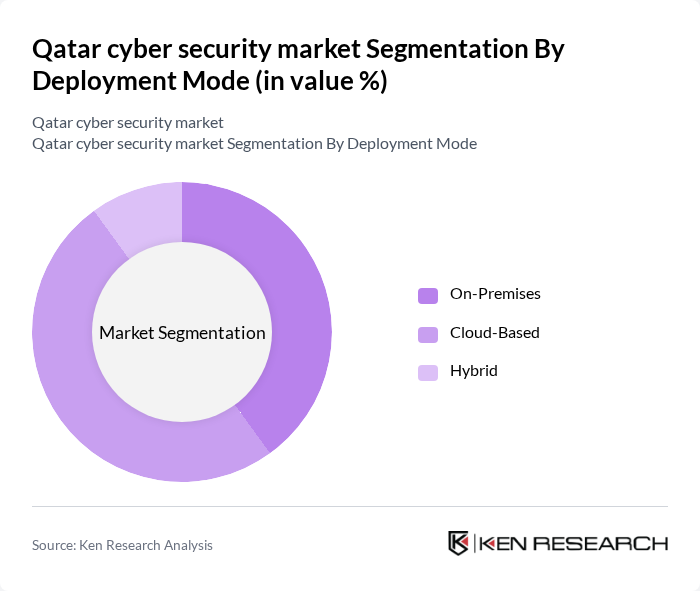

By Deployment Mode:The deployment mode segment includes on-premises, cloud-based, and hybrid solutions. Organizations are increasingly adopting cloud-based solutions due to their scalability and cost-effectiveness, while on-premises solutions remain popular among enterprises with stringent data security requirements. The cloud-based segment holds the largest share, driven by rapid digitalization and the shift to remote work environments .

The Qatar cyber security market is characterized by a dynamic mix of regional and international players. Leading participants such as Malomatia, Ooredoo, Vodafone Qatar, Q-CERT (Qatar Computer Emergency Response Team), Qatar National Bank (QNB), Gulf Business Machines (GBM Qatar), Cisco Systems Qatar, IBM Qatar, Palo Alto Networks, Fortinet, Check Point Software Technologies, McAfee, Trend Micro, Trellix, and Kaspersky Lab contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Qatar cyber security market appears promising, driven by ongoing government support and increasing awareness of cyber threats. As organizations continue to digitize operations, the demand for innovative cybersecurity solutions will rise. The integration of artificial intelligence and machine learning into security protocols is expected to enhance threat detection and response capabilities. Additionally, the focus on regulatory compliance will further propel investments in cybersecurity, ensuring a robust defense against evolving cyber threats.

| Segment | Sub-Segments |

|---|---|

| By Offering | Security Type Cloud Security Data Security Identity & Access Management Network Security Consumer Security Infrastructure Protection Other Types Services |

| By Deployment Mode | On-Premises Cloud-Based Hybrid |

| By End-User | BFSI Healthcare Manufacturing Government and Defense IT and Telecommunication Other End Users |

| By Industry Vertical | BFSI Government Healthcare Retail IT and Telecom Energy and Utilities Others |

| By Region | Doha Al Rayyan Umm Salal Al Wakrah Others |

| By Pricing Model | Subscription-Based Pay-Per-Use One-Time License Fee |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Financial Sector Cybersecurity | 100 | IT Security Managers, Risk Assessment Officers |

| Healthcare Cybersecurity Solutions | 60 | Chief Information Officers, Compliance Officers |

| Telecommunications Security Measures | 50 | Network Security Engineers, Operations Managers |

| Government Cybersecurity Initiatives | 40 | Policy Makers, Cybersecurity Analysts |

| SME Cybersecurity Awareness | 70 | Business Owners, IT Administrators |

The Qatar cyber security market is valued at approximately USD 650 million, driven by increasing digital transformation initiatives and rising cyber threats across various sectors, including banking, healthcare, and government.