Region:Middle East

Author(s):Dev

Product Code:KRAD7697

Pages:85

Published On:December 2025

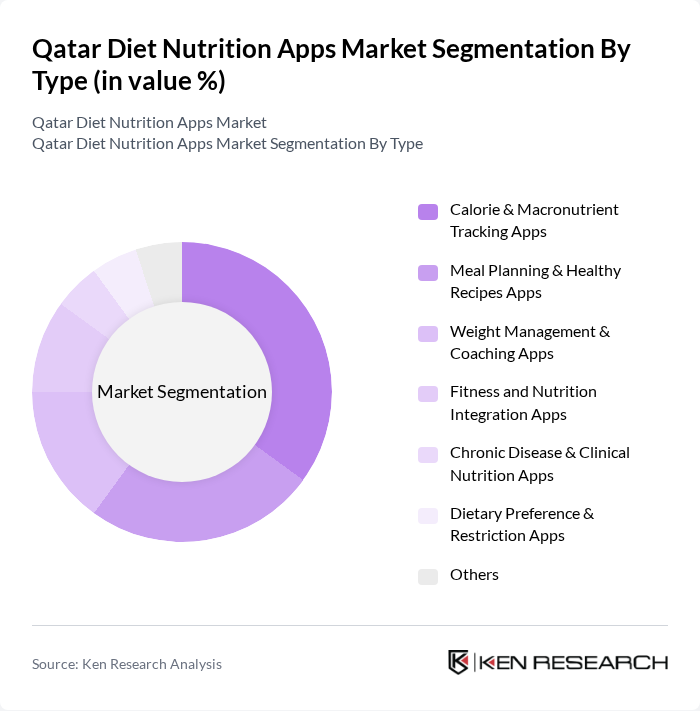

By Type:The market is segmented into various types of diet nutrition apps, including Calorie & Macronutrient Tracking Apps, Meal Planning & Healthy Recipes Apps, Weight Management & Coaching Apps, Fitness and Nutrition Integration Apps, Chronic Disease & Clinical Nutrition Apps, Dietary Preference & Restriction Apps, and Others. Among these, Calorie & Macronutrient Tracking Apps are leading the market due to their popularity among health-conscious individuals who seek to monitor their dietary intake closely. The increasing trend of personalized nutrition and fitness tracking has further propelled the demand for these apps.

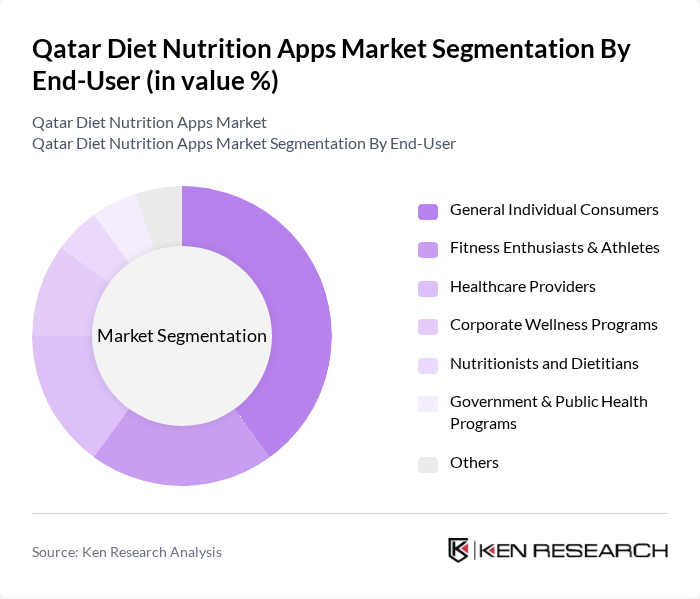

By End-User:The end-user segmentation includes General Individual Consumers, Fitness Enthusiasts & Athletes, Healthcare Providers, Corporate Wellness Programs, Nutritionists and Dietitians, Government & Public Health Programs, and Others. The General Individual Consumers segment dominates the market as a large portion of the population seeks to improve their health and wellness through diet management. The increasing awareness of nutrition's role in health has led to a surge in app downloads among this demographic.

The Qatar Diet Nutrition Apps Market is characterized by a dynamic mix of regional and international players. Leading participants such as MyFitnessPal, Noom, Lose It!, Cronometer, Yummly, Lifesum, FatSecret, HealthifyMe, MyNetDiary, PlateJoy, Qatar Calorie Counter, Calorie Counter – Fasting & Diet (by Leap Fitness Group), Fitbit (Nutrition & Food Logging Feature), Samsung Health (Diet & Nutrition Tracking), Apple Health & Apple Fitness+ (Nutrition Integrations) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Qatar diet nutrition apps market appears promising, driven by technological advancements and evolving consumer preferences. As users increasingly seek personalized health solutions, the integration of artificial intelligence and machine learning will enhance user experiences. Additionally, the focus on mental wellness and community engagement within apps is expected to grow, fostering a more holistic approach to health. These trends indicate a dynamic market landscape poised for innovation and expansion in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Calorie & Macronutrient Tracking Apps Meal Planning & Healthy Recipes Apps Weight Management & Coaching Apps Fitness and Nutrition Integration Apps Chronic Disease & Clinical Nutrition Apps (e.g., diabetes, obesity) Dietary Preference & Restriction Apps (e.g., Halal, Vegan, Gluten-Free) Others |

| By End-User | General Individual Consumers Fitness Enthusiasts & Athletes Healthcare Providers (Hospitals, Clinics) Corporate Wellness Programs Nutritionists and Dietitians Government & Public Health Programs Others |

| By User Demographics | Age Groups (Teens, Young Adults, Adults, Seniors) Gender Income Levels Lifestyle Segments (Sedentary, Moderately Active, Highly Active) Expatriates vs Qatari Nationals Others |

| By Monetization / Subscription Model | Free Apps (Ad-Supported) Freemium Apps with In-App Purchases Subscription-Based Apps (Monthly / Annual) Enterprise / B2B Licenses (Corporate & Healthcare) One-Time Purchase Apps Others |

| By Functional Features | Food Logging & Barcode Scanning Integration with Wearable Devices & Health Platforms Custom Meal & Diet Plans (Including Local Qatari Cuisine) Progress & Outcome Tracking (Weight, BMI, Biomarkers) AI-Powered Coaching & Chat-Based Support Social & Community Features Others |

| By Language & Localization | Arabic-Only Apps English-Only Apps Bilingual Arabic–English Apps Multilingual Apps (Including Hindi, Urdu, Tagalog, etc.) Others |

| By Device Compatibility & Platform | iOS (iPhone, iPad) Android Web-Based & Progressive Web Apps Integration with Smartwatches & Wearables Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| General Users of Diet Apps | 150 | Health-conscious individuals, Fitness enthusiasts |

| Nutritionists and Dietitians | 60 | Registered dietitians, Nutrition consultants |

| App Developers | 40 | Mobile app developers, Product managers |

| Healthcare Professionals | 50 | Doctors, Health coaches |

| Fitness Trainers | 45 | Personal trainers, Group fitness instructors |

The Qatar Diet Nutrition Apps Market is valued at approximately USD 42 million, reflecting a significant growth trend driven by increasing health consciousness, rising obesity rates, and the adoption of technology in health management.